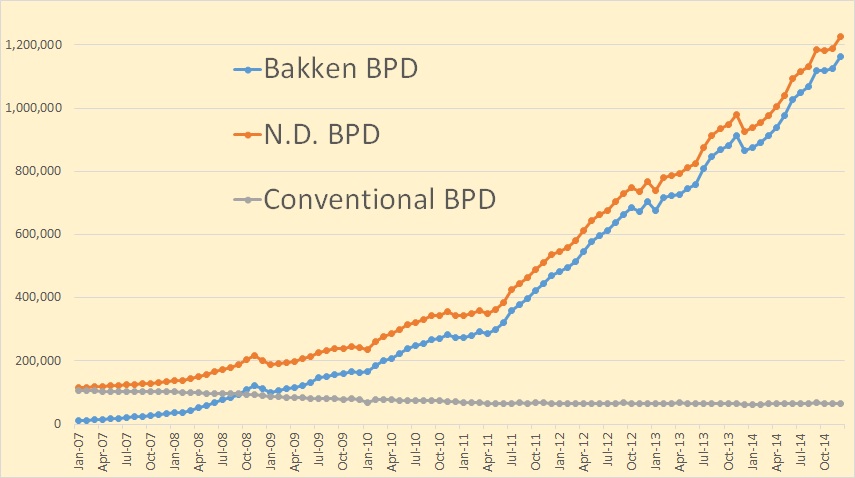

The North Dakota Industrial Commission has released the Bakken and North Dakota monthly production numbers for December 2014. There was a bit of a surprise as Bakken and all North Dakota production was up just over 39,000 barres per day.

Since Bakken production was up at almost the exact same amount as the rest of North Dakota, (Bakken up 39,080 kbd vs. 39,086 bpd for ND), suggest that all the wells being brought on line are Bakken and Three Forks rather than conventional wells.

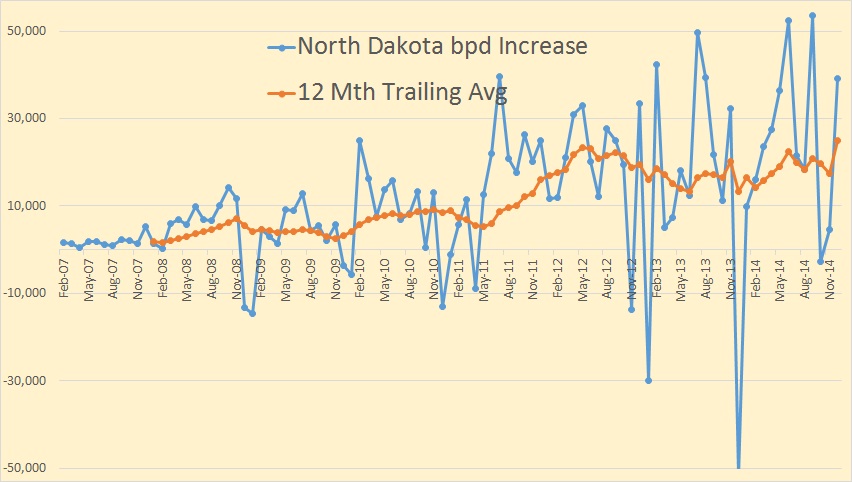

The North Dakota change per month, 12 month trailing average reached a new high in December of 25,006 barrels per day. That means North Dakota oil production was up an average of 25 thousand barrels per day every month in 2014.

From the Director’s Cut:

Nov Oil 35,647,735 barrels = 1,188,258 barrels/day

Dec Oil 38,047,667 barrels = 1,227,344 barrels/day (preliminary)(NEW all-time high)

1,163,352 barrels per day or 95% from Bakken and Three Forks

63,992 barrels per day or 5% from legacy conventional pools

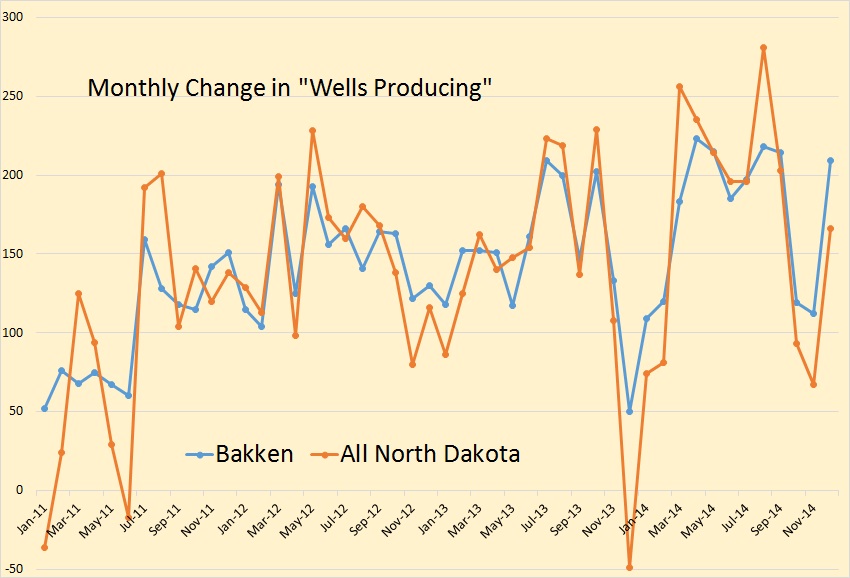

Nov Producing Wells = 11,951

Dec Producing Wells = 12,124 (preliminary)(NEW all-time high)

8,826 wells or 73% are now unconventional Bakken – Three forks wells

3,298 wells or 27% produce from legacy conventional pools

Nov Sweet Crude Price = $60.61/barrel

Dec Sweet Crude Price = $40.74/barrel

Jan Sweet Crude Price = $31.41/barrel

Today Sweet Crude Price = $34.50/barrel (lowest since February 2009) (all-time high was $136.29 7/3/2008)

Nov rig count 188

Dec rig count 181

Jan rig count 160

Today’s rig count is 137 (lowest since July 2010)(all-time high was 218 on 5/29/2012)

The statewide rig count is down 37% from the high and in the five most active counties rig count is down as follows:

Divide -62% (high was 3/2013)

Dunn -45% (high was 6/2012)

McKenzie -28% (high was 1/2014)

Mountrail -41% (high was 6/2011)

Williams -40% (high was 10/2014)

The drilling rig count dropped 7 from November to December, 21 more from December to January, and has since fallen 23 more from January to today. The number of well completions increased from 48(final) in November to 173(preliminary) in December. Oilprice is by far the biggest driver behind the slow-down, with operators reporting postponed completion work to avoid high initial oil production at very low prices and to achieve NDIC gas capture goals. There were no major precipitation events, only 3 days with wind speeds in excess of 35 mph (too high for completion work), and 2 days with temperatures below -10F.

Completions outpaced drilling in December. At the end of December there were an estimated 750 wells1 waiting on completion services, a decrease of 25.

Rig count in the Williston Basin has fallen rapidly. Utilization rate for rigs capable of 20,000+ feet is about 70%, and for shallow well rigs (7,000 feet or less) less than 50%.

The North Dakota rig count stands today at 137 with the next location listed as “to be stacked” number at 7. Of course many of those listed as “Undetermined” are likely to be stacked as well.

Helms did not mention the number of wells completed, only that they outnumbered drilling by 25. However the number of wells producing in the Bakken increased by 209 while the total number of North Dakota wells increased by only 166. This means that at least 43 conventional wells had to be shut down.

An increase in 209 wells producing in the Bakken is a near all time high. With 750 wells awaiting completion it now all depends on fracking crews.

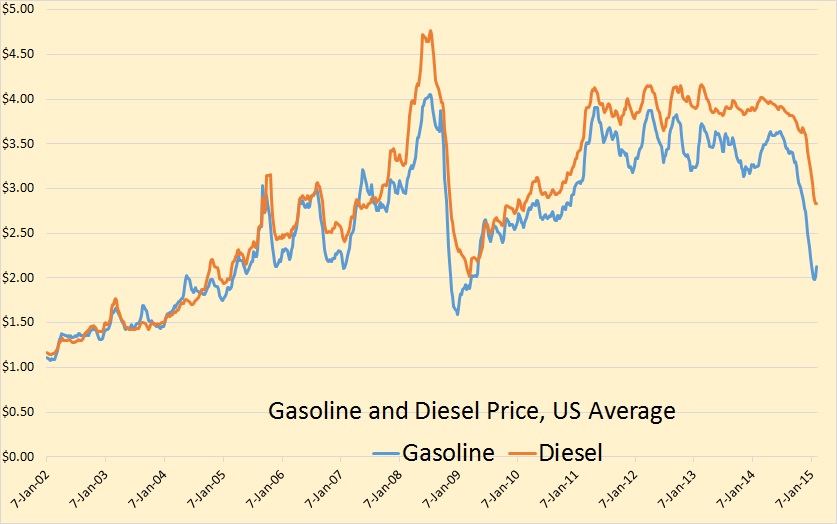

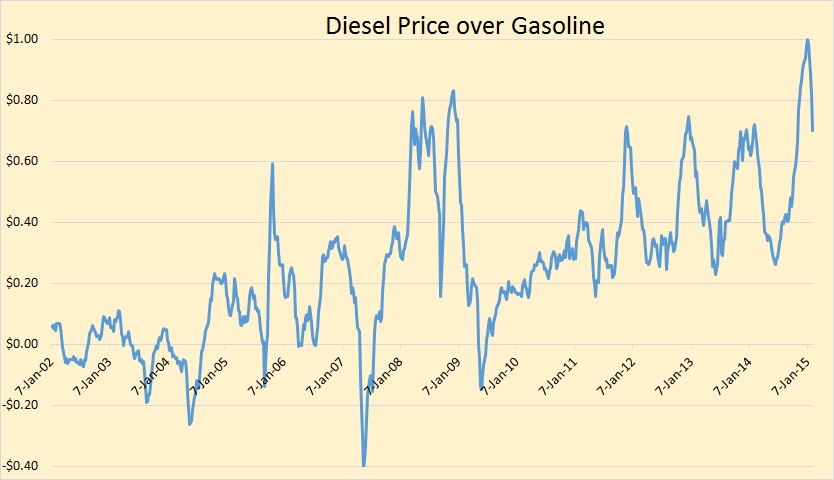

On another subject, I found the following chart interesting. The Data is from the EIA and is the average for all the US.

Why is diesel prices outpacing gasoline prices?

Beginning in 2004 diesel prices started outpacing gasoline prices. As late as June 2009 there was a short period where gasoline prices were higher than diesel but then diesel prices started to climb and has been well above gasoline prices for over 5 years now. Why? Is is because of more demand or is it because there is less diesel in the lighter crudes being produced in the US?

And one last point on another subject. About a couple of weeks or so ago there was a guest essay by Tom Giesen attached to one of my posts. It was on the problems of fracking. One commenter who goes by the handle “Clueless” asked me if I was a member of that cult. I replied with a somewhat ambiguous answer that I now wish I could change. I would change it because I wuz wrong! Now I neither a friend nor foe of fracking, but the process should stand or fall on its own merits an the public should not be mislead by a lies an half truths.

Several months ago I watched the documentary Gasland and was highly impressed. But a couple of days ago I was browsing Netflix documentaries and came upon a documentary called “Fracknation”. It was a critical examination of “Gasland”. I was shocked! Gasland was so full of lies and half truths it is alarming. For instance those flaming water faucets. It turns out that they have been doing that for ever since running water in those places. And it does it in places where there is no gas frcking for many miles. It is just methane in the same area as the water table.

Josh Fox, the producer of Gasland, said a shale well can be fracked up to 18 times. and each frack takes 1 to 7 million gallons of water. Then he stated there are 450,000 fracked gas wells in the US so 7 million barrels times 18 fracks comes to about 40 trillion gallons of water. Obviously he was confused between “fracked stages” and “fracked wells”. And apparently someone informed him of his stupid error because that segment has been removed from the Youtube version but still remains in the Netflix version.

Fracknation is not available on Youtube but is on Netflix. Another expose’a of Gasland, that can be found on Youtube is Truthland. It is a shorter video, 35 minutes. It is good but not quite as good as Fracknation. Here is a short video of how Fracknation got started: FrackNation the documentary that exposes Joshua Fox as a liar?

_________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne@gmail.com

Ron, What are the chances that both those movies are sensationalized and not very factual? The real risks and benefits of fracking are what they are. Folks in the rest of the world know that producing energy might create a little pollution. Some of the folks in this country just aren’t used to it.

Donn, Fracknation and Truthland are not documentaries trying to make a case for fracking. They both are to examine the case made by Gasland. Either the facts are as Gasland stated or they are not.

Example. The flaming faucets. Either the gas was coming from natural sources and was there long before the fracked wells or it was not, meaning it was coming from ruptures in the well casing.

The flaming faucets are there so one is truth and one is a lie. They both cannot be a lie.

Even though I believe Giesen was wrong, I was out of line asking you if you were a member of a cult. Sorry.

And I was wrong in giving you such a silly and ambiguous answer. Sorry.

Heard on radio rig count drop was big again. However, appears Bakken rig losses may be slowing and that most rig losses are in Permian Basin?

Hi Ron,

If you count up the number of Bakken wells that started producing in Nov 2014 and assume 95% of the confidential wells that started producing in Nov are also Bakken wells (Helms has been saying for 12 months that 95% of drilling targets the Bakken Three Forks), then there were about 174 wells completed in November. I think Helms estimate is incorrect for well completions in November.

Also there may have been a few non-Bakken/Three Forks wells brought online, but additional output from those wells may have just balanced the decline in the legacy wells.

Even with the falling number of rigs, with 750 wells waiting on completion it will take a long time until the new wells per month falls below 130, even if only 75 new wells are drilled per month it would be 13 months before the backlog of wells waiting on completion was down to zero. At 130 new wells per month output will be relatively flat, with maybe a little decline in output (5 kb/d or less). The model below assumes new wells per month decrease by 8 per month until May and by 3 in June to reach 130 new wells per month and then remain at that level until Jan 2017.

I noticed that the model is falling behind the data for May 2014 to Dec 2014 so I tweaked the average well profile from April to Dec 2014 with an increase of 2.5% each month to attempt to get a better match with NDIC output data. If the average well profile in fact increased through Dec 2014 and we assume the well profile is unchanged from Jan 2015 to Jan 2017, then only 120 new wells per month is enough to keep output from falling by more than 8 kb/d (output falls a little and then rises). New wells per month decrease by 7 or 8 wells per month from Jan 2015 to July 2015. Chart below.

Hi Ron,

I misspoke on the average new well EUR from Jan 2015 to Jan 2017.

Earlier I said it was fixed, in fact in both models EUR decreases from June 2015 at a gradually increasing rate of decrease reaching a maximum annual rate of decrease in June 2016 at 7.5% per year. Chart below is the EUR(kb) of the average new well over time for the model above, with annual rate of decrease of new well EUR on right axis.

Dennis, I am posting my reply below in order to get a wider format for my graph.

FWIW: I suspect one key issue with fracking is what drillers do with the contaminated effluent. I believe most of the it is is dumped to the ground water, since hauling it off site for proper disposal is expensive. It would be far easier and cheaper to drill a ground water well and dump the effluent. This would contaminate wells used for drinking water. and perhaps some natgas is also injected (mixed in with the effluent) that would cause flaming faucets (at least for a short period until the drillers stop discharging effluent into the ground water).

I recall reading about a town in Texas where most of the inhabitants left because of ground water contaimination and the smell, and people were getting sick. I recall reading, and I believe you also commeted about Frackers dumping contaminated filters in barns and abandon buildings (to avoid disposal costs). The cost of hauling and disposing effluent would be much more expensive.

I also recall reading that in California, Frackers were legally dumping effluent in to the ground water (used by local residents for drinking). I am sure some one got a kick back on that agreement.

Is there a state in the USA where salt water disposal is allowed as you describe in your guess? I’ve never heard of anything like it, but since there are 50 states….

Regarding natural gas injection with flow back water, that’s also an interesting guess. How do they get the water full of gas from the producing well to the disposal well? By pipeline?

No, I think they just drill a disposal well on site, near the Oil/Gas Well and pump it in. No need for any pipeline. They already have the drill rig on site. its barely cost them anything to drill a shall well to dispose of the effluent waste on site.

That said there are probably drillers that do truck it offsite for disposal, but in a effort to save time and money, I believe many cheat and illegally dispose of the effluent waste, causing ground water contaimination.

No, they simply cannot drill a shallow well and pump waste into it. They would go to jail if they get caught doing it. Most of the companies do have their own salt water and waste water disposal well. But they have to be drilled into an assigned disposal layer that is usually sandstone or some other porous rock. It must be well below the level of the water table.

You can tell which wells are disposal well. Their permits are in the 90,000 numbers. Like this one at the very bottom of the active drilling rig list at: Drilling Rig List

CANELSON 43 LIBERTY RES MNGMT CO STOMPING HORSE SERVICE WELL 2 NWNW 21-158N-95W WIL 90326 33105903260000 2/11/2015 Undetermined

This isn’t really related directly to this topic, but I just saw this and thought I would post it here.

Here’s how a $50 drop in oil prices affects every country in the world

http://www.businessinsider.com/global-impact-of-50-oil-price-fall-2015-2?utm_content=buffer5e3b0&utm_medium=social&utm_source=facebook.com&utm_campaign=buffer

The idea that cheaper oil is good for importing countries is not quite so simple.

I will use South Korea as an example of an importing country.

Government revenues actually declined in 2014 because of a lower tax intake.

Partly because of lower fuel prices at the pump, but also because all 3 of the big oil refiners made huge operating losses, i.e. no tax on profits.

The waiver text about wells completed/producing is back.

Another big weekly drop in the Baker Hughes Rig Count.

The first week in October the oil rig count was 1609. It now stands ag 1056 for a drop of 553. That is just a tad over one third.

The Baker Hughes count for North Dakota is 123 down 9.

The ND.gov list is 137, as per the director cut.

Included in this ND.gov list is 10 wells from 2014

4 of these 2014 wells are from EOG. By all accounts EOG are one on the gun drilling companies. So why would they be taking so long to drill their wells?

Also Continental have been MIRU on ELIAS 1-21H for the last 2 weeks from memory. I only noticed it as it is down to be stacked. I believe some of the oil companies, EOG being one of them, are just not updating there results to the ND govt!

PS There are actually 8 wells going to stack as per the ND.gov page. One note is a little cryptic, “Johnsons corner Nabors yard”. I doubt they will be drilling in there own back yard, but you never know, smiles.

I have put an updated stacked graph here:

http://crudeoilpeak.info/us-drilling-rig-count

Also international rigs

http://crudeoilpeak.info/international-drilling-rig-count

Thank for the international rig count post. Interesting all areas dropping since October 2014 except middle east. Would be interested in why middle east is up.

Saudi taking advantage of cheap rig rates to do more infill drilling? Perhaps in anticipation of a drop off in shale growth?

Maybe they are chasing there own Red Queen?

Well, the minute you drill an oil well you’re getting on a red queen treadmill, it’s just that the shale treadmill is set a lot higher than for conventional.

Anyway I guess the Saudis will have known what their announcement in September would have done to the oil price, so they’d have done a cost benefit analysis. Probably cheaper drilling was a benefit.

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

If there were 192 wells in the Bakken in 2000 and now there are 8944, you are going to have more oil pumped from the ground. 45 times the number of Bakken TF wells than in January of 2000, 14 years time.

You will need more personnel, a larger workforce.

A permanent workforce that does oil hauling, well servicing, road maintenance, railroad employees, translates to more car sales, more housing, more schools, all to pump the 1.2 million barrels per day. Much more economic activity than in previous years prior to the development of the Bakken.

If there are 1 billion barrels of oil pumped every 900 days and there are 18 billion left to go, 18×900=16,200 days of oil production remaining at 1.2 million barrels per day.

16,200/360=45 years of time to extract the oil.

If it all dries up and blows away, that will be too bad.

Doesn’t look like that is going to happen anytime soon, but it could.

8944 Bakken TF wells are going to produce oil for more than a couple of years.

It all should withstand the test of time. A look back into the history of the production of oil in the Williston Basin should be a forecast for the future, with the added bonus of more oil.

BNSF hauls about 10,000 600 barrel carloads each week. About 1400 cars each day, 14 trains of 100 carloads.

Warren knows he’ll never be able to haul 1.2 million barrels of oil each day unless there are more oil tanker cars, more train engines and more train crews.

A pipeline is going to be better. Just build a new pipeline that follows the rail line, a lot of the preparation is done already, right of ways, easements etc. It will be less hassle.

A BNSF oil pipeline sounds good too. It’ll free up track space, less wear and tear on the system, more oil in the BNSF pipeline. Build it all the way to the New York harbor and have the piped Bakken oil shipped to Saudi Arabia when they begin to import oil like is projected. They’ll be wanting (strike that) NEEDING Bakken oil too someday.

Time is on the side of the Bakken.

Hi Ronald,

About a billion barrels have been pumped from the Bakken/Three Forks so far, there will only be about 10 Gb of oil recovered so 9 Gb to go if oil prices get back to $100/b by say 2018.

There are limits to how fast the oil can come out of the ground and how many new wells can be drilled per month. A gentle decline in new wells per month to 120 new wells per month and then staying at that level for many years would lead to a peak of about 1200 kb/d until about 2020 with a gentle decline until 2036.

Chart below with 120 new well per month scenario out to 40,000 wells in Jan 2036.

Hi Ron

The previous post you mention with the guest post is not coming up: ‘US Production and Imports, and a Guest Essay’ at http://peakoilbarrel.com/guest-post/ It gives a not found error. Any reason?

Pete, I don’t know what the problem is. I click on the link you posted and get the post with no error. But you can also just click on “home” on this post and scroll down. It will be the fourth post down.

Try this link, I think it will work.

http://peakoilbarrel.com/guest-post-2/

Thanks Ron, another good post by the way. (Very strange about the link. I get the same error message on my work and home computer, in different parts of London, on all browsers, and first got it from the home page. I wanted to refer to the stats in the article. Anyway, never mind, unless your cache still keeps it somehow.)

But I any case, I think you are too hasty to damn yourself, and say you were wrong about Gasland, and take a neutral position on fracking.

I’m not at all convinced by Chesapeake Energy’s attempt to discredit Gasland in Truthland. It’s what the oil companies do best.

So, lets say maybe some tap water in the region could be set aflame before fracking arrived. (Hmmm, is this good water?) But is it good if your tap water didn’t set on fire, was perfectly safe, and now does set on flame, as a result of fracking nearby? With god knows what contaminants in it? Suddenly the expose of gasland looks like it might be misleading itself.

So I soon found this which made me suspicious: “Shelly Depue, the protagonist in Truthland, forgot to mention that Williams Petroleum is under investigation for numerous violations at the wells on her property including faulting casing that has allowed gas to bubble up for over a year. And her neighbors have contaminated water.”

Makes me wonder if Shelly was paid for Truthland – not that she shouldn’t get paid, but that it might influence her memory. Links easy to find by googling ‘truthland video fracking’

Pete,

FYI I get the same “Not Found” message.

Ron may have deleted the post.

No I have never deleted a post. I deleted one comment about two weeks ago but it was not one of the regulars here.

Try this link. I changed the title. I think there was a conflict.

http://peakoilbarrel.com/guest-post-2/

Pete, are you familiar with well construction practices? The geology in the area where that specific tap was set on fire? The history of the region? Had there been any wells or mining activity in the area in the previous 150 years?

Some of us know that side of the business very well, we could approach this as a forensic study. For example, what are the pathways you would propose to get natural gas from a tight fractured reservoir to a fresh water aquifer?

Josh Fox’s “The Sky is Pink” .

http://topdocumentaryfilms.com/sky-pink/

“Gasland was so full of lies and half truths it is alarming. ”

Glad you finally got that straightened out, Ron.

Now all you have to do is apply the same detective work to Peak Oil.

What I read here is absolutely no different than what I saw and heard on “Gasland”.

Errr, just point out the lies and half truths I have posted Carl. I will see what I can do. What have I posted that you disagree with… and why. The why is very important.

Ron, and to whom else it might concern…… I don’t actually have an Internet connection at home, let alone much else usual stuff such as TV, stereo, video, playstation, radio, or even newspapers or magazines. So, I happily walk a four mile round trip through wonderful farming country and very clean nature to access the Internet for free at the local library, instead. Therefore, I am often offline for days at a time.

I don’t have the time or inclination right now to quibble over specific words said by someone, somewhere, sometime at this site. But, I do access it once in awhile just too keep track of what’s going on. As, I have put in way over 1000 hours studying the PO phenomenon, I don’t think anyone here should take my words so lightly. In case you don’t know, I am the one who challenged the entire team of editors at TOD to a public debate on PO on their terms, at their website, but they wisely declined after reviewing my comments. Not too many months later, as most would know, TOD closed due to a falling interest in PO, which was exactly correlated with a rising (Internet) interest in fracking. This was not a mere coincidence.

But, in general, PO predictions have been repeatedly proven wrong, not only by other people, but simply by time itself, year in, and year out just like clock work. At some point one just might come to the conclusion that Chicken Little is just always saying, that surely the wolf is at the door this time. It always seems to be this time, but never last time. I think a good question to ask yourselves is whether the next coming of PO will actually occur before, or after the second coming of Jesus? So how about we talk about religion, belief, first and second comings and such instead, because that is all that PO has proven itself to be so far.

The fact remains, that all predictions are by definition only statements about a future, that cannot be determined by ordinary human means. They require a leap of faith that I am simply not capable of, yet am honest enough to humbly admit. I simply do not believe in belief, nor do I have any faith in faith. Yet all of you apparently do, and quite adamately so. I only operate from a basis of first hand knowledge and experience.

In regards to PO, the issue now is primarily shale oil, and perhaps secondarily, oil sands oil. Contrary to popular belief, world oil consumption is still (slightly) increasing, while world (especially US and Canada) production is still increasing. There is no glut at present, and there has not been one recently, but there is a stubborn over supply of oil on the market right now even with WTI oil priced around $50. How much is difficult to know, but it’s probably about 25-50 million barrels in floating storage (idled ships) and about one million more a day piling up for about as long as the eye can see. There is no sign of any change coming. The only production cuts that I know of is several hundred thousand bpd from Libya due to rebel activities.

Sorry, but try as hard as you like, the future coming of PO is not heralded by such low oil prices, and for so long. You have all been very carefully explaining for years on end, how ever higher oil prices mark the coming of PO. The present period simply marks the ultimate demise of all PO theory, because everything even left about PO theory just got shot to shit. Hubbert’s peak was scheduled to be surpassed in late 2015. Now it’s more likely to occur in 2016, or possibly all the way to 2017. It is expected that the US will be producing about 12,500,000 bpd before too long. What are you all going to do, not if, but WHEN Hubbert’s peak is surpassed?

The fact is that the root cause of all differences of opinion between us is based solely upon this group’s general ignorance of US shale oil geology and extraction methods, when all such knowledge is readily available to the general public at company websites. Don’t worry, I know why you don’t bother to access this generally correct information. It is because you do not BELIEVE it, and you do not have the FAITH, that they are telling you the truth. Your lack of faith, and your lack of belief, still keep you located squarely in the lap of religion, not science. What you don’t seem to get is the fact that these oil companies all enjoy the default position. Therefore, they must be considered to be innocent of all (your) charges against them, until the opposite is PROVEN. But, it is exactly this, that you cannot do. So, you choose to simply disbelieve them instead, which consequently proves, that PO is only a belief (dis-belief) system, which specifically means that it is a religion.

Perhaps an educational video from my favorite atheist, Qualia Soup, would help explain things. http://youtu.be/5wV_REEdvxo

But peak oil HAS occurred in many places or companies wouldn’t be looking for other places to drill.

Shale and tar sands are only of interest because the cheaper fields are declining and other cheap fields haven’t been found.

Boomer II,

To start with,…”It ain’t over until it’s over.” Get it? I think you need to be able to distinguish between a TEMPORARY peak, and some kind of final peak. The final peak is well known to anyone who is even remotely aware of what PO actually is. It really is quite simple. It starts to occur when about half of the OOIP of the area concerned is reached. I think you know the rest. But, if the total OOIP of any given area is unknown, (“X”) then it is obvious that NO ONE knows what half of “X” actually is, or when in the world this might occur. That is why Hubbert got it wrong. He never figured out what “X” actually was, and nor has anyone else before or since, so you might as well drop the whole charade, because that is all it is.

So, don’t bother feeding me any line of BS about any country on this planet that has reached PO, because YOU, spelled Y-O-U, don’t know. Besides that fact, it doesn’t even matter anyway, as long as other countries haven’t reached their peaks. This is not exactly rocket science, but you don’t seem to be able to even see the main difference between your ass and your elbow. Your complete ignorance of the mere basics of PO is absolutely astounding to me!

Shale and tar sands are only of interest because they are actually cheaper to develop than many other conventional sources. One of the main reasons why, is that their locations and geographical extent are generally known. Therefore there are no finding costs. Economically viable means of production (mostly at $100 oil) are very well known, and very well proven. That is why they are being (over) produced.

Do you happen to have contact to any mainstream media? Because, I’m seriously wondering what planet you actually live on.

So, don’t bother feeding me any line of BS about any country on this planet that has reached PO, because YOU, spelled Y-O-U, don’t know. Besides that fact, it doesn’t even matter anyway, as long as other countries haven’t reached their peaks. This is not exactly rocket science, but you don’t seem to be able to even see the main difference between your ass and your elbow. Your complete ignorance of the mere basics of PO is absolutely astounding to me!

I’m going to let others here respond because they know more about oil than I do. You are posting in a peak oil forum.

You’ll be someone’s dinner.

Boomer II,

You are correct that there are many people at this site, who know more about PO than you do. I just happen to be one of them. There really and truly are MANY others. In such a situation, the obvious course of action for you would be to simply ask enough questions until you gain enough correct answers, that you will be one of the many here who do know, what they are actually talking about.

Ask questions? That is precisely how most of us have gotten the answers, that you apparently still lack. The first step to gain knowledge is always the admittance of ignorance. Without that, no knowledge will ever be gained.

It is YOU, spelled Y-O-U, that needs to be reminded, that YOU are posting in a PO forum, not me!

Nobody, I repeat, NOBODY at this forum has the ability to eat me for dinner. You don’t even have a clue about who you are really up against here, or why. And, don’t expect anyone at this forum to fight YOUR battles for YOU, especially when you keep choosing the loosing side of every argument. Besides, it is well known, that the duty of another is always full of danger. Caveat Lector.

I will share this with you, though. It was a comment posted in this forum in response to a young man (age 27) who thinks we need to go out and find more oil.

I’m a professional of around your age working in the oil exploration business. This last decade has been the single busiest decade for oil and gas exploration ever. The oil companies have been throwing mountains of cash into upstream spending, increasing at a rate of about 10% a year. We’re looking deeper underground, further offshore, under giant subsurface salt domes and we’re even down to trying to crack up source rocks to squeeze out the oil. And what do we have to show for this superhuman effort? Around a 4% increase in oil production over a 10 year period, and a whole lot of surveys which didn’t find a great deal. Most of the money we were throwing into the system merely went to holding off decline, but that’s coming to an end now because the oil majors simply can’t afford to do it any more.

So while you might be right that we need many more oil and gas discoveries, it’s extremely likely that it ain’t what we’re gonna get. We’re going to get to live through some very intersting times, my man, and no mistake.

Don’t know why the above was posted, but last time I checked world oil production was still going up, and the present oil price is still getting held down because of over production. Apparently, $40-$55 WTI oil has not been low enough, long enough to discourage US, and by extension world overproduction. Looks like we will all just have to continue living with an over abundance of oil at rock bottom prices. It seems like oil certainly is rather cheap and easy to find and produce these days. Apparently, historical production data does not tell lies, but people still do.

“Gasland was so full of lies and half truths it is alarming. ”

Glad you finally got that straightened out, Ron.

Now all you have to do is apply the same detective work to Peak Oil.

What I read here is absolutely no different than what I saw and heard on “Gasland”.

So, Gasland (a film about fracking, not peak oil) plays fast and loose with the facts, and that proves that peak oil theory is false?

Wow. That is an amazing leap of logic. How do you justify it?

Futilitist,

FYI ….. I have also spent thousands of hours studying all aspects of Liberalism, which is what both PO and “Gasland” and a multitude of other issues are actually all about, when you get down to the nitty gritty. The patterns of deception and outright propaganda tactics are unfortunately exactly the same for all the well known Liberal causes. Instead of asking me to justify my claims, why don’t you simply do as I have done? Why not start viewing PO in the same light as Gasland, and see what you come up with?

According to the original “RED QUEEN” article, also posted at this site, the Bakken is not supposed to be producing more than 650,000 bpd (mid figure). The EIA expects the Bakken to be producing at exactly DOUBLE that by March, 2015, or 1,300,000 bpd. The incorrectness of this Red Queen article has yet to be confirmed at this website. I recently read an otherwise good article on oil production, that unfortunately referred to this aspect as being very real right now, or quite soon. Methinks, this website should start aligning itself with what is known to be true, rather than what is known to be false. I am indeed curious as to why so many seem to disagree with my suggestion. Perhaps, you know why?

spent thousands of hours studying all aspects of Liberalism

In other words, you listen to Rush Limbaugh and think you are learning something.

No, it means that I actually have never listened to Rush Limbaugh at all. I do not live in the US. The official/unofficial “American spokesmen for the case against Liberalism are Bill Whittle ( Tea Party) and Thomas Sowell (Economist and Historian, plus student of Milton Friedman (also an Economist. Why don’t you study the words of these men and educate yourself properly. To even speak of Rush Limbaugh suggests a very profound ignorance of the many fallacies of Liberalism. I know for sure that I am communicating with a first class loser. You just proved it. Here are some very short sample videos for your much needed education on the fallacies of Liberalism. I do hope you can tolerate the color of Thomas Sowell’s skin. Most Liberals cannot. http://youtu.be/XzT21b-BMQk

http://youtu.be/FAA_So0d01w http://youtu.be/za6tV1oLQbI

Carl, if you do return to read this I would love to read something specific. For example, do you think the ultimate reserves are higher? Or do you propose an oil source in an exotic location or type of rock we don’t know about? What’s your secret sauce?

So far our Carl Martins tend to comment only once or twice before disappearing. I think most of the comments made by this sort of character are made seriously though.

There really are tens of millions of people who believe there is always going to be plenty of oil because somebody told them so…… That somebody being a mouth piece for business as usual.

When you ask them a serious question they suddenly realize they are in water way over their heads as a rule if they are both serious and intelligent and don’t come back.

There are countless business as usual mouth pieces possessed of ENORMOUS status and wealth and even moral and intellectual authority that contribute on a regular basis to the ” Peak Oil is a Myth ” meme.

Harvard University for instance. I am sure Harvard must have at least a couple of professors who understand basic geology at the freshman level it was taught to me at a ” Cow College ” back in the Dark Ages but I have yet notice that one of them has had anything to say publicly about that recent paper by Mageuri or Magoo or whatever his name was that is never mentioned in the MSM without throwing in the word HARVARD in every other line at a minimum.

Then everybody’s favorite whipping dog our federal government says oil production will continue to increase for another generation at least. Everybody calls on the feds when they want an authoritative source to back up an argument even if they are a dyed in the wool Tea Partier or a Green Peace executive.

Add in the fact that most people learned almost nothing outside their narrow specialty in university- assuming they went – and that hardly anybody learns anything outside his specialty after leaving university – and it comes as no surprise that the Peak Oil band is about as big as a gnat or fly buzzing around the fifteen hundred pound business as usual oil cow.

But we soldier on, in my case mostly because I have nothing more entertaining to do except work and after a half a century of that it I finally realized that W O R K is a four letter word. 😉

Fernando,

I do not relate to the term reserves particularly well, ultimate or not at all. But, I do know that worldwide merely the known amounts of shale oil in place at present, (OOIP) is about 30% more than the total amount of oil we have so far extracted. That said, I am primarily only focused on US shale O&G production. As Hubbert, himself, once said, what first happens in the US, tends to happen later in the rest of the world. This website has not yet acknowledged the primary cause of the present day low price world oil situation. It is because of the US shale oil revolution. It is therefore a stand off between Saudi Arabia and Saudi America, as to which country has the right to call itself Saudi. So far, American shale oil is winning hands down. Just curious, do you happen to have any idea why?

OFM,

Publicly traded oil companies provide interested parties with all relevant information regarding their respective land positions, reserves and resources, present rate of production, and guidance regarding their future plans for production, sometimes several years out. Besides that, they often supply various bits of information about competitors, and the shale plays they are involved in. Much geological information is also made available, but a basic understanding of geology must be present to understand much of it.

Most companies that I know of, which is quite a few, have given out information suggesting that they have years, if not decades, of future drilling sites. This was with $100 oil. There are obviously far less places right now, but technology keeps improving. You only need to study this information to understand what is likely to happen in the near future. No PO in sight.

But no one, I repeat, no one, expects oil prices to remain this low more than a year or so at most. Personally, I don’t expect them to get back to $100 anytime soon, but that is only my opinion. Much of my money is still heavily invested in US shale oil production, because I have studied all the relevant facts. I am not at all interested in fiction. Most of my time is spent studying ignorance and delusion. That is why I am here. For your enjoyment and education…….

http://youtu.be/d2afuTvUzBQ

I haven’t been as pessimistic as some of you, because I think the human race will find a way to survive, even if at very reduced numbers and at a much more constrained lifestyle.

But I have to say, when I see comments like this, I can see where some of you are coming from. People are capable of being in denial until their world falls apart. And even then, I suppose, they can come up with reasons why everything fell apart rather than the actual reason: It wasn’t that oil ran out, it was that God is punishing gays, or Communists are stopping the world from finding oil.

Most companies that I know of, which is quite a few, have given out information suggesting that they have years, if not decades, of future drilling sites.

Sorry if this was posted already. It’s getting a bit more difficult to keep up here. Lot’s of comments.

Luis de Sousa piece wrt debt financing/tight oil.

http://attheedgeoftime.blogspot.co.uk/2015/02/shale-sub-prime-and-ides-of-march.html

This will lead to some interesting times! From your link

As more information emerges, the moment of truth is slowly becoming visible. Petroleum companies must submit their 2014 asset reports to creditors until the end of March. Based on petroleum prices of late December,

It will be acquisition time for the big boys.

Every real country boy learns early that one of the first and most fundamental rules of trade is that you sell to somebody in a hurry to buy and buy from somebody in a hurry to sell.

Keeping this simple rule in mind has enabled me to enjoy a lot of luxuries I could not have afforded otherwise as well as enabling me to avoid a lot of hard work.

Dennis, I agree the backlog of wells awaiting fracking will keep production high for six months or so. I have no idea how many wells are coming on line each month when even Lynn Helms either don’t know or is extremely confused by the matter.

I still believe that production will start to drop in June or July. But the number of producing wells added each month has increased by about 20 per month over the last 12 months. That is one reason we have seen an average of 25,000 barrels per day increase in production monthly.

Hi Ron,

When Enno sends me new data, I will forward it. Just sort out the Bakken wells and then sort by dtae and you can count up the wells, but count 95% of the confidential wells as Bakken wells also.

Data in your inbox

Ron – you should be aware that the make of Fraknation (one Mr McAleer) does seem to have his own agenda, as does his wife who makes films with him:

Thus one of his other films is entitled: Not Evil Just Wrong (from wiki):

Not Evil Just Wrong is a film McElhinney and McAleer directed and produced to challenge Al Gore’s An Inconvenient Truth. It suggests that the evidence for human-caused global warming is inconclusive, and that the impact of suggested legislation for mitigating climate change would be much more harmful to humans than beneficial.[12] The movie was filmed in 2008, and was screened at the International Documentary Film Festival Amsterdam[13] and at the Right Online conference in 2009.[14]

His wife (wiki): McElhinney is a popular speaker at conservative conferences. Her most recent appearance was at Right Online in Las Vegas, hosted by Americans for Prosperity, where she spoke out in reaction to Van Jones—who had made an appearance at Netroots Nation.[32] She spoke at both the 2009, 2010, and 2012 Conservative Political Action Conferences. In 2009, a U.S. poll identified McElhinney and her husband, Phelim McAleer, as the most popular conservative speakers after broadcaster Rush Limbaugh and columnist Ann Coulter.[33]

And more about his climate change denialism:

”In October 2010, film director James Cameron donated $1 million to oppose California’s Prop 23, which would have overturned AB 32—California’s climate change legislation.[42] In response to this donation, McElhinney and McAleer made a short film; it alleged that passage of AB 32 would increase Californians’ energy costs, and suggested that Cameron, who’d been quoted as saying, “we are going to have to live with less,” lives a more energy-extravagant life than most Americans.[43] The Independent said that this attack advertisement was “tapping a rich rhetorical vein”, but ignores Cameron’s distributor, 20th Century Fox, which buys carbon offsets.[44][45]”

http://en.wikipedia.org/wiki/Ann_McElhinney_and_Phelim_McAleer

It would be hard not to conclude that the makers of the film that attacks Gasland are not just paid shills of the fossil fuel industry………..

I agree Andy. I’ve just posted a quick comment in my thread above on Chesapeake Energy’s Truthland which I also find suspicious on a number of accounts. It should probably go here.

oh boy Ron, another Pandora’s box. Good on you for trying to figure it out.

might as well try to watch GASLand II.

anyway…..

Affirming Gasland

A de-debunking document in response to specious and misleading

gas industry claims against the film.

http://1trickpony.cachefly.net/gas/pdf/Affirming_Gasland_Sept_2010.pdf

http://thinkprogress.org/climate/2013/06/09/2126271/phelim-mcaleer-fracknation-tobacco-playbook-josh-fox-gasland/

Ezrydermike, if a person wants to be one who is believed then they should refrain from lying. But if you are caught in just one lie, especially if it is a really big whopper of which your whole case is built around, then you are not a person I would believe on anything.

The flaming faucets was one really big whopper of a lie. And it is obvious Josh Fox knew it was a lie. But he choose to tell that lie anyway. That’s all I need to know about Josh Fox.

FrackNation the documentary that exposes Joshua Fox as a liar?

My apologies, up thread I described this guy in Fracknation as a Brit. No he is an Irishman.

I understand the point you are making about lying.

I haven’t seen Gasland II, Fracknation or Truthland. It’s been a while since I saw Gasland. I guess I’ll be watching them this weekend.

Josh Fox does seem to address some of this in the Affirming Gasland link.

Well said, Ron.

Andy, I am aware of the fact that the McElhinneys are both right wing raving nut cases that think all environmentalist are evil lunatics. And they think peak oil advocates are just nuts. However to its credit I saw nothing in the documentary “Fracknation” that would even hint at any at any anti environmentalism. The entire documentary was devoted to exposing the misleading claims of Gasland and nothing else.

If there was a hidden agenda in the film it was well hidden because I did not see it.

You only have to view this lecture by Ann McElhinney to know she is an absolute nut case.

“Lessons from the Debate over Fracking”

I found that she has no idea what an environmentalist really is and puts them all in one basket. Actually environmentalist disagree among each other almost as much as they disagree with the right wing nut house.

But neither of the McElhinneys were in the film. It was narrated by a soft spoken Brit who, like Joe Friday, just wanted the facts mam, nothing but the facts.

So, lets say maybe some tap water in the region could be set aflame before fracking arrived. (Hmmm, is this good water?) But is it good if your tap water didn’t set on fire, was perfectly safe, and now does set on flame, as a result of fracking nearby? With god knows what contaminants in it? Suddenly the expose of gasland looks like it might be misleading itself.

Pete, gas seeps are very common all in many places in the US. Methane in the water does not hurt it, to my knowledge anyway. Well just as long as you don’t smoke in the shower.

However the claim that the gas came from the fracked wells is more than a little absurd. The gas wells are a mile or two below the water table and no frack would reach that high. And the well casing is steel, reinforced with concrete then steel again. No gas can escape.

But some of the water did contain a lot of iron and sulfur, which had nothing to do with the fracking either. But watch “Truthland”, it will explain a lot and is only about 34 minutes long.

Truthland: Dispatches from the Real Gasland – Full Movie [HD]

The best way for frack supporters to prove their industry is safe is to test water and air before, during, and after. The industry has often been secretive, which gives rise to suspicions that they have been hiding something.

I agree. And remember methane is an odorless gas so you need gas detection instruments. It’s produced during decomposition of manure and accumulates around manure storage areas; not a big deal around farms. Although maybe Mac can provide input on that. Exploding barns?

And methane seeps are common worldwide on all scales. The reasonable approach, as you suggest, is baseline tests before drilling and monitoring afterward.

Boomer, Mr. Leighton, Several companies operating in the Marcellus have already, in a proactive mode, been taking well water samples from nearby wells before any drilling/fracturing occurs so as to have a baseline showing no damage has taken place and thus, they cannot be sued for less than perfect water content.

Somewhat less than surprisingly, there are a fair number of residential wells found to already contain relatively high contents of items such as sulpher, iron, radon, and, yes, sitting atop some of the largest coal and nat gas formations in the world, methane.

Oh Ouch Wow!!

So far as I have ever heard only one barn has ever for sure exploded as a result of of methane build up inside it. This one was a dairy barn in Germany and judging by a picture of it the Germans built it better and tighter than some of my neighbors houses.

Farm buildings are ordinarily sturdy but not at all that airtight and so any dangerous gas build up inside generally has to come from a fast leak from a storage tank or supply line. If a barn explodes you can safely bet somebody was up to something dangerous inside such as working on a gasoline engine or making meth.

Silo’s used to store grain are subject to dust explosions.

I guess a barn could suffer a dust explosion but it seems VERY unlikely. Too much ventilation not enough work going on to fill the air with dust and probably too much humidity most of the time.

A silage silo- a tightly constructed structure used to store and ferment chopped green forage- can theoretically explode. This involves improper management equivalent to driving the wrong way down a one way road. I have never heard of an actual case but then there is no reason I would have unless it were nearby.

Silos with forage are usually low oxygen high environments and falling into one may result in suffocation. It happens at least a couple of times every year someplace in the US.

If there is methane enough to burn there should not be oxygen enough to support a fire.And the fermentation is supposed to be to to CO2.

I have a theory: these Germans have hermetically sealed roofs, put a bunch of cattle in the barn for several weeks, feed them hops and hay, the cows fart like crazy, the warm methane rises, and an explosive concentration is reached as a 17 year old farm hand goes up a ladder holding a candle and a Playboy magazine.

Okay, Fernando … and all readers in the “You Can’t Make This Up” mode, last year, Argentinian scientists developed harnesses for cows that captured their farts. Yes, these so-called ‘fartpacks’ were developed to prevent the release of climate changing methane caused by cattle flatulence. Y’all can google that .

Quick aside/followup Fernando, to our recent exchange regarding 32-well pads … Encana still holds the record, I believe, for most wells drilled from a single pad. In a box canyon in the Piceance formation in northwest Colorado, they drilled 52 directional wells from a 4 1/2 acre pad in 2011. Picture is on the web somewhere from a local paper (Greeley Tribune?). Impressive engineering.

Amazing. They must have been on rough terrain. We seldom drill more than 50 wells from offshore platforms. And that’s very expensive real estate.

Doug, While I generally lurk here a connent is in order. In S.E. Pa. where I an from a large steer feeding operation with a liquid manure system underneath the feedlot began to lose a few head here and there. Long story short…a very large and heavy “manhole”cover was moved by gas pressure enough that the missing cattle were found in the open tank!

I watched Truth land but did not find it convincing. I think that some way or another, contaminated water gets out into the environment. Even if fracking only disturbs the rock formations outside the well casing and results over many months, due to high pressure, in methane seepage into the water table where there was none or very little previously, and some outage spills from the site, or as a result of disposal methods, and mixes with the water, in my view the overall message, symbolised by the flaming tap water, is probably correct.

Pete, I cannot vouch for anyone’s disposal methods. In fact companies in the Bakken have been caught disposing radioactive filters in unauthorized dumps. But the idea that the gas, due to fracking, seeps up a couple of miles through hard rock, to the water table is just a little absurd.

Not even Josh Fox was dumb enough to make that claim. I don’t think anyway. I thought they were claiming that the well casing leaked in the area of the water table. But if he is claiming that the gas does migrate two upward to the water table, then I have even less respect for his opinions than I did earlier… if that is possible.

Ron Wrote:

“However the claim that the gas came from the fracked wells is more than a little absurd. The gas wells are a mile or two below the water table and no frack would reach that high. And the well casing is steel, reinforced with concrete then steel again. No gas can escape.”

What happens to the effluent after fracking is completed?

http://www.nbcbayarea.com/investigations/Waste-Water-from-Oil-Fracking-Injected-into-Clean-Aquifers-282733051.html

Tech, that is a different subject altogether. Why would you quote me about how gas may or may not get into the water table then answer it with a statement about dumping fracking fluids?

Example, statement:

Bird dogs cannot fly.

Reply:

But pigs love to wallow in mud.

Ron Wrote:

“Tech, that is a different subject altogether. Why would you quote me about how gas may or may not get into the water table then answer it with a statement about dumping fracking fluids?”

I don’t think you’ve connected the dots. The drillers are disposing their waste into the ground water using shall wells, which causes some NatGas to be pumped into the ground water with the effluent. When they drain the well (oil or Natgas) of effluent, its also going to include Nat Gas too. Do you follow now?

You must be joking. No, they simply cannot pump their waste water into a shallow well they drill near the drilling site. There are disposal wells and they are very deep into an assigned disposal layer of sandstone. Check the last rig listed here.

Drilling Rig List

That is a disposal well, that is where they pump the salt water produced with the oil. There is no gas in the water they pump there.Why would there be gas in it? The oil is separated from the water and I assure you any gas would be separated also.

CANELSON 43 LIBERTY RES MNGMT CO STOMPING HORSE SERVICE WELL 2 NWNW 21-158N-95W WIL 90326 33105903260000 2/11/2015 Undetermined

“You must be joking. No, they simply cannot pump their waste water into a shallow well they drill near the drilling site. There are disposal wells and they are very deep into an assigned disposal layer of sandstone. Check the last rig listed here.”

You are correct, its illegal, but it they were doing it, it would explain how the ground water is getting contaminated, would it not? Unfortunately not everyone in the world is honest and follows the rules.

No, it explains nothing. A company would not openly commit such a crime. The CEO would go to jail, the driller would go to jail. No one would take such a chance.

But the ground water is not being contaminated by fracking. And the idea that gas could be injected back into the ground with water is really weird to put it mildly. I mean that a stretch even the anti fracking activist would not dare take.

Look at the web site below. They list over a dozen instances where the groundwater has been tested by various state and federal agencies. Not one single case of groundwater contamination was found.

How Anti-Fracking Activists Deny Science: Water Contamination

State Review of Oil and Natural Gas Environmental Regulations, Inc. (STRONGER): “Although an estimated 80,000 wells have been fractured in Ohio, state agencies have not identified a single instance where groundwater has been contaminated by hydraulic fracturing operations.” (January 2011)

Ron Wrote:

“No, it explains nothing. A company would not openly commit such a crime. The CEO would go to jail, the driller would go to jail. No one would take such a chance.”

Of course the would not openly do this. But crimes are committed all the time. I am giving a reasonable hypothesis of how ground water could get contaminated. Its plain silly to assume that drillers and service companies will never commit crimes.

Ron Wrote:

“Look at the web site below. They list over a dozen instances where the groundwater has been tested by various state and federal agencies.”

Here is a news source of confirmed ground water contamination:

http://www.usatoday.com/story/money/business/2014/01/05/some-states-confirm-water-pollution-from-drilling/4328859/

“Pennsylvania has confirmed at least 106 water-well contamination cases since 2005, out of more than 5,000 new wells. There were five confirmed cases of water-well contamination in the first nine months of 2012, 18 in all of 2011 and 29 in 2010.”

You asked how would the Natgas get injected into the ground water, Simple: They don’t bother hooking up the equipment to seperate the gas from the water. They literally connect the drain pipe into the shallow well pushing both effluents and Natgas (in suspension) into the shallow well. Most of its effluent waste but there will be some NatGas present too, or perhaps condense (still under high pressure) that boil off when the pressure drops.

I am sure we will see this practice come to light in a year or two, and people will go to jail.

Here’s a quote from the article you linked:

“Experts and regulators agree that investigating complaints of water-well contamination is particularly difficult, in part because some regions also have natural methane gas pollution or other problems unrelated to drilling. A 2011 Penn State study found that about 40% of water wells tested prior to gas drilling failed at least one federal drinking water standard. Pennsylvania is one of only a few states that don’t have private water-well construction standards.”

Some states just need improved standards and regulations.

I find the use of the term “climate denial” to be pretty weird. I’ve never met anybody who “denies the climate”.

To understand Gasland’s merits one has to approach it from a knowledge based point of view. I remember seeing it, laughing about it, and thinking it was a lot of BS. But I’m prepared to sit down to discuss it and see if there’s any merit to anything it mentions.

I find the use of the term “climate denial” to be pretty weird.

FYI, In ordinary parlance it usually is considered shorthand for “climate science denial”! To be even more specific it is generally used to describe the denial of climate science by individuals who self label as skeptics, but have no climate science credentials to speak of, yet feel they are nonetheless qualified to deny the results of the peer reviewed science done by actual climate scientists based purely on beliefs and mostly ideological grounds . They do not accept, that, CO2 added to the atmosphere as a result of humans burning fossil fuels is causing profound changes in climate stability.

I read peer reviewed papers all the time, and some of them are nonsense. Are you familiar with the process? Peer review doesn’t mean the text is that good. Peer review can range from absolute uselessness to very helpful hints. Some peer reviewers also like to bless dumb papers, because they have a “I dont pee in your soup if you don’t pee in my soup” attitude.

As for your use of “climate denier”, it sure sounds very inaccurate.

Whatever, Fernando.

The point I would like to make is that if I’m diagnosed with heart disease I’m going to pay attention to what my cardiologist and his colleagues have to say and until my plumber gets his MD and has spent a decade or two working as a cardiologist, I really don’t care how many medical books he has read, his opinion about heart disease ain’t worth squat.

The point is that in this world people can disagree, and such words are considered an insult.

Check this out

“The Tragedy of the Risk-Perception Commons: Culture Conflict, Rationality Conflict, and Climate Change”

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1871503

“The individual level, which is characterized by citizens’ effective use of their knowledge and reasoning capacities to form risk perceptions that express their cultural commitments”

In other words, people are following their cultural leaders, and rationalizing on the way.

People don’t use a label like “climate denier” when trying to persuade someone – it’s a shorthand for talking about someone who’s following their cultural leaders rather than their best thinking.

Or they use “climate denier” when they follow THEIR cultural leaders. The paper does show the amount of knowledge in both extremist groups is roughly similar, the “skeptics” appear to be slightly more knowledgeable, and the degree of extremism increases with the amount of education. This is why I always try to point out that name calling and patronizing attitudes are better avoided. In this particular case I think there are quite a few people cranking things up on purpose for their own polical reasons.

Yeah, both sides have a fair amount of herd-following.

Yet, even though both sides have their share of subjectivity, there is an objective reality, and it happens to be on the side of the people who feel that Climate Change is a serious problem. I’m not sure exactly what historical accident put Republicans in the camp of the Fossil Fuel industry, and Democrats in the camp of the scientific community, but that’s where they are.

Pretty much only in the conservative political corner of the US, and only in small odd corners of the scientific community do we still find disagreement. A tiny amount of scientific disagreement isn’t surprising – we have to keep in mind that it still possible to find a tiny number of biologists, and a significant number of non-biology scientists, who don’t believe in evolution…

Here, for instance, are the physicists: “The American Physical Society “strives to be the leading voice for physics and an authoritative source of physics information for the advancement of physics and the benefit of humanity”.

Their current statement about Climate Change is as follows:

“The evidence is incontrovertible: Global warming is occurring. If no mitigating actions are taken, significant disruptions in the Earth’s physical and ecological systems, social systems, security and human health are likely to occur. We must reduce emissions of greenhouse gases beginning now.”

That’s a strong statement.

See http://www.aps.org/policy/statements/07_1.cfm

Even the society for Petroleum Geologists is on record as agreeing. What more do we need?

I think running out of fossil fuels and overpopulation are more critical. I’m also worried about governments violating human rights, and the way useless wars are being started.

I agree those are all serious problems.

But, we have better and cheaper substitutes for oil, and we don’t for our biosphere.

“I’m also worried about governments violating human rights…” ~ Fernando Leanme

But that’s what they do as part of their very existence. When you see governments and their use of force (upholding so-called-private corporate property [laws] for example) through the eyes of anarchism/simple ethics, all superficial concerns, say in the news, about this or that government’s transgression all fall away when you get that governments are really just pimps. It’s pimped-out neofeudalism/neoserfdom.

What part of undemocracy do you not understand?

“It is just as difficult and dangerous to try to free a people that wants to remain servile as it is to enslave a people that wants to remain free.” ~ Niccolò Macchiavelli

“It seems that the claim I and many others have made for years, that the ‘War on Terror’ is a gigantic fraud used to instill fear and further the creation of an unconstitutional surveillance state in America is absolutely true. The ‘terrorists’ they have declared war on are the American people themselves.” ~ Michael Krieger

The governments are the biggest terrorists; have the monopoly on terrorism, not just force.

“The most dangerous man, to any government, is the man who is able to think things out for himself… Almost inevitably he comes to the conclusion that the government he lives under is dishonest, insane and intolerable…”

~ H.L. Mencken

”I’m not sure exactly what historical accident put Republicans in the camp of the Fossil Fuel industry, and Democrats in the camp of the scientific community, but that’s where they are.”

It is a simple as simple can be – SO SIMPLE that most people refuse to believe it.

We are tribal or pack animals and our neocortex is on our boss. We are members of the tribe first last and foremost with only a very few exceptions.

The MODERN liberal wing of American politics – which overlaps mostly but by no means entirely with the Democratic party these days – is pushing an agenda that pisses of social conservatives to the nth degree.

So part of the answer is that many things the Democrats want is are things to be resisted and fought agains because there really is a CULTURAL WAR being actively fought. If the liberals want it then conservatives must necessarily try to deny it as part of the war. You win a war physical or cultural one fight at a time. Lose enough fights and you lose the war. You don’t give up ANY ground without a fight unless you must. SO -EVEN if an issue means NOTHING to you personally if you are a true blue conservative and the democrats are FOR it you line up against it. This works both ways of course.

Another part of the answer is that the liberals who are politically active are generally insulated from the direct undesirable effects of their initiatives. I am painting with a broad brush but I can say with no doubt whatsoever that the odds of a person being a liberal are twice as high if he is a government employee as if he is a construction worker – unless he is in a powerful union.Most working people of course are not members of powerful unions. The unions are siamesed to the Democrats. Teachers and post office people and government people in general don’t get laid off when an industry closes or moves due to changing regulations etc. Redneck working people do. This scares the hell out of working people and the business community is highly skilled at fanning the flames of this fear.

Just about every new law and regulation I have ever heard of makes it HARDER fro an uneducated or poorly educated person to go into business for himself or to stay in business for himself. IF just a third of the environmental regulations that have been proposed for my area and my industry are ever implemented I would be forced to shut down except that I have already retired. Right now there are regs that may or may not go into effect that will result in the defacto uncompensated taking of about twenty percent of my very best land. I will still own it and have to pay taxes on it but it will be totally worthless to me except to go rabbit hunting.

The liberal wing thinks it is fine to say what will be legal and illegal according to their own morality – whereas the conservatives like their own older morality much better.So a real conservative hates a real liberal’s guts and the liberal returns the favor with interest.

The Democrats are right about environmental issues but the proof is such that if you do not want to believe it you can easily convince yourself it is flawed or even fabricated. Not many people – probably not more than two or three out of a hundred in this country – are actually qualified to have opinions except second hand – meaning their opinions are accepted as a matter of faith. You can graduate from almost any elite college or university in the country with the exception of a VERY few that are just about all science or engineering oriented without learning half as much real honest to Jesus science as I learned in a backwoods high school on the academic track well over half a century ago.

ONE SO CALLED SURVEY course is all you need for a bunch of majors at Yale. Look it up. These courses are about the intellectual equivalent of basket weaving.

Now the liberals /Democrats are WRONG about a great many things that are important to me and TO ME it is perfectly OBVIOUS they are wrong.

But to a liberal my proof is no good. A liberal doesn’t want to believe and just like a conservative finds it very easy to convince himself that CONSERVATIVE evidence is flawed or even fabricated.

Society moves slowly. The average conservative is slow to admit than new regulations are needed but eventually accepts them. The average liberal is slow to accept any loss of government power and authority but likewise gradually comes to accept it.

If my cousin the mail carrier had his way UPS and FEDEX would be outlawed. Fax machines too.

I used to be a teacher and I KNOW without a shadow of doubt that the teachers unions and teachers lobby and monopoly is ninety nine percent about teacher and one percent about kids.

IT is mostly US and THEM or to put it slightly differently US OR THEM folks. We are just naked apes that have learned how to wear clothing and make stuff.

The mid brain is still in charge.

Old farmer mac,

“We are just naked apes that have learned how to wear clothing and make stuff.

The mid brain is still in charge.”

This is something you and I agree about.

Hoping Political Economist or someone who can decipher this model can shed some more light on this:

Don’t waste time with solar – lecturer

“Despite Jamaica being a land of sunshine, a senior lecturer at the University of the West Indies, Mona, has suggested that it would be uneconomic for the country to harness solar power to fire the power grid.”

The actual resaerch paper (pdf)

Achieving the Renewable Energy Target for Jamaica

The researcher, an economist, is saying “”Contrary to increasing popularity of solar panels in Jamaica, given current investment climate and costs, solar energy is not recommended as an energy option for electricity generation for the national grid,”. He may be absolutely correct as far as the national grid goes but, the calculations for individual businesses, especially those with high daytime and low night time electricity consumption, point to fairly short payback periods (4 years).

Alan from the islands

Alan – The model seems to only consider CAPEX (Capital Expenditures),

and ignores O & M (operations and maintenance).

At least that’s how I read “c sub(i)” – the unit cost of capital/kWh for electricity source i.

Solar, wind and hydro are “all CAPEX” (actually O & M is around 10 – 20% of lifetime cost),

whereas cheap gas turbines are 10 – 20 % CAPEX, with huge and variable (unless one has a 20-30 year hedge on fuel) O & M costs.

He _could_be_ including O & M in “capital cost”, with a model of net present value of the O & M costs,

but I don’t see any assumptions about discount rates, lifetime, presumed inflation, etc. that are typically part of such an approach to LCOE (Levelized Cost of Energy).

And I don’t see any actual numbers associated with capital costs – highly suspicious – “trust me, I’m the expert”.

Here’s a decent paper on LCOE of various technologies, comparing 6 different models/sets of assumptions. The assumptions make a lot of difference, and some of clearly outliers – the EPRI’s MERGE 2009 assumes PV CAPEX of $8/Wp flat to 2050 – when large scale PV is today closer to $2/Wp.

http://www.nrel.gov/docs/fy11osti/48595.pdf

The NREL paper is from 2011, and many of the models don’t have much/good real-world cost data.

The International Renewable Energy Agency, among other things, tracks actual costs of renewables projects.

This IRENA paper will have updated real-world costs from 2014.

http://www.irena.org/DocumentDownloads/Publications/IRENA_RE_Power_Costs_2014_report.pdf

This paper has a better (at least, less obscure model of cost of power), and it’s focused on Caribbean islands. (top of page 3).

http://www.reiner-lemoine-institut.de/sites/default/files/plessmann2012_paper_energy_supply_on_interconnected_renewable_based_islands_in_the_eastern_caribbean_sea_5thired_berlin.pdf

They’re decent enough to put their assumptions in at the back.

And even there, they don’t break down their O & M costs, just providing a lump sum.

It’s interesting to note this paper also sees little need for PV, as wind is so cheap, at least at utility scale.

And geothermal is claimed to be even cheaper.

IRENA has some regional reviews, this one is project case studies of islands in general, though it mentions some projects in the Caribbean.

http://www.irena.org/DocumentDownloads/Publications/IRENA_Renewable_Energy_for_Islands_2014.pdf

Well … if there is any validity to the whole Marie Orsic (her pic is viewable online) and the Aldebaran stuff, that woman could shanghai my sorry, brainless ass to any planet in the galaxy anytime she wants.

Alan, I’m not 100 % familiar with Jamaica, but I put my pencil to it for Cuba. And I reached exactly the same conclusion. The best option seems to be to expand sugar cane, reduce cattle, use some of the sugar for ethanol, burn bagasse, use wind as dictated by local wind fields, build hydro, pumped storage (to use wind excess to store power.

Cuba has a lot more land than Jamaica. This means we can produce and store ethanol to burn in turbines to use when the wind is down. Theoretically, if we add a couple of nuclear power plants for baseload we would be zero net emissions by 2050. But first we got to get rid of the Castro dictatorship.

If you want, run by that business case for a small business, and I’ll look it over. Sometimes one can take advantage of government rules and subsidies which don’t apply at a national level.

How long ago did you run your numbers for Cuba? It is my understanding that while wind power is getting cheaper year by year that solar power is getting cheaper even faster and may soon be cheaper than wind in a lot of places with good sun but only so so wind.

Some people claim solar is already cheaper. I think they are probably right for small scale installations but not for big ones. It seems the cheapest wind project that is large enough to be economical runs into the millions where as you can install solar efficiently in much smaller increments.

Does Cuba have a really good wind resource ? I expect it probably does but not sure.

OFM – check out page 27 on the IRENA report, it shows costs in 2010 and 2014. While PV came down greatly, it’s still (on the average) more expensive than (onshore) wind.

http://www.irena.org/DocumentDownloads/Publications/IRENA_RE_Power_Costs_2014_report.pdf

You’ll see projects range greatly in cost.

Here’s the thing with renewables – they’re all site specific.

A place with no stream and/or no elevation drop – not good for hydro, even if hydro is the cheapest renewable (on average).

A place with greatly variable wind – may not get a wind system built there – not worth the bother.

What you say is true – for $1000 a person can power a small ‘fridge from solar in pretty much all tropical and temperate locations, but small wind is typically more expensive and requires fossil backup.

But big wind, with a grid to shift power around, is often cheaper than coal, though it requires millions of US $ (or equivalent) up front.

Large wind turbines are less than 1 $/Wp in many places (total installed cost just over $1 up to $2.50), but small ones are like $4 to $9/Wp, which is same or worse than solar pretty much anywhere.

Big Chinese wind turbines are down to $0.6X/Wp.

The NREL wind map for Cuba I found shows a few good spots, but mostly moderate.

http://www.nrel.gov/wind/pdfs/cuba.pdf

more international maps at:

http://www.nrel.gov/wind/international_wind_resources.html

Old farmer, I did it two days ago. This was triggered by a discussion we had about biofuels. I think I described how I had helped build a biofuels systems dynamics model, but it wasn’t used for a specific case like Cuba’s.

Jamaica is a fairly small island, it has a mountain chain running down the middle, so it’s very different from Cuba. A wind power set up would have to be designed so it can be shut down and withstand storms and hurricanes, and the shut down period can last several days.

I don’t really worry about solar power kits for a single home, I’m afraid that’s fairly irrelevant when one has to worry about powering a modern society. If you want to obtain the real cost of solar power work it out like this: take a new plant’s capacity, say the 550 MW plant in California. Multiply by the time the sun is available in winter (say 10/24ths). Take that figure and assume you store half of what it produces in a giant battery pack. This 550 MW plant would yield 115 MW. It cost 1.5 billion US dollars, without the batteries. That’s $13k per kW excluding batteries, and expenses. And if this exercise is carried out for a northern location then the derating is much harsher. Daylight hours are shorter, and it’s not unusual to have two solid weeks of overcast (remember the Battle of the Bulge and the siege of Bastogne?).

For Jamaica wind is much better. But in their case the realistic solution is to build a high efficiency coal plant and get a long time supply contract from Colombia. The Germans build coal plants like fast food joints make hamburgers. The Jamaicans are definitely better off copying the Germans.

For Lodges we design for no more than 15% kWh thru Batteries, maximizing nighttime effeciencies if you are able to shift loads like Day Laundry. Invest in the PV side, Size the array for Cloudy days. For Re-sale or Grid, Time of use rates reflect storage costs at night and loads will shift to day. Store daytime production via Hot water, Ice making, Freezers, etc.

Yes, but a country isn’t a lodge. What I do is try to use apples and apples comparisons. And I’m really worried about the dumb incentive plans used by some european countries for solar. I’m ok with incentives for wind up to a point. But I’d rather have hydro and nuclear plants than solar. They just need lower costs, and find a viable storage mechanism.

A wind power set up would have to be designed so it can be shut down and withstand storms and hurricanes

That’s pretty standard for off-shore wind plant.

solar power kits for a single home, I’m afraid that’s fairly irrelevant when one has to worry about powering a modern society.

Take a look at caiso.com. Look at the afternoon peak. Look hard – it’s disappeared. The daily peak used to be noon to 3pm, by a good distance, and that’s gone forever. Why? Customer-side solar power, both on industrial/commercial roofs, and on residential roofs.

It’s big, it’s real, and it’s here.

solar…Take that figure and assume you store half of what it produces in a giant battery pack