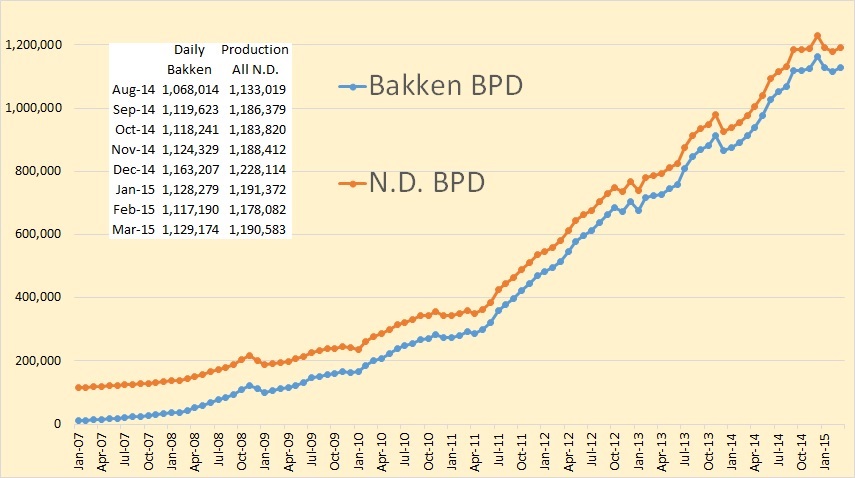

North Dakota has published their Bakken Production Data as well as North Dakota Production Data.

North Dakota production was up 12,501 bpd above February but still stands 37,531 bpd below the December high and is still 789 bpd below the January production numbers.

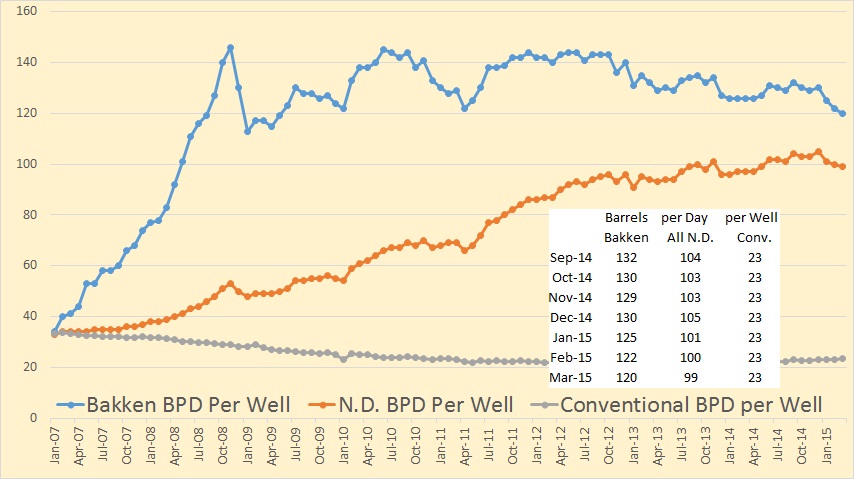

Barrels per day per well is dropping, 12o for Bakken wells, 99 forN.D. Total and 23 for Conventional wells.

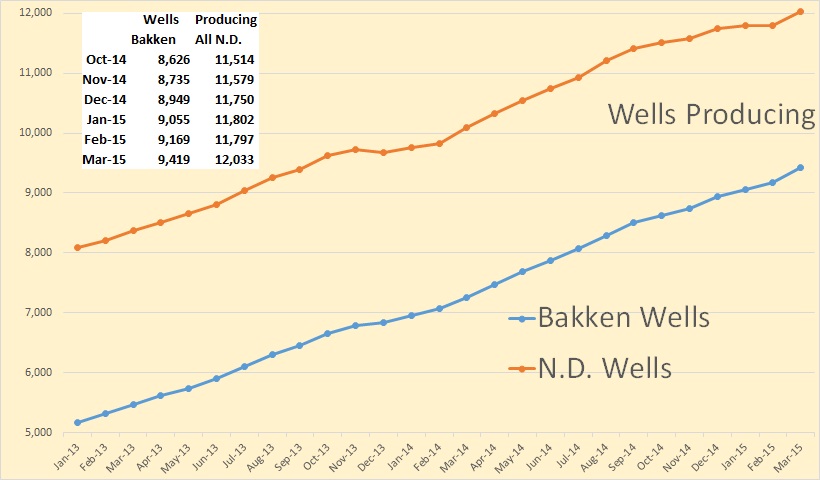

According to the NDIC stats the number of wells actually producing in the Bakken increased by 250 in March and total North Dakota wells increased by 236. Which means some non-Bakken wells were shut down. Lynn Helms said, in the Director’s cut, that the increase was 240 producing wells though his totals were different.

From the Director’s Cut:

Feb Producing Wells = 12,199

Mar Producing Wells = 12,439 (preliminary)(NEW all-time high)

9,397 wells or 76% are now unconventional Bakken – Three forks wells

3,037 wells or 24% produce from legacy conventional pools

Feb Permitting: 197 drilling and 0 seismic

Mar Permitting: 190 drilling and 0 seismic

Apr Permitting: 168 drilling and 1 seismic (all time high was 370 in 10/2012)

Feb Sweet Crude Price = $34.11/barrel

Mar Sweet Crude Price = $31.47/barrel

Apr Sweet Crude Price = $38.33/barrel

Today Sweet Crude Price = $46.00/barrel (all-time high was $136.29 7/3/2008)

Feb rig count 133

Mar rig count 108

Apr rig count 91

Today’s rig count is 83 (lowest since January 2010)(all-time high was 218 on 5/29/2012)

The statewide rig count is down 62% from the high and in the five most active counties rig count is down as follows:

Divide -77% (high was 3/2013)

Dunn -74% (high was 6/2012)

McKenzie -52% (high was 1/2014)

Mountrail -63% (high was 6/2011)

Williams -63% (high was 10/2014)

Comments:

The drilling rig count dropped 25 from February to March, 17 more from March to April, and has since fallen 8 more from April to today. The number of well completions2 rose sharply from 42(final) in February to 189(preliminary) in March. Oil price is by far the biggest driver of the slow-down followed by oil extraction tax triggers, NDIC gas capture goals, and NDIC oil conditioning rules. There were no major precipitation events, 8 days with wind speeds in excess of 35 mph (too high for completion work), and 1 day with temperatures below -10F.

Over 99% of drilling now targets the Bakken and Three Forks formations.

At the end of March there were an estimated 880 wells waiting on completion services, a decrease of 20. To maintain production near 1.2 million barrels per day, 110-120 completions must be made per month.

I bolded that last line because I flat don’t believe it. If they had 240 additional wells in March and production increased by only 12,500 barrels per day it will take one hell of a lot more new wells than 110 to 120 to keep production flat. Of course there is a difference between additional “wells producing” and “new wells completed” but that should make little difference. Old low or non producing wells are shut in so the number of “new wells” should be larger than additional “wells producing”, in most cases that is.

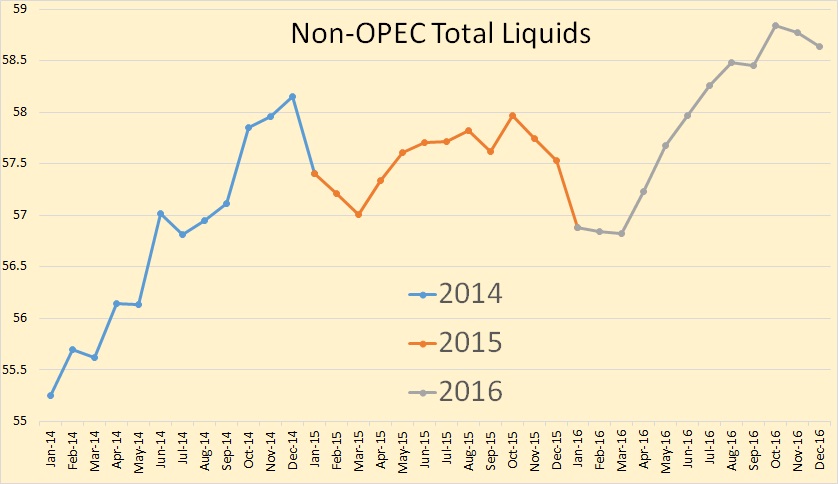

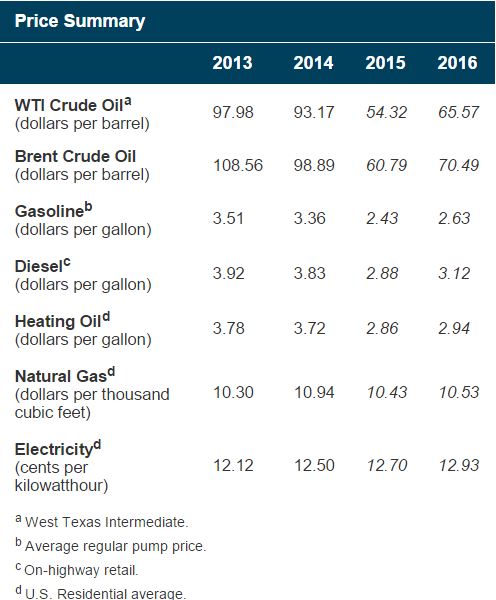

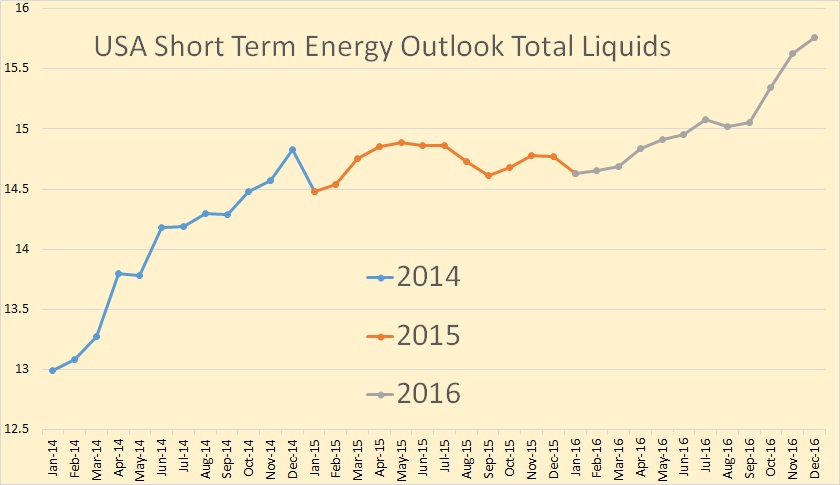

The EIA’s Short Term Energy Outlook just came out. All the data is “Total Liquids” and is in million barrels per day.

The EIA is actually expecting total liquids to decline from the high of the last three months of 2014, though the annual average would still be .83 million barrels per day higher. However they are expecting things to really take off again in 2016.

They are predicting WTI prices to average $65.57 next year. That is not enough, in my opinion, to allow a shale recovery. So I really don’t understand their reasoning.

Looks like they are not expecting much of a production increase foe the US in 2015, closing the year below the December 2014 level. But they expect things to take off late in 2016. This is rather strange in view or their price prediction for 2016.

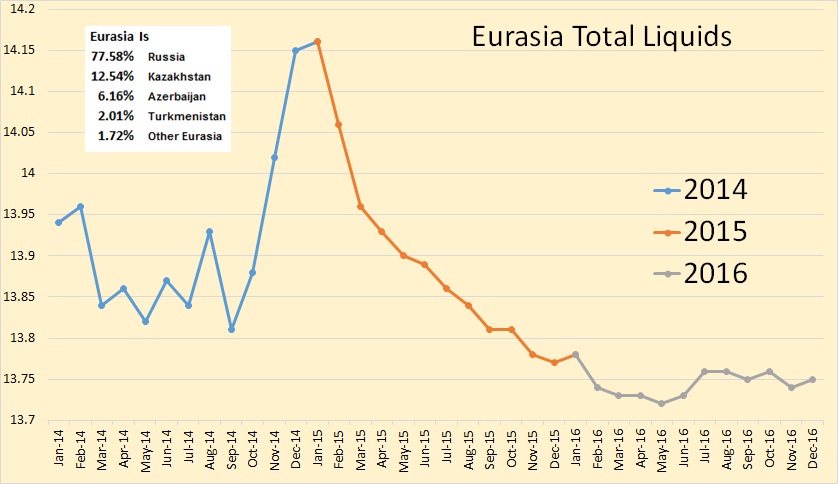

The only other really interesting prediction they had was Eurasia. They expect Eurasia to peak in January 2015 and decline pretty fast from that point on. Obviously they are not expecting Kashagan, Kazakhstan’s giant but troubled field, to come on line before 2017.

The decline is exaggerated here on this non-zero chart. From peak to valley is really only about 3% of total production. But nevertheless 3% is quite a lot from such a large producing area.

___________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

Enno Peters data shows 179 new wells began producing in March 2015 and production increased by 12,500 bpd. That means it would take at least 160 wells per month to keep production flat. If there were 150 wells completed in April then there will be at least a 10,000 bpd decline.

Hi Ron,

The first month that a new well produces it only produces for about 15 days on average because the well start dates can be anywhere from Mar 1 to March 31. So some of the boost from 179 new wells will occur next month.

Lynn Helms estimate of 120 new wells for flat output is correct as far as I can tell. Enno has also run some simulations which show the same thing and Rune Likvern has also said that although 140 new wells are needed for the first month, that the number of wells needed to keep output flat falls to about 110 new wells after 10 or 12 months (from memory), with an average of about 120 new wells per month for 12 months (if I am remembering correctly). Chart below showing modelled output for the North Dakota Bakken/Three Forks with 120 new wells added each month from April 2015 to Dec 2016.

The first month that a new well produces it only produces for about 15 days on average because the well start dates can be anywhere from Mar 1 to March 31. So some of the boost from 179 new wells will occur next month.

Geeze Dennis, I know that. But half of the new wells from February were responsible for the increase this month. It works the same, month after month.

Lynn Helms estimate of 120 new wells for flat output is correct as far as I can tell.

No, he is off by a country mile. It will take about 150 to 160 new wells per month to keep production flat. That is what the data from the past 12 months tells me,

Feb + March well completions is 241. Divide by 2, and we can guesstimate that the 12,500 bpd drop is equivalent to 115.5 well completions.

Gotta say 120 well completions to stay flat sounds like a good estimate.

I agree with Ron about number of wells needed to keep production flat. There were 152 new wells in January and 160 new wells in February and production fell a bit in February.

I tried to attach a graph showing number of wells put on production each month (not completion month). But it didn´t work :(..

Hi Freddy,

There seems to be a size limit, try using gif format to reduce file size and use fewer pixels (smaller image.)

Usually 50 kB or less works.

It’s starting to look like the new wells are not as productive as the ones in the past. Past posts have talked about running out of sweet spots. Or maybe these are shorter horizontal lengths with less fracks?

I have heard talk about a new method to make the wells much less expensive, I wonder If that is being implemented.

Actually, I have some graphs with one month after first production data that shows that the wells have produced as good as or even slighty better than older wells. February was a really really good month for McKenzie. There seems to be some problems attaching files. So not sure I can show them. The decrease in production is because the number of new wells is a bit lower than before.

You are both right. The confusion arises from the meaning of “keeping production flat”. Is it for the next few months, then Ron is right. If you talk about the long term (> 6/12 months), than Dennis is right. About 120 wells per month (plus/minus 10) are needed to keep production at 1.2 m bpd for the coming years.

I have posted the following graph a few months ago.

Yes that sounds reasonable. Older wells decline slower. But you have assumed that future wells will produce as good as current wells?

Yes, it’s just a simple projection. I have no idea how future well curves will look like.

Hi Enno and Freddy W,

It turns out that I was assuming new well EUR had increased in 2013 and 2014, if that is wrong and EUR has not changed (or not by as much as I had assumed which was about a 16% increase from Dec 2012 to Jan 2015), then Ron is correct, about 150 new wells per month are needed long term to keep output flat and about 160 new wells short term (next month). Some comments on this down thread.

Hi FreddyW,

I agree with Enno, I am looking at a steady number of wells that will keep output relatively flat over 12 to 24 months. About 140 to 150 are needed for the first couple of months, then fewer wells are needed. I know that Ron won’t be convinced, but it seems that you Enno and I are in agreement.

My scenarios assume that well productivity decreases starting in June 2015 with a gradual increase in the rate of decrease for 12 months. A maximum annual rate of decrease is reached in June 2016 at 7%/year. This is just a guess based on adding 120 new wells per month, if wells are added at a faster rate, the rate of decrease is higher, if the wells added per year doubles then the rate of decrease doubles.

Essentially I pick a rate of decrease that causes the URR of 40,000 wells to be 10 Gb (USGS mean estimate).

The date that this begins is a wild guess. We won’t be able to tell until 12 to 24 months after it has begun.

Yes pretty much. But as I showed last time, completing a new well close to an old one, cause the old well to increase production because of well interference. This causes the average decline rates to look more favourable than it would have been without well interference. Up until 2014 the number of new wells has increased every year. I suspect that if the number of new wells stay flat, then decline rates for older wells will increase a bit. If they stop completing new wells entirely in an area, then I expect decline rates in older wells in that area to increase substantially. Currently, the average production for wells completed in 2008 has actually increased the last year or so because of well interference (as I discussed last time). So I think a bit more than 120 wells per month may be needed.

Hi FreddyW,

The well interference idea is interesting. Sometimes the older wells may be refracked as well. Looking at the data for some of the closely spaced wells, it looks like the old wells did increase output when new wells were drilled and I had thought it was due to a refrack, but your idea makes more sense.

As wells get very closely spaced we may see more of this, but decline rates may steepen as well.

For now I have assumed that the increased output in 2013 and 2014 will result in higher EUR per well, instead we may see achange in the shape of the well profile with a steeper decline over the fist 24 months and overall EUR unchanged from the 2008 to 2012 average (or perhaps lower).

Freddy, is the production increase in older wells when a new well is drilled caused by the new well fractures extending close to the older well area of influence?

I’m used to the term interference, but I see it as interference between two transients causing a boundary which in turn leads to pseudo steady state. Is the term interference used for hydraulic fractures?

Fernando

I do not know if Freddy has confirmed info on this topic, but the term ‘halo effect’ has been used for the past couple of years to describe this.

When an existing well is temporarily shut down as nearby wells are frac’d, pressure readings on the shut in well can spike dramatically. When these wells resume production, it is quite common for output to rise from pre-frac levels and stay elevated for many months.

As far as I know, there are several theories trying to explain this with no unanimous, provable answer, yet.

Hi Fernando and coffeeguyzz,

I don´t know the exact reason. I have just observed the phenomena in my data. I did consider pressure buildup as the reason. But the production is three times the original production and I always find a well close by being completed at the same time. So I think some sort of communication is more likely in these cases.

Hi Dennis,

Yes absolutely, I think that is a possibility. Looking at the latest yearly production profiles I can see that the decline rates for 2013 and 2014 are for sure higher than earlier years the first 12 month. Then for 2013 it seems to follow the 2010 and 2011 curves. 2013 and 2014 has only recovered something like 10-15 thousand barrels more during the first 12 month compared to earlier years. So if that trend continues, then that is the extra amount of oil they will recover. But the decline rates may as well turn out to be higher than earlier years.

Hi FreddyW,

Thanks for your insights.

My thinking is that the recent output increase may be due to more frack stages and higher proppant levels during the frack job have increased the initial flow rates. The total amount of oil recovered over the life of the well may not change because there is only so much of the original oil in place that can be recovered profitably.

So initally the decline rates will be steeper, but later the decline rates may be less steep.

Eventually the sweet spots will be fully drilled and then estimated ultimate recovery(EUR) of the average new well will begin to decrease.

Freddy, Dennis

What you – Dennis – just mentioned is a HUGE component in all the plans/computations that companies bring to bear in these matters, specifically higher, earlier returns at the expense of future production.

Recent case in point … in the Utica, a company just used Gasfrac’s methods and got the expected early ‘bump’ in IP.

However, as has been the case these past years, the higher flows were not sustained.

There is still a massive amount of data gathering, analyzing and theorizing occurring in these fields.

Maybe it’s a combination? Let me think about it. You know, if this is happening it may mean water injection will work in the future. Crazy.

Fernando,

You are one step ahead in the thought process, but I’m thinking the players involved are a couple of yards ahead in their projections.

Pure speculation on my part, but if you were an operator with, say, six wellbores, each two miles long and spaced 500’/600′ apart, and felt you could pressurize the matrix with, say, liquid/gaseous CO2, field gas (being done successfully right now by DeeThree in Canada, nitrogen or some combination, you may very well increase your recovery by several percent.

As it is, 90%+ of the hydrocarbons are still in place.

This is why there is ongoing research and field trials in attempts to utilize this massive underground collection grid that – at present – is being significantly underutilized.

Coffeeguyzz, I’ve served as a “Typhoid Mary”, providing consulting services to companies wishing to have a peek into un patented technology owned by other companies. The amount of work that goes on isn’t visible to most company engineers, and some of what they do is really far out. But I’ve found the work doesn’t bring to bear all the tools they could use.

I suspect these tight zones are suitable for some sort of EOR, but they need to try it ASAP, because the processes work better if the oil viscosity is preserved close to the initial value. And sone of the more exotic techniques require incredibly high prices.

I thought about it. I suspect most of the rate increase observed in a fracked well after it´s shut in to frac offset wells is caused by flow from the naturally fractured reservoir into the hydraulic fractures. This means the well pressure will build up or increase as the fluids pack the fracture system and the well itself.

I´m under the impression such wells being shut in to frac offset companions are mostly in a transient flow regime (the negative pressure pulse caused by the well hasn´t reached a boundary, the well behaves as if it were producing an infinite reservoir). Even if the natural fracture system has very low permeability, the hydraulic fractures have a large contact surface, which means they should “recharge” with fluids.

Regarding the use of EOR, I think they need to step way out of the box on this issue. For example, it´s common to prescribe keeping injection pressure below frac pressure in injectors. However, I´ve found a fracked injector isn´t that undesirable. In some cases it´s necessary to get enough injectivity. I don´t think ANY simulations, tests, or pilots which maintain a low injection pressure will work worth a darn.

Fernando

I have not been following events too closely, but two years ago, DeeThree used one lateral wellbore in a field of ten, I think, to re-inject gas in the Upper Bakken Silt formation in Canada.

They reported 20%/30%/ increase in output and arrested decline rates.

Their plans called for placing one injector for every future 3 or 4 laterals.

As a follow-up to your observations about watching ExxonMobil’s actions, they (XOM) have announced a new, proprietary frac’ing process, XFrac, that has greatly enhanced effectiveness as well as speed. Despite my extensive checking, I found almost no detailed description of the process, although the few available tidbits of info lead me to suspect it is some iteration of the coiled tubing conveyed Bottom Hole Assembly that appears to be poised to rewrite the frac’ing processes everywhere.

XTO, XOM’s subsidiary, is going balls to the wall drilling up in the Bak.

I thought a year ago we stopped believing there had to be a relationship between new completions and production breakeven. We were seeing several months with quoted numbers that blew apart all scenarios proposed.

Ron somewhere made the point that mid month doesn’t matter because previous mid month is in play and so in raw form 150 new completions * what xxx bpd first month? = what’s the legacy decline now (where legacy is defined as all wells past month 1). Thought it was supposed to be 90K bpd by now.

So pick any bogus number you want for xxx and that will tell you how many wells offset 90K. If xxx avgs 800 bpd month 1, then 90K/800 = 112. If month 1 avg flow is 400 bpd then you gotta have 224 wells — unless truckers decide to go on strike. Then you can complete all the wells you want and you’ll flow nearly nothing.

Hi Watcher,

Two problems.

First legacy decline in the DPR is not correct, it is between 55 and 60 kb/d not 90 kb/d for March 2015.

Second, the legacy decline changes over time and depends on the number of wells drilled.

As a simple example, assume all legacy decline comes from the most month of new wells drilled prior to the current month. If 200 wells were drilled last month the lagacy decline would be higher than if 100 wells were drilled.

A more detailed example down thread.

In my comment above “most month of new wells drilled” was supposed to be “most recent month of new wells drilled”.

Hi Ron,

Hopefully this explains it, as charts are not convincing it seems.

Link to spreadsheet below:

https://drive.google.com/file/d/0B4nArV09d398cGg5Z2NEREY4MEk/view?usp=sharing

A more extensive spread sheet at link below with slightly lower well profile. New estimate, 127 wells needed for flat output.

https://drive.google.com/file/d/0B4nArV09d398dTNOWFBEMmVYYTg/view?usp=sharing

New wells fall from 180 to 135 over a 6 months and then gradually to 127 new wells per month over 6 to 18 months for flat output in ND Bakken/Three Forks.

Chart below shows (as Enno suggested) that Ron is correct initially that about 150 new wells are needed, but it gradually falls over time (read number of new wells per month on right axis). My 120 new wells per month estimate was wrong, it is about 125 to 130 new wells per month needed for flat output (127 new wells from July 2016 to July 2018). The average number of wells per month from July 2015 to Dec 2017 is 130 new wells per month in the chart below.

Something interesting I saw looking at EOG’s Parshall Field production information for March, 2015 as reported on the ND site which was released yesterday.

EOG had 310 wells listed in Parshall Field for March, 2015. The average production per well was 132.22 barrels of oil per day, which is above the Bakken average of 120 reported by the State of ND for March, 2015.

However, I also noted that of the 310 wells, 72 were either shut in or produced less than 30 barrels of oil per day for March, 2015.

Parshall is considered to be one of the top producing fields in the North Dakota Bakken. Yet over 23% of the wells are now below 30 barrels per day. Maybe there are some reasonable explanations for that many low producers besides massive decline rates?

It would be really interesting to see EOG’s lease operating statement for Parshall for the first 3 months of 2015. I assume the 2014-2015 wells are carrying the earlier completed wells.

Shallow

I did a quick scan of the permit #’s of EOG’s Parshall wells and, unsurprisingly, many are pre #20,000 – indicating that they are ‘older’ wells (a precise recounting could be had by accessing the wells’ histories via the ND subscription service).

It is recognized by the managers’ statements over the years that EOG is postponing full development of the Parshall for several reasons, including a main focus on the Eagle Ford.

EOG has been in the forefront (as usual) in the nascent area of secondary recovery processes in the shale fields. There has been much speculation that the suits have yet to identify the optimal field design so as to incorporate both maximal infill spacing as well as future secondary recovery efforts.

The adjacent Sanish field – viewable on the ND Gis map – provides a glimpse of future Parshall development.

Hi Ron,

The point is that 180 new wells will be different from 160 new wells, in March there were a lot of wells relative to Feb, but not all of the increase will happen in the first month also this affects legacy decline, so it is probably best to look at three month output averages which will smooth out some of these effects.

Also remember that the legacy decline is not fixed, as the number of wells added each month falls, the legacy decline(in kb/d) also falls. In April 2015 the legacy decline will be 58 kb/d and 148 new wells are needed for flat output, by April 2016 (if output remains flat) legacy decline falls to 50 kb/d and only 128 new wells are needed to keep output flat. In this scenario first month output is assumed to fall from 427 b/d for a new well in April 2015 to 415 b/d in April 2016 (due to new well EUR decrease starting in June 2015).

Note that the new well EUR is assumed to fall at a 7% annual rate from June 2016 into the future until new wells are no longer completed at the 127 well per month rate. Output starts to decline in 2019 due to new well EUR decrease.

In April 2015 the legacy decline will be 58 kb/d and 148 new wells are needed for flat output,…

The below copied and pasted from the DPR Bakken data:

Now I am not saying that 82,161 was the actual legacy decline in April but I would bet my social security check this month that it was one hell of a lot closer than 58,000 barrels.

Hi Ron,

You are correct.

I was using the 2008-2012 average well profile for my legacy decline calculations rather than the higher output from the 2013 and 2014 wells. Legacy decline is about 80 kb/d.

In my reworked model (using new well profiles for 2013 and 2014 wells estimated from Enno Peter’s dataset). The first month for the average 2014 well is about 500 b/d. There were 179 new wells in March, and if we assume the 2014 well approximates the 2015 wells, so output would increase by 89.5 kb/d from these new wells.

Actual output increased by 12 kb/d, so legacy decline would be 77.5 kb/d if all new wells produced for the full month.

I realized that I was using the lower well profiles for the average 2008 to 2012 well for my legacy decline calculation, you are correct that 58 kb/d is too low for legacy decline. Using the correct first month output of 500 b/d for 2014 and 2015, legacy decline is 79 kb/d in March 2015 for the model and falls to 76 kb/d by June 2015 if 150 new wells per month are added from each month from April to June. For April the legacy decline rises slightly to 80 kb/d, close to the DPR value (which includes Montana and North Dakota).

The reworked model is at link below:

http://peakoilbarrel.com/bakken-data-short-term-energy-outlook/comment-page-1/#comment-516966

Note that I also agree that if new well EUR has remained about 345 kb from 2008 to 2015 with the shape of the well profile changing over time, then about 150 new wells will be needed for flat output, rather than the 130 wells I estimated with the assumption that new well EUR had increased in 2013 and 2014.

So you are right on that point as well, if average new well EUR has remained relatively constant since 2008.

Ron Patterson said:

It’s all part of The Beautiful Story.

Plentiful and cheap oil, and Russia down for the count; what more could one ask for?

http://i.imgur.com/4OoyMKl.png

From today’s IEA Oil Market Report:

“the strong performance of some other sources of non-OPEC supply defied expectations. Russian oil companies seem to be coping exceptionally well with lower oil prices and international sanctions, thanks to a flexible tax regime that lightens their fiscal burden as prices drop and to steep cuts in production costs that came courtesy of the rouble’s depreciation. Russian production jumped by a steep 185 kb/d year-on-year in April.”

Thanks Glen yes there is a beautiful story that we are all to believe. The economy is recovering we are at full employment and no inflation (did I mention energy independence and that Russia sucks?) Anyway it will be interesting to see how this all plays out and yes this play will play out in spite of manipulation of the price of crude. It is interesting that every time metals and oil are up the stock market gets smashed. The junior sector in mining and oil E&P companies and explorers have been destroyed as central planners, banks and politicians continue to pick the winners and the losers. So energy independence, flying pigs, unlimited debt and fiat all have about a zero percent chance of coming true.

t is interesting that every time metals and oil are up the stock market gets smashed.

Otherwise known as “the business cycle”.

The more things change…

Nick I am talking about day by day not the business cycle. Wow.

Above I had an interesting discussion with Freddy W and Enno Peters about the number of wells needed to prevent output from declining in the North Dakota Bakken/Three Forks.

If the EUR of the average new well has been increasing since 2012, as I have assumed since I have had access to Enno Peter’s data gathering from the NDIC, then only 130 new wells would be needed over the long run until about 2019. Enno agrees (until new well EUR starts to decrease) and Freddy W thinks I have underestimated, Ron thinks it is at least 150 new wells per month and probably more like 160 new wells per month.

Freddy W and I seem to agree that the new well profiles from 2013 and 2014 indicate steeper decline over the first 12 months than earlier (pre-2013) wells. One possibility is that the shape of the 2013 and 2014 well profiles have changed to something with steeper initial decline with a flatter decline in the later months with the overall estimated ultimate recovery (EUR) of the 2013 and later wells remaining at previous levels (around 350 kb).

I created hyperbolic well profiles for the average 2013 and and average 2014 Bakken/Three Forks well based on the limited data available (14 months for 2014 and 26 months for 2013). These were added to my Bakken/Three Forks model and as expected, the results are very different.

from the earlier model. This “new” model requires about 147 new wells per month from July 2015 to Dec 2016 to keep output from declining.

Note that Ron has been telling me this for months, now I agree, if the assumption that new well EUR has remained relatively constant over the 2008 to 2014 period is correct. We can only guess as to what the actual recovery from the average Bakken/Three Forks well will be.

If we assume an average of 147 new wells per month are added each month from April 2015 to Dec 2019 and EUR begins to decrease in June 2015 and reaches a maximum annual rate of EUR decrease of 8% in June 2016 we get the scenario below (optimistic because debt issues may not allow this level of new wells in the future).

Economically recoverable resources are about 6 Gb through 2030 under the oil price assumptions in the chart. I have raised OPEX and other costs to $12/b (previously I used $8/b) and transport costs were raised to $14/b (from $12/b before), OPEX is assumed to rise at a real rate of 3% per year, real well cost starts at $8.1 million and it is assumed to increase at a real rate of 3% per year starting in Jan 2016. The real discount rate is 7% (10% nominal assuming 3% inflation), royalties and taxes are 26.5% of wellhead revenue.

Per recent conversation and what’s the Bakken constituent content and Jeffrey’s magical chart of distribution yield per API rating . . . .

I suggested cutting gasoline usage is somewhat meaningless (beyond China just consuming whatever you cut) — in that the theory of cutting gasoline usage reduces crude oil consumption is not proven. If you cut gasoline usage you do not particularly affect diesel and jet fuel usage, which require the same amount of crude to be refined in order to achieve their required quantity.

The rebuttals were well you can make diesel from any carbon. True, and you can make crude oil from methane. But you don’t and won’t. Too energy intensive.

And Jeffrey’s suggestion which I elaborated on . . . if you are looking for middle distillates and can’t get them from shale oil, you stop buying shale oil and let it accumulate in storage, and use imported, diesel/kerosene rich imports. My elaboration . . . since reducing gasoline consumption doesn’t reduce diesel consumption, then you have no impact on crude oil consumption. You’ll still have to refine crude and balloon gasoline storage.

Well lo and behold, this from the oil refinery wiki:

Oil refining in the United States[edit]

In the 19th century, refineries in the U.S. processed crude oil primarily to recover the kerosene. There was no market for the more volatile fraction, including gasoline, which was considered waste and was often dumped directly into the nearest river.

The rebuttals were well you can make diesel from any carbon.

That was in the relatively long term, so focusing only on that is misleading. In the short term refineries can make modest adjustments to their output product mix fairly easily and cheaply, and gasoline can be substituted for diesel used to move people and freight. In the longer term refineries, shippers and drivers can make larger adjustments.

Uhhh, we need a real oil refinery Chem Eng. here (instead of a very rusty physical chemist),

but my take is that tweaking a big distillation column more than 5% or maybe 10% is an invitation to trouble. The columns have bubble trays with cap sizes, etc., outlets welded into certain places along the column, associated heat exchangers and reflux loop; all calculated around mass flow rates and temperature based upon what the cuts are from the planned feedstock (que Jeffery’s chart of fractions vs. API, though also note the “dumbbell crudes” situation, where two fluids at the same API may have vastly different amounts of any given fraction).

There are also crazy issues like keeping flow rate high enough to move fouling particle out of the column and associated heat exchangers to avoid premature plugging, or some contaminant like nitrogen in a new crude causing unwanted polymerization thence clogging, etc.

If you cut back on the content of something coming out (either one thing a new crude is low in, or everything that a new crude has except what you want), you have to slow down everything, which screws with the heat flow and the mass flow, which screws with the efficiency of the bubble trays separation ability. You can only tune your heat exchangers, etc. a certain amount before you end up hiring some hot shot consultants to revamp the refinery, then a bunch of welders and fabricators.

Read the PDF down at the bottom of this linked page for a taste of the issues:

http://www.revamps.com/articles/consider-retrofits-to-handle-highviscosity-crudes/

This PDF is about modeling distillation:

http://razifar.com/cariboost_files/Some_20Practical_20Aspects_20Of_20Modeling_20Crude_20Oil_20Distillation.pdf

from above:

“The product final boiling points are controlled by draw rate, not fractionation”

translation: what I said above, what Watcher said in his post above:

a chain is only as strong as its weakest link.

n.b. if you slow your refinery down to a new weakest link for no good reason, then your utilization rate gets bad, economics goes to hell, and the guy(s) with Profit & Loss responsibility above you fires you.

This:

http://www.turnermason.com/blog/2013/07/16/no-free-lunch-refiners-have-to-invest-to-take-advantage-of-advantaged-crudes/

says Flint Hills spent $250 million to change their Corpus Christi plant to be able to run Eagle Ford crude and condensate.

repost of:

U.S. refiners turn to tanker trucks to avoid ‘dumbbell’ crudes

http://www.reuters.com/article/2015/03/23/us-usa-refiners-trucks-analysis-iduskbn0mj09520150323

“In a pressing quest to secure the best possible crude, U.S. refiners are increasingly going straight to the source.

Firms such as Marathon Petroleum Corp and Delek U.S. Holdings are buying up tanker trucks and extending local pipeline networks in order to get more oil directly from the wellhead, seeking to cut back on blended crude cocktails they say can leave a foul aftertaste. …”

tweaking a big distillation column more than 5% or maybe 10% is an invitation to trouble.

That’s what I meant by “In the short term refineries can make modest adjustments to their output product mix”.

On the other hand, 10% would be a pretty meaningful change in allocation.

actually you’re doing good. Chem E’s just by order tanks from catalogs anyway

I was trained in a plant with a distillation unit (part of my basic training back in the 70’s), and I was allowed to play with it to tune my computer models (those were the early days of computer modeling of plants, and my boss knew zero about them, so I had a free hand even though I was a rookie).

The distillation unit can be forced to make more of a given product. The ability to do so is enhanced if the overall capacity is reduced, or there’s excess heat exchanger and overhead cooling capacity.

The feed can also be modified upstream of the distillation unit feed. This can be done using a brute force approach running the crude through a desalter (heater treater train) to drive the light ends off, which of course leads to a richer feed to an NGL recovery unit (which in turn may choke on it unless that hot gas is cooled and fed to a knockout drum).

When I was being trained I was encouraged to dream up these schemes, run the models, and if possible test the plant a bit. But I had a very easy going environment. I remember one time I cooled the top too much, drove pressure down, which led to excess boil off at the bottom. This dropped the fluid level, the alarms went off, and the plant automation system went into full emergency shut down.

Nowadays the models are slicker, and I can think of a few low cost solutions they can put in within 30 months to help them process more light crude. A simple stabilizer sounds like a no brainer. As I wrote before, if I wanted to capture more sales to the USA I would strip the crude before it gets sent to the USA. This would allow the imports to match the light USA blends.

LOSING CONTROL can be harmful to ones financial health,

Most folks in here know me as the so-called Gold-Silver Bug. That being said, I haven’t posted much on the subject over the past several months… even though I believe its highly relative to the oil market. We must remember, ENERGY is the DRIVER, while FINANCE is supposed to STEER the economy.

Just wanted to share a little TID BIT of info. I speak to some very interesting folks in precious metal and financial industry. I chat with someone (regularly) who was very well connected in the start of the great financial derivatives market in the 1990’s. Let’s just say, he knows a great deal about the FRAUD called Derivatives.

Anyhow, the European and U.S. Bond markets cracked last week Wednesday. Ever since then, we see serious volatility in early market trading than the massive liquidity comes in to save the day. Well, according to some interesting sources there is a real threat of a lack of liquidity going forward and this may impact the markets in ways that no one is quite prepared.

I truly believe all the nice charts and graphs showing a subtle decline in U.S. Shale Oil as well as Global oil production will be overly optimistic. I don’t think folks really understand just how propped up and highly leveraged these markets truly are.

When the day comes that the U.S. Treasuries fail to find a BID or the broader stock markets open and we see liquidity dry up and blow away… the next day, the U.S. will be a much different place. Unfortunately, the U.S. financial system died in 2008, and all the Fed and Member banks have done is prop it up with more and more lousy paper.

This will end badly… and probably virtually overnight. At that point, it will be interesting to see just how much capital the Shale Oil & Gas Industry will be able to access to continue the DRILLING TREADMILL.

steve

When the day comes that the U.S. Treasuries fail to find a BID or the broader stock markets open and we see liquidity dry up and blow away… the next day, the U.S. will be a much different place. Unfortunately, the U.S. financial system died in 2008, and all the Fed and Member banks have done is prop it up with more and more lousy paper.

Why would the Fed allow Treasuries to find no bid? And if HFT engines allowed the stock market to crash 90%, why would not a president, any president, issue an executive order restoring prices to their previous level by law and deny anyone who complains access to courts.

Money . . . numbers on a screen . . . will never end this. The folks, the zillions of folks looking for this particular apocalypse because they can see that the system has completely departed normalcy, somehow those same folks can’t make the intellectual leap to recognize that if the system is completely departed from normalcy, there is no reason at all why what I just said could not happen.

Watcher,

I didn’t say the Fed would stop printing and propping. But as you are firmly aware there is this competing organization called the BRICS AIIB Bank. At some point time, the Chinese will announce they have something north of 10,000 metric tons (maybe 15,000+ mt) of gold and that should do wonders for the nitwits who think gold is something you put around your neck.

Regardless, I count on the Fed and member banks continuing business as usual. However, the Chinese and Russians know the U.S. Dollar’s days are numbered. Which means, at some point, the Fed can print as much Crap Federal Reserve Notes as it wishes, but it will not be able to prop up the Dollar any longer.

By the way Watcher you said this: “And if HFT engines allowed the stock market to crash 90%, why would not a president, any president, issue an executive order restoring prices to their previous level by law and deny anyone who complains access to courts.”

Watcher, while you have provided some excellent comments here, this is not one of them. You of all people should realize the Stock Market is nothing more than a Ponzi Scheme, worse than 2007. How can the President order a return to high values if the values aren’t worth it?? LOL

Probably by 2020, Americans will realize what it is to live as a THIRD WORLD COUNTRY.

steve

Watcher – can you let this go unchallenged? From SRS – “You [Watcher] of all people should realize the Stock Market is nothing more than a Ponzi Scheme, worse than 2007.”

The stock market it is the value of most of the large businesses in the US. So, if someone “gave” you all the stock in Coca Cola, you would reject it since it is worthless? GE, McDonalds, Facebook, Tesla, Apple, Proctor & Gamble, Johnson & Johnson, Exxon and on and on with thousands of names. Mostly all owned by retirement plans.

“Ponzi Scheme” – Probably the most ridiculous statement I have ever seen in print.

It’s like Rush Limbaugh says. “It’s best for me not to say much about some things, because, of course, once I have spoken there’s nothing more to be said.”

haha

Besides which, if oil scarcity arrives and denies P&G and Coke the ability to get product to market, then indeed their prices do collapse.

But that’s not the point. The point is money is invented. You can redefine it anyway you want. Things are worth NOT an analysis of net present value of future flow of money. They are worth, somewhat precisely, what someone is willing and able to pay for it.

So the prices fall 90%. The prez looks around the table and says “this shall not stand”. I’ll craft his executive order for him.

“I hereby declare martial law, and as Commander in Chief I order the following steps. The Federal Reserve will purchase one share of stock in all companies of the S&P 500. The price paid for each share will be its price last Friday. The seller selected will be from a cross section of major brokerages, who will select from their clients at random to sell 1 share of their holdings at this premium price. The Fed is willing and able to execute these transactions and define a new price.

This will restore all prices to their level of last Friday. Trading will then resume with a regulatory imposition of no downticks as a rule. Buying and selling of shares may resume but no transaction can take place at a lower price than the last.

All short sales open at close of business last Friday will be closed out at that price. No securities lawsuits will be permitted for the forseeable futures.

It is my intention that martial law will remain in place for no more than 90 days, but this is not a hard limit.”

That should cover most of it. If anyone finds a loophole, they’ll be arrested and assets confiscated. I guarantee you no one will complain about having their asset prices restored. The shorts who hoped for a windfall will get nothing.

There’s nothing in what I just laid out particularly different from abrogating mark-to-market, which has already been done (and remains abrogated).

I agree with Watcher. Even before declaring martial law, in fact I believe right now it is in the National Interest to keep the ball rolling by whatever means possible. Preferably with a little discretion to allow everyone there plausible deniability.

As someone said awhile back its a game of last one standing and if the BRICS challenge the dollar in any meaningful way it will be considered an act of war so I don’t believe they will do it.

I read that Russia and Chinas position is to prepare for war but do everything possible to avoid it.

I think there are problems with the state theory or constitutional theory of money too.

If only things were as simplistic as the various monetary theorists believe they are, we could eliminate all the chaos and uncertainty from human existence.

“This will restore all prices to their level of last Friday. Trading will then resume with a regulatory imposition of no downticks as a rule. Buying and selling of shares may resume but no transaction can take place at a lower price than the last.”

That would not work. There would be no market and foreign capital investment would quickly halt. There is no need to declare martial law, or for an executive order. Its very likely the US would follow Japan, the Fed will do the buying of stocks to prop them up with more QE. However, if we look at Japan it has not helped their economy. It been stagnate for over 25 years, but appears to be slow reaching its limits, as Japan need ever larger amounts of QE in a shorter period to keep it afloat. Sooner or later they will need start increasing QE 10x for each cycle and this will unleash the hyper-inflation genie. Once Japan goes under, the rest of the industrialized world will have a tough time continuing there own QE programs.

Proping up the stock market would not prevent massive unemployment. Companies will continue to layoff workers if the don’t need the production or labor. Despite that Stock prices have more than doubled since 2009, hiring has remain virtually non-existent. The US is moving towards automation which needs much fewer workers and companies prefer stock buybacks than expansion. The stock market is not the real economy, No matter how much manipulation a gov’t takes on the stock market will not save the real economy. People can not spend/consume resources that don’t have.

For the last 15 to 20 years the US economy managed BAU but substituting real production with debt. The debt bubble can’t really grow further, so the US economy is in a permanent state of stagnation and nothing the gov’t can do will prevent an collapse when it unfolds. At best they can stretch it out for a while. The US economy has been in a state of decline since the 1980’s. US Manufacturing Peaked in 1979, and by 1987, the US switched from a net creditor to a net debtor. Debt is being used to hide the economic decline.

FWIW: energy is “real” money, Without an ever increasing energy supply the “real” economy can not grow. When the energy supply shrinks, so will the “real” economy. Energy is needed for production, nothing can be produced, or shipped without energy. This should be extremely obvious.

The debt bubble can’t really grow further, so the US economy is in a permanent state of stagnation and nothing the gov’t can do will prevent an collapse when it unfolds.

A conservative investor would steer clear of both stocks and bonds right now.

But those with excess cash keep putting money into them, presumably because they don’t see other good investments.

At what point do they decide these stocks and bonds are worthless and decide to either not invest in anything or to switch to other investments?

Seems like as long as they put their capital into overvalued investments and don’t sell those investments, the bubbles will keep growing.

At what point do they decide something else has real value? Will they start buying up water, fertile land, and preservable food stuffs?

I am curious when investors are going to pull out. They should have done so by now if they were value investors.

What’s going to trigger a stock market and bond market collapse?

clueless,

I’ll respond to you… if you don’t mind. Anyone who follows the broader stock markets besides the typical nitwit American who believes everything coming out of MSM, realizes the Dow & S&P500 are ready for one hell of a CLIFF DIVE.

Now, this might not happen tomorrow, next week or next month, but it’s coming. The U.S. Stock market is so overvalued and oversold, the forces of gravity will cut valuations like a sledge hammer.

The U.S. Stock Market, Treasury Market and Retirement Market are all PONZI SCHEMES.

Now, Watcher may be correct that the Magicians at the FED and US GOVT will fight like hell to continue propping it up, but this is not sustainable over a long time period.

The GREAT FINANCIAL ENEMA is coming. Grab your cherry cola and popcorn.

steve

Almost everything that everybody owns is purchased with money. And almost all of that money came from wages. And almost all of that money came from corporations that paid wages. [Generically] – How did you buy your house? How did you buy your car? How do you pay for food? How do you pay for clothes? How do you pay for almost everything? From wages? Which almost all come from corporations. Which almost all have value AND WHICH ARE NOT PONZI SCHEMES!! WTF – I think that I have discovered the PERFECT definition of STUPID.

Clueless,

For starters you can watch the video below by Ray Dalio

http://www.economicprinciples.org/

And read the report below from Bank of England on “Money creation in the modern Economy”

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdf

Rune,

I should know better. One can’t debate a PROPAGANDA Mentality with LOGIC. All we can do is wait for the fundamentals to kick that finally pushes the system over the cliff.

Then I would imagine these folks will have to WAKE UP and smell the coffee.

steve

Just ignore him ClueLess,

I’ll bet your net worth is more than 10 times that of Steve’s. Those that have failed in life commonly justify their mistakes with this kind of nonsense wishing it on others. That being true, I’m sure Steve lives a “FINANCIAL ENEMA” everyday.

Oh heavens it’s not that bad.

There are a lot of people walking around who flat out know from a lifetime of experience that what they see around them is not the money world they grew up in.

The rants then unfold and anger and, frankly, flailing for a “solution” via gold or bitcoin or shorting this or that.

Right about here someone is supposed to start a paragraph as “what they don’t realize is” or “what they don’t understand is” or “what they get wrong is” and there is no need.

Oil scarcity has forced all of these measures to . . . as a guy above just said, keep the ball rolling. Keep the wheels turning. Redefine rules, break them, create new ones . . . do whatever it takes to keep the wheels turning. As FASB said when they erased mark to market . . . “enforcing this standard would benefit no one”.

Similarly, embracing reality and informing the public of it . . . would benefit no one. Letting the wheels stop turning helps who?

Fair play that kills many people is no longer the principled thing to admire or pursue.

But that which is inevitable is inevitable. The Fed will try to print oil, but it can’t be printed. They are just buying time, praying for a miracle (haha in a foxhole) and if you were sitting on the FOMC, you would do the same thing. Flail and invent new things like QE . . . to keep the ball rolling and hope some miracle (rather than the equally probable disaster) uses that time bought to unfold.

Depending on how malleable and adaptive the system is, it may start ‘flipping poles’ and inventing new tricks and responses to better ride the peak oil shrinkage downslope.

If it can create new prices, new decrees, etc., perhaps it can create new policies, salaries, job fields, democratic adjustments, and better, maybe somehow ‘inverted’ financial/political responses to the realities of diminishing oil, etc., supplies and increasing environmental dangers.

Hey clueless I like your name and I would agree that you are in fact clueless. Stocks are overvalued even when using zero interest rates (Gibson’s Paradox). But bonds really are the biggest ponzi in the history of man so what happens to stocks when bonds don’t get a bid like is now starting to happen around the globe? Do you really think the Fed controls the bond market long term? They call it QE but it’s true definition is counterfieting and it will fail.

There is no long term. Because of oil.

The Fed can buy as many bonds as it wants and at any price it wants to pay.

Who would stop them?

History

Watcher,

The basic mechanism for the worldwide bond bubble is the trade surplus of emerging countries, which is invested and sterilized by central banks in mostly Treasuries. So worldwide central banks (China, Japan, Brazil, India,….) buy Treasuries and save this money on behalf of their citizens. However, these investments are never meant to be spent, hence the term ‘sterilized’. When oil prices and other import goods rise, emerging countries have less surplus and can spend less money on Treasuries. This is exactly now the case. When the oil price rises, less money is available for Treasuries and interest rates rise and the dollar falls. If the FED would do too much QE on its own, the dollar would fall and this would be very inflationary. So there is a limit for the FED to do QE. It is much more elegant that foreign central banks sterilize Treasuries. The question is how long can they do it. A low oil price certainly helps.

Sterilization has to do with controlling the net injection of money by selling one part of the yield curve as another is bought. You have your definition wrong.

A long end purchase is sterilized by a short end sale. Or vice versa.

Heads up people, been watching the US budget deficit. Month after month it is missing CBO projected target. I suspect this year will be $500B or so.

This is paper that was getting scarce before and a reason for suspending QE. This week’s auctions do appear to say foreign CBs are buying US paper at auction (the Fed is not allowed to buy at auction, it must buy from the primary dealers when QE is active).

Watcher,

What you are referring to …by selling one part of the yield curve as another is bought…. has been done by the FED years ago and is called operation twist. This does not increase the amount of bonds, yet adjusts the shape of the yield curve and is neutral to the dollar. Sterilization on the other side does increase the amount of outstanding bonds, yet as the bonds are bought by a foreign central bank, it actually strengthens the dollar – and lowers the currency of the buyer. I stick to my definition of sterilization of bonds.

We’re running out of replies Heinrich. You understand Twist so you should understand sterilization, but we won’t dwell on this because it’s actually another of those definitions that didn’t exist 10 yrs ago (like QE).

Clueless wrote:

“Almost everything that everybody owns is purchased with money. And almost all of that money came from wages. And almost all of that money came from corporations that paid wages.”

Unfortunately, most if its was bought using debt, or future wages.

Clueless wrote:

“How did you buy your house? How did you buy your car? How do you pay for food? How do you pay for clothes? How do you pay for almost everything? ”

Not wages, but debt. Very few people buy homes or cars using cash. Most borrow to pay for these items.

“Which almost all come from corporations. Which almost all have value AND WHICH ARE NOT PONZI SCHEMES!! ”

“had value” would be more appropriate. Corporations have been using debt. Since the 2008 crisis, companies propped up stocks with buybacks, financed with…. DEBT!

The executives of public traded companies are rewarded by keeping stock prices high. So rather than make better products or services, its just easier to borrow and issue stockbuy backs. Its pretty close to a Ponzi scheme.

http://fortune.com/2015/02/11/stock-buyback-binge/

https://fortunedotcom.files.wordpress.com/2015/02/buybacks1.gif

Corporate Debt:

http://3.bp.blogspot.com/-5FVlwP0VUU0/VKnQUUygU2I/AAAAAAAAP-E/6FHIXOumSuE/s1600/Screen%2BShot%2B2015-01-04%2Bat%2B7.23.49%2BPM.png

Clueless, I suggest you do a bit study on different kinds of money – M0, M1, M2 and M3. Physical volumes of all the things do not change much in a short period of time (say, one year) but money (especially, M2 and M3) could increase a lot during the same period. Hence, the idea of current financial engineering conducted by central bankers being similar to a Ponzi Scheme is not without merits.

The U.S. Stock market is so overvalued and oversold,…

Don’t you mean “overbought”?

Ron,

LOL… that’s my Archie Bunker syndrome. Yeah… OVERBOUGHT…

steve

Steve,

China will back their currency with gold? Never going to happen. They have a fiat money just like everyone else. Why the hell would they ever back their currency with gold? It would be a death sentence for their economy if they did. You don’t really understand money if you think otherwise. The yuan would become so overvalued to other currencies they couldn’t export anything they manufacture. If they back it with gold then they can’t print all the yuan they need to keep all their ponzi going. Or do you believe the US dollar is the only ponzi out there?

SAWDUST,

I never said the Chinese would back their currency with Gold, but instead there is rumor of Gold Trade Notes. Regardless, there is good reason why the Chinese Govt continues to acquire a great deal of gold quietly. There was a brief announcement earlier this year that the Chinese may finally release their official gold holdings in May, but that is now postponed for whatever reason.

Again, I see no reason why the Chinese are acquiring so much gold if they don’t have plans for it. This is also true for Russia. Anyhow, the days of the U.S. Dollar world reserve status is coming to an end.

Lastly, STOCKS, BONDS and most PAPER ASSETS are based on the economic principle of NET PRESENT VALUE. This is sort of a financial time machine. The market calculates future earnings and sets a price today. What happens when U.S. Shale oil production finally heads south in earnest.. along with the rest of the world?

How will the fall in oil production impact all that highly leveraged paper garbage masquerading as ASSETS??

steve

How will the fall in oil production impact all that highly leveraged paper garbage masquerading as ASSETS??

There is a logical alternative to paper currency based on faith? Really, people talk about fiat currency as if there was some kind of an alternative, something else they could choose. If so then it would behoove you to tell us what it is and how it would work.

Ron,

Going back to sound money such as gold will likely be impossible as it will be to run Dallas, LA, Manhattan, Chicago or whatever other metropolis on say half of the oil production we are using today. Of course, as production continues to decline, the situation will likely become even more dire for these cities that can only survive on plentiful HIGH EROI ENERGY.

I really don’t know what would work to tell you the truth. There have been several alternative monetary systems using some sort of physical backing (Gold-Silver-Oil-etc) thrown around in the precious metal community, but I have no faith on whether they would work.

That being said, I do know that GOLD & SILVER have been high quality stores of value and money for thousands of years. The reason I trust gold or silver is due to the ECONOMIC ENERGY locked in each 1 oz coin. A certain amount of energy in all forms and in all stages went into the production each coin of gold or silver.

Basically, its bought and paid for economic energy, whereas the U.S. Dollar and most paper assets are ENERGY IOU’s. Now, the U.S. Dollar fiat monetary regime worked hunky-dory since 1971 when the world continued to increase global oil production (and debt). However, the peak and decline of Shale & Global Oil production will be a BEE-OTCH to this highly leveraged paper system.

Again… RON, I really don’t know what kind of alternative monetary system that could work, but I do know what assets will hold (or increase) their value in the future while most physical and paper assets will decline.

I believe the U.S. Dollar or U.S. Treasury and or broader stock markets will have a Bear Stearns-Lehman Brothers event. One day the stock price is over $100, and the next… you can’t find a buyer at $2.

Steve

Steve, only a tiny fraction of all money exist in paper currency. Most of it is just a bank computer entry in thousands of banks around the world. And it is transferable via electronic signal, in milliseconds, between banks though they may be on the other side of the world.

That would not be possible with any physical form of money, be it shells, rocks or precious metals.

Ron,

Yup… that’s the problem. Electronic Digits. Again, I never said a physical backed monetary system would work. Rather I said most paper and physical assets will decline in a peak oil environment. Whereas, Gold and Silver will hold (or increase) their value.

BIG DIFFERENCE.

steve

Steve,

I bought into the gold/silver/precious metal bug when I first started reading about peak oil and finance.

After “warning” my family and friends about fiat currencies….I now feel like an idiot. Not surprisingly they don’t care about my opinion now!….LOL!!!

All that gold and silver stuff is complete bullshit.

The unit of currency doesn’t have to have hard “value”. As if silly rocks have value.

It simply has to be trusted enough that you can take it to a video store and buy a porn movie…Try that with a gold nugget…LOL!!!

Paper and electronic digits work fine as long as you can trust the integrity of the system.

Zerohedge and all these gold bug sites are nuts.

Lesson learned!!

My Post is my attempt to try to help others to not make the same mistakes I made:

Do not scare your friends and family by screaming about fiat currencies. You will be labelled as the nutbag on the family tree…FOREVER…LOL!

Fiat currencies work great !!! (excluding inflation/deflation)….LOL!!!!

The gold bugs, the Austrians, the monetarists, they’re all looking for some silver bullet to slay the monetary monster, to put monetary policy on auto-pilot.

This sort of magical thinking, when put in practice, has invariably had disastrous consequences.

John Kenneth Galbraith, writing in Money: Whence It Came, Where It Went, warns of the magical thinking of the various schools of monetary Utopianism:

Galbraith goes on to explain how Keynsian monetary theory also ended up being vitiated.

Despite what the monetary Utopians claim, there really is no to way remove humans, along with everything that implies, from the monetary equation or from monetary policy making.

This of course doesn’t preclude evangelists from the various schools of monetary Utopianism — the latest I suppose being MMT — from proclaiming their version of truth as being self-evident and beyond dispute.

Ron dismantles Ron Paul and the other gold bugs in one post.

I never thought of that. You couldn’t ship the gold fast enough.

Also running a trade deficit on the gold standard would mean you were effectively exporting your gold supply.

I think Karl Denningers “One Dollar Of Capital” is the best system I have seen to structure a financial system.

Karl thinks peak oilers don’t understand thermodynamics or chemistry so his idea might not be popular here. Hydrocarbons are just a battery, doesn’t matter where they come from.

I’ve never seen him comment on flow rate.

Let the games begin!

Boltzmann Brain IV.

So, you feel like you got burned buying precious metals. I understand that. However, your assumption that precious metals have no fundamental need going forward is typical of those who forget 2,000 years worth of history.

Again, the Chinese & Indians are acquiring gold hand over fist. Now, if the Chinese or Russians weren’t adding gold to their reserves, then maybe you might be correct. But, we see quite the opposite.

The mentality in the WEST is to believe in PAPER GARBAGE. That’s fine with me. The next great financial shock will wake up the living dead. Assumptions change all the time…. however, the collapse of the U.S. Dollar and Treasury market should do wonders for folks who have faith in paper.

steve

“…the point of money is that it makes intermediation easy…

Intermediation… is the process by which other people insert themselves between the producer and the consumer of any good or service, and take a cut of the proceeds of the transaction. That’s very easy to do in a money economy, because—as we all know from personal experience—the intermediaries can simply charge fees for whatever service they claim to provide, and then cash in those fees for whatever goods and services they happen to want… Money is a system of arbitrary tokens used to facilitate exchange, but it’s also… the framework of laws, institutions, and power relationships that creates the tokens, defines their official value, and mandates that they be used for certain classes of economic exchange. Once the use of money is required for any purpose, the people who control the framework—whether those people are government officials, bankers, or what have you—get to decide the terms on which everyone else gets access to money, which amounts to effective control over everyone else… ” ~ John Michael Greer

Thank you, John…

I sort of skimmed this kind of thing in my previous comment under a previous/recent article hereon using the ‘Kid and Cae-Dad’ dialogue.

When we talk about money– gold/silver/shells/tally-sticks– (or is that currency?) we need also to talk about who/what is deciding how it works. And we need to talk about it from an anarchic perspective too.

“Until you change the way money works, you change nothing.” ~ Michael Ruppert

Caelan MacIntyre,

To reiterate what I said back up the thread, I think there are also problems with the state theory or constitutional theory of money.

Don’t tell the Marxists or the neocons this, or for that matter the adherents of any political doctrine based on Fichte’s political philosophy, but there are limits to what can be achieved with state violence.

If only things were as simplistic as the various monetary theorists believe they are, we could eliminate all the chaos and uncertainty from human existence.

Steve,

I have no doubt that metal has value in an industrial capacity or that humans may value certain metals.

My wife loves gold, diamonds, silver and the like. My wallet doesn’t. LOL!!!

I have no doubt you could run a money system on these things.

As Ron points out, with the internet and the fact that transactions take place in milliseconds, these units of currency are no longer plausible.

If you can get past Denninger’s guns, birther and climate change nonsense, his “One Dollar of Capital” idea is pretty good IMO.

and I am an expert in converting world economies to new financial systems BTW!! LOL!!!!!

In Denninger’s system every dollar of commercial lending must be backed by a dollar of capital (not gold). Everything must be marked to market daily.

The money system doesn’t have to change. But banks can’t inflate at will by expending credit out of thing air. They must have the capital to back it up.

If they make bad decisions, they eat it. Not the citizens.

Note this is not 100% reserve banking.

thanks!

seems like the Chinese like US Treasuries as well as gold..

http://www.bloomberg.com/news/articles/2015-05-15/china-s-holdings-of-treasuries-rise-for-first-time-since-august

1.00 ZWD = 0.00276319 USD

0.00276319 USD times 390 equals 1.05 usd.

How many Zimbabwean dollars equals one US dollar? Answer: 390

Ten dollars, 3900 zwd

100 usd, 39,000 zwd.

One troy ounce of gold is 1223 dollars, so you will need 390 times 1223 to have enough Zimbabwean dollars to buy an ounce of gold.

That would be 476,970 Zimbabwean dollars.

Good thing there are one hundred trillion Zimbabwean dollar notes, you could use one one hundred trillion dollar Zimbabwean note to buy an ounce of gold and receive 99,999,999,520,030 Zimbabwean dollars in change.

Those Zimbabwean one hundred trillion dollar notes are the way to go when it comes to cash on hand.

Fiat currencies can really be the answer to all of those financial problems.

Just one one hundred trillion dollar note from Zimbabwe would pay off the US national debt in a heartbeat and have 83 trillion dollars remaining to spend some way.

What difference does it make if the dollars are from Zimbabwe or the US? It’s all paper and digits, it really wouldn’t matter that much.

The US Treasury can buy one on Ebay for 21.50 usd, so they should really buy some and balance the budget overnight.

You could buy everything on the planet with those 100 trillion dollar Zimbabwean notes.

Thanks for the post Ron.

A quick update of 2 graphs.

My impression is that the so-called “fracklog” is dropping as fast as never before : if I count correctly, about 124 wells were spudded in March, while just over 180 wells were starting production. What is strange is that this is different from what Helms is mentioning (he mentioned 900 wells in Feb, and 880 wells in March spudded but not completed, a drop in fracklog of 20 wells). I think the drop in the fracklog is closer to 70.

And graph 2) (keeping them below 50 kb)

Looks like more than 50% of production is from wells less than 15 months old.

With low recovery amounts as shown in your graph, the cost of drilling and fracking has to fall considerably to make economic sense. At $40 per barrel it barely covers the cost of the original well in ten years.

A big fracklog is not something new. In fact there was more than 600 wells waiting on completion in the Bakken in 2014.

From North Dakota’s DMR presentation:

Enno,

Looking at the dates for when wells were spudded, more than 90 of the wells that were reported to have started to flow in March 2015, were spudded in September 2014 or earlier. That according to your data tables based on NDIC.

If shale companies are given the choice to borrow more to drill or conserve cash/pay down debt, almost all will borrow more and drill.

Most of the guys running these companies are gamblers and have lived on the financial edge at various times in their lives. They have drilling fever. Does not matter much if it makes financial sense. As long as they can get their hands on the $$ they will drill and complete the well. They have a huge number of locations out there and by golly they are going to drill them until the banks and investors say they can’t. Drilling is the way they achieve their “high”.

Just operating existing wells is boring. Ever notice how 95% of the shale conference calls and investor presentations focus on drilling, less than 5% on operations? Just operating existing production is boring to Wall Street too. It is much tougher to market existing production where the production and financial parameters are pretty much known. The possibility of a “gusher” is always easier to market. The oil business has been this way for 150 years.

I wonder what the long term business plans of companies like Continental, Whiting, etc. are? Do they envision a time when they will become income generating companies that pay dividends? Once they have drilled up their US shale locations, where are they headed next? What will they look like in 2025?

FWIIW

Shallow,..and others taking an interest

I updated my estimate on cash flow for Q1 2015 for Bakken(ND).

Assumptions average well cost $8.5M, added producing wells as per NDIC statistics, which may vary month from month from other sources, but the total over time should be close irrespective of how the counting is done.

For Q1 2015 the companies in Bakken had an estimated total negative cash flow of about $2Billion!

Rune,

Could you summarize your analysis?

Average: numbers of wells per day, drilling vs completion cost, gross oil price received, opex?

Nick,

I just did.

Gross oil price is WTI (monthly).

Flow as per NDIC reports.

Average well cost is from spud to flow (which includes drilling and completion).

OPEX (including transport), financial costs, royalties and taxes as stated in my previous posts.

http://fractionalflow.com/2015/03/21/is-the-red-queen-outrunning-bakken-lto-extraction/

Rune,

I think it would be helpful to give the actual average numbers for each of those basic parameters.

Nick,

Could you pls be more specific?

Something like this (these numbers are randomly made up):

Wells drilled: 360

Completed: 300

Average overall drill cost, including completion: $8.4M

Avg completion cost: $4.2M

Bbls produced: 100M

Average gross oil price received: $40

Avg opex/bbl, including royalties & taxes: $10

Other? Admin & overhead? Interest? Dividends?

Nick,

If you read Ron’s post, the comments here and looked at his figures and my post I linked to, you would have most of those figures.

Apart from that you may have a look at companies’ quarterly financial statements and their 10-Ks.

Well, could you just show the calculations that produced $2B in losses?

Nick,

I said nothing about losses.

You have all the data to run the estimates yourself.

Nick G. I think in previous posts I summarized the cash burn of both Whiting Petroleum and Continental Resources. Neither breakdown Bakken financials from other plays in their 10Q from the first quarter 2015. They are number 1 and 2 in terms of net production in the Bakken, I believe.

I will try to look at those again later and give you exact numbers, but as I recall, each burnt about 3/4 of a billion dollars in Q1 2015. That is for all plays, but Bakken makes up the vast majority for both. I think combined average production for those two was around 340,000 BOEPD in all plays. Whiting is about 90% oil and Continental is about 70%.

Again, I’m not in a good place to look it up right now but will. The above is from memory.

It would not surprise me if Rune’s $2 billion cash burn figure in the Bakken is conservative.

I am positive that CLR borrowed 790 million on its line of credit in Q1 of 2015 and another 250 million on its line of credit in April, 2015.

Whiting issued over one billion in common stock and convertible notes.

As I stated recently, Continental is on pace in 2015 to borrow the equivalent of 35% of the State of Oklahoma budget for FY 2014-2015. That is even with cutting rigs by over half. Only an oil price spike will cause a different result.

Shallow,

I hold my $2B (cash burn for Q1 15 for Bakken (ND)) to be conservative. A more detailed analysis (and thus time consuming) would be preferred.

FWIIW I also use a metric (amongst several) for leverage (total debt on net cash flow) and it has so far not been higher than it was for March 15 (this is based on estimates as from Jan 2009).

Rune, I believe you and like Shallow, am surprised it is not more. I can assure you there is at least that much negative cash flow from the Eagle Ford, 1st quarter 2015, and more. The LTO industry keeps writing checks it cannot cover.

At the risk of pissing people off, the speculating about how many Bakken wells its going to take each month to keep production levels level is like sitting on the couch watching TV while the house burns down. This shale stuff is a financial disaster unfolding before our very eyes. I have no idea how the shale industry is going to survive the next 12 months much less pay 300 billion dollars of debt off.

What am I missing?

Mike

If prices rise sharply, all is well.

If not, then late investors (who are piling in with senior positions) get returns, and early investors get diluted or wiped out.

There’s an enormous amount of cash floating around looking for high ROI, even with large risks.

Mike,

My focus for some time has been what cash will the companies have available (from operations and external funding) for well manufacturing and how will they service their growing total debt.

130ish fracks should cost what, almost 1.3 billion dollars/month.

Someone is lending that. These are serious numbers.

Nick, if prices rise sharply is yet another hypothetical and even if they do I personally don’t believe all is well. I know a little bit about well economics, decline rates, and managing oil and gas revenue; I don’t see how these shale companies can continue to provide a valuable source of energy to America under mounting, massive debt loads. In my opinion, that’s what we should be worried about.

Mike

Rune, I know precisely what your focus is on, and why, and I am grateful for your work. I personally believe its time to declare peak oil production worldwide, or whatever, and move on to what’s next. If LTO production is so bloody important to America, Americans better be worried about how the shale oil industry is going to survive. The US shale industry has NOT been a financial success story; anyone that believes that has a bad case of debt denial.

Thank you again for leading the way on this issue. It’s important.

Mike

Hi Mike,

I would think the wheels fall off this train(LTO production) at some point for the reasons given by Rune, Shallow Sands, and you.

At some point output falls and oil prices increase, then LTO production might increase. You would be able to guess better than me because you have seen busts before, but if oil goes to $85/b and stays there wouldn’t output stabilize at some lower level?

Eventually output falls to the point where oil prices go back to $100/b (maybe by 2017?) and LTO output slowly increases or at least stops decreasing.

If a bunch of these companies go belly up, won’t some of the bigger companies swoop in and buy up some of the better leases?

Dennis, I don’t know what the price of oil is going to do in the future. I believe very strongly, however, that the sustained period of high price stability the shale oil industry wallowed in for 7 years is over. I believe that significantly changes what we can expect, or predict from the LTO industry in the future.

The LTO industry is in no way self sufficient, as evidenced by the debt it has and it’s current income situation (Rune). How much swooping occurs, how many more wells get drilled, how many more un-frac’ed wells get frac’ed all depends on where the money is going to come from outside the LTO industry.