North Dakota publishes monthly ND Historical Barrels of Oil Produced by County. This data however does not include confidential wells. But they do estimate, by county, their confidential well production here: Oil and Gas Production Report

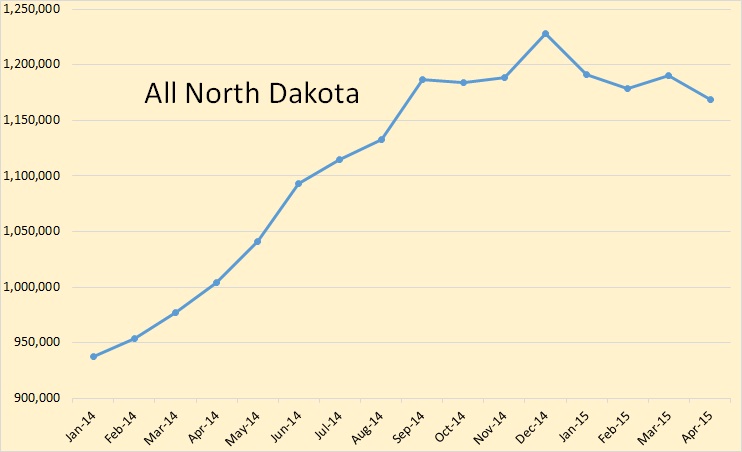

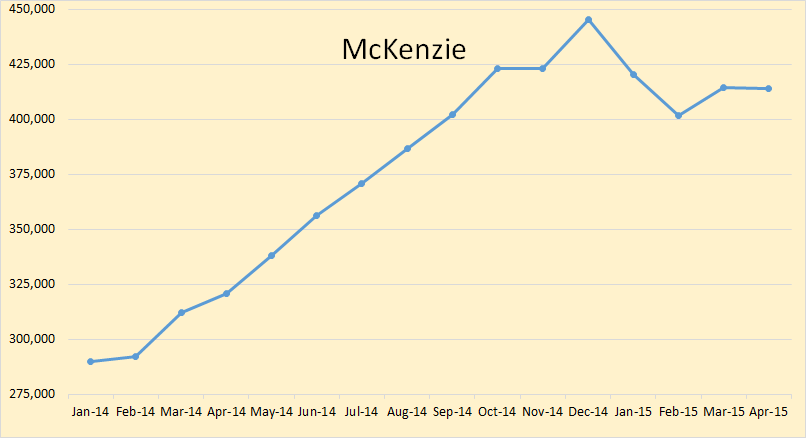

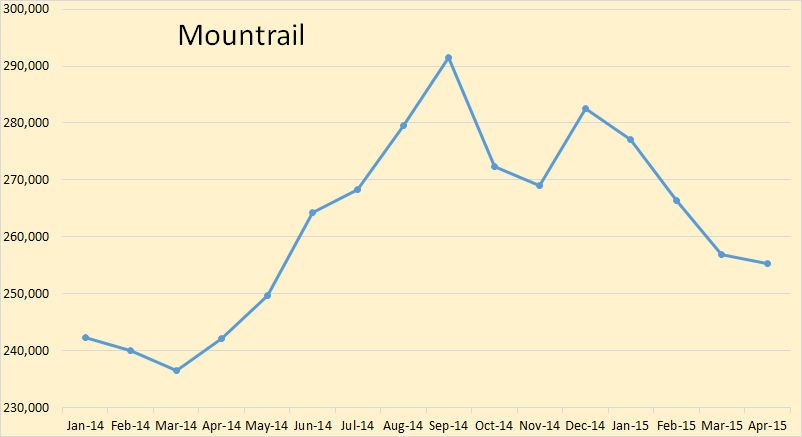

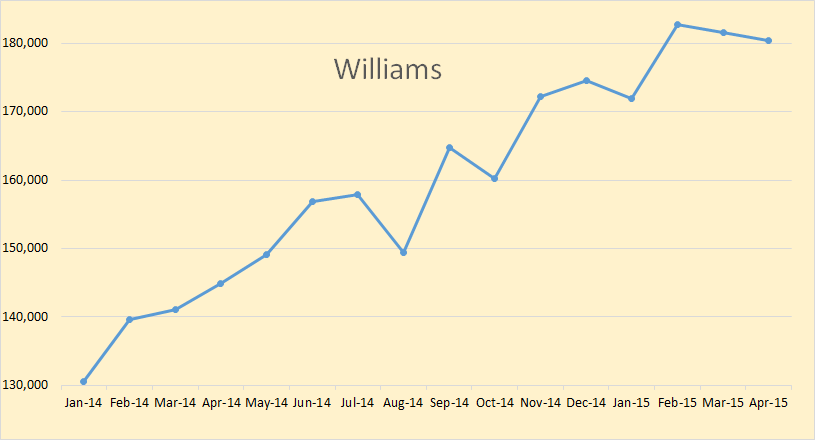

All charts are in barrels per day and are only for the last 16 months in order to get a better and expanded view of what each county is doing.

First a sixteen month view of all North Dakota production. North Dakota production, in April, stood at 1,168,636 bpd. That is 17,631 bpd below their production last September, seven months previous. North Dakota production is down 59,385 bpd since the high reached in December.

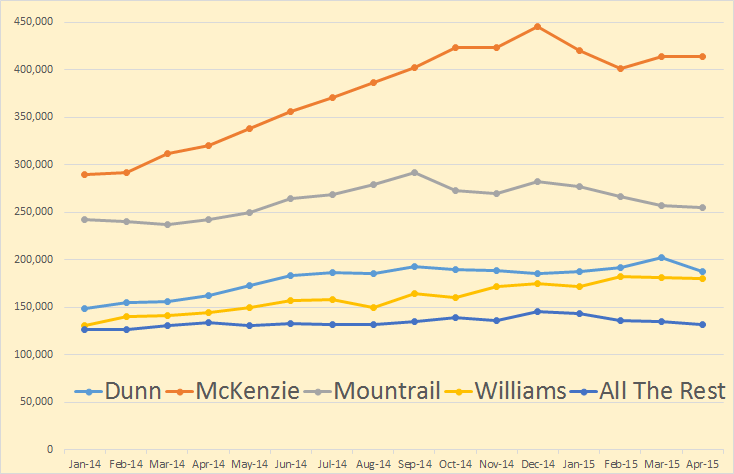

McKenzie County April production stood at 413,671 bpd, 31,555 bpd below their high in December.

Mountrail County production stood at 255,384 bpd in April, 36,132 bpd below their peak in September.

Dunn County, North Dakota’s third largest producer peaked, so far, in March at 202,609 bpd but fell 15,348 bpd in April to 187,262 bp.

Williams County production stood at 180,434 bpd in April, 2,239 bpd below their latest peak in February.

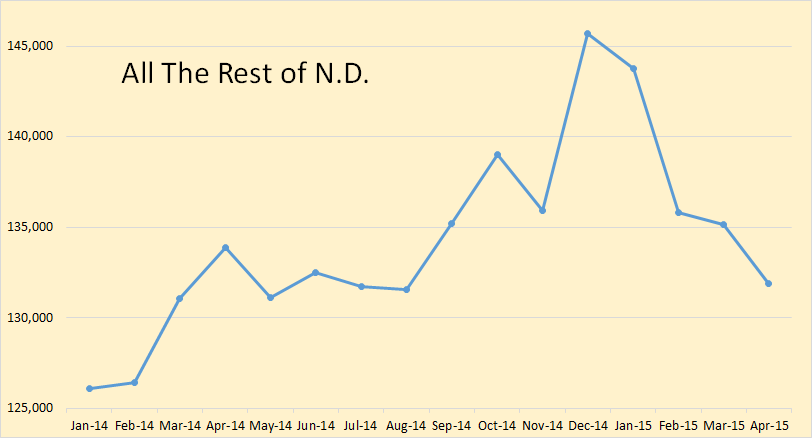

Production in all the rest of North Dakota combined stood at 131,885 bpd in April. That was 13,802 bpd below their peak inDecember.

Here I have a zero based chart of all four counties plus all the rest to give a better comparison of what each county is producing.

I hope this gives everyone a closer look at what is happening in the Bakken.

What’s happening in Canada? Is production increasing of declining? I know the Alberta Oil Sands are not all of Canada’s production but it is where most all the increase in Canada crude oil production is coming from.

Gas Production Falls in Q1 2015

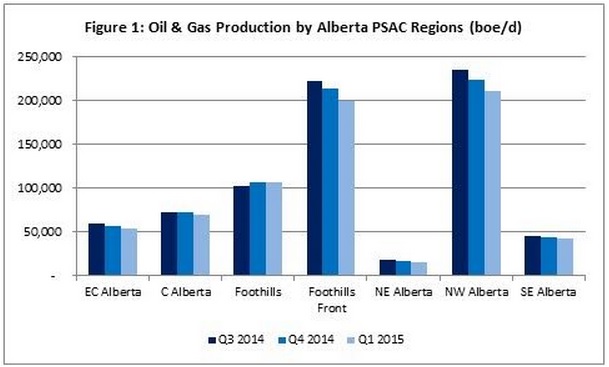

Q1 2015 saw a significant fall in oil and gas production across Alberta, with many companies recording large declines in core operating areas compared to the end of 2014.

Between Q3 2014 and Q1 2015, overall Alberta production – excluding oil sands – has fallen by 8% (56,880 boe/d) and between Q4 2014 and Q1 2015, overall production has fallen by 5% (34,165 boe/d). This is due to a number of factors; the fall in global commodity prices is perhaps the major reason for this decline, but companies have also suffered due to other external pressures such as pipeline difficulties or maintenance periods, for example. CanOils Assets is a powerful new tool that can identify both where production declined to the greatest degree and which companies recorded the biggest net decline.

Here we have production from every area of the Alberta Oil Sands. Every place decreased in production each quarter.

Every area of the Alberta Oil Sands dropped significantly in each quarter. Of course this is oil and gas production. But I find it strange that gas production could fall so much that it drug down the total by that much.

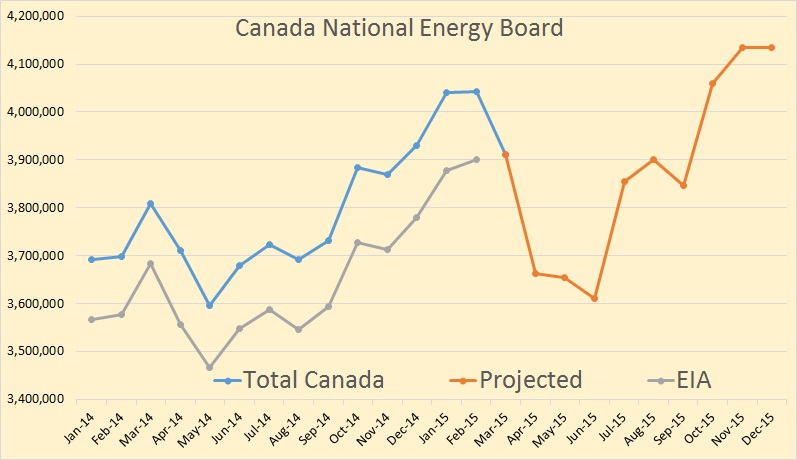

Here is actual Canadian production and future projection from the Canadian Energy Board along with the EIA’s estimate of Canadian production. They seem to have the exact amount except for the EIA’s estimate is an average of 140,000 barrels per day lower. I suppose Canada is counting something the EIA is not.

In Other News

Petrobras slashes investment by 37 per cent to reduce leverage

Petrobras, which is one of the world’s most heavily indebted oil companies, said that it was cutting its projection for investment in 2015-2019 to $130.3bn, or by 37 per cent in relation to its previous plan…

In a statement, Petrobras said that it was cutting forecasts for domestic production to 2.8m barrels per day of oil equivalent by 2020 from the previous target of 4.2m.

It appears that those who expect Brazil to hold off Peak Oil are betting on a losing nag.

Our old corcunopian buddy Michael Lynch has an article in Forbes. Hw he seems to be a bit worried about what’s happening in Venezuela:

Desperate Venezuela 4: Oil Market Impact Of Unrest

Low oil prices would seem to suggest that there is nothing to worry about from potential political unrest in Venezuela. I think it’s more that the situation in Venezuela’s problems remain over the horizon for many oil traders, until the level of unrest increases to the point where oil production and exports appear to be threatened. The economic and social situation has become horrendous, but since there have been no terrorist attacks (or Kardashian visits, kind of the same thing), it hasn’t gone the media coverage it deserves.

___________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

Oil Production Vital Statistics July 2015 – equilibrium reached

Ron, IEA is making life difficult with revisions. US revised upwards once again by 300,000 bpd even though the May number is down on April. Most of N American falls are in Canada and Mexico – according to the IEA.

Looking at the collapsing spread between Brent and WTI I’ve come to a few conclusions, and would thoroughly enjoy others thoughts.

1. Increases in Saudi and Iraq production, along with the market perception of potential future rises in Iran, Iraq, and Saudi production, is putting downward pressure on Brent.

2. U.S. imports are down, continuing a multi-year trend. This also puts downward pressure on Brent as less U.S. imports are equivalent to increased supply – more oil available for the world market.

3. U.S. production is down (at the same time imports are falling) putting upward pressure on WTI.

I see this trend continuing, and what it means to me is that WTI will have a strong incentive to

A) Rise more rapidly during up movements.

B) Have a more resilient price floor for any downward moves.

It helps that both of those have rang true during this last few months of stability in prices. WTI moves lower in slow, even, multi-day moves, but upward moves happen swiftly and strongly.

For my trading strategy this is a bit of a golden egg – downside risk is moderate when/if crude prices break trend lower, the price floor in a downward move has strong resistance, upward moves are strong and abrupt when/if crude prices break higher, and there is multiple, weak resistance ceilings that a strong move would break through easily.

Betting on oil going up basically has a great risk ratio in terms of potential loss/gain at the moment. There’s plenty of reasons we could see prices move lower going forward, but it would be temporary, moderate movements. There’s also plenty of reasons oil could move higher going forward, and if we break this price window of stability, then we’d see strong movement into a much larger price window with a clear floor (the trend breakout price) and no defined ceiling.

1. 2. and 3. together could lead to WTI price higher than Brent ?

Without an Iran nuclear deal I don’t see prices going much lower.

Hi Ron,

Data from the National Energy Board (NEB), shows a drop in output in March 2015 of about 130 kb/d, output for March is similar to Dec 2014 levels. Note that data after October 2014 are estimates by the NEB as not all province data is in from Nov 2014 to March 2015, the estimates will be revised as new data comes in.

https://www.neb-one.gc.ca/nrg/sttstc/crdlndptrlmprdct/stt/stmtdprdctn-eng.html

Thanks Dennis. So it looks like the big drop was in March. 130,000 barrels per day, that is one hell of a drop.

Hi Ron,

You are welcome, thanks for your post.

The drop would be expected given the oil price, it is similar to the drop from April 2014 to May 2014, also the data after Oct 2014 are estimates and will be revised.

Dennis I cannot seem to bring up the data you have posted here. I can only get the average for 2015 and the data appears to be in tons per day. What did you use for a conversion factor?

Hi Ron,

Try the following links:

https://www.neb-one.gc.ca/nrg/sttstc/crdlndptrlmprdct/stt/2015/stmtdprdtncdncrdlqvlnt2015.xls

and

https://www.neb-one.gc.ca/nrg/sttstc/crdlndptrlmprdct/stt/2014/stmtdprdtncdncrdlqvlnt2014.xls

There are two sheets in the Excel files, one is in cubic meters per day and the other is in barrels per day. The file gives the average for the year, but it also gives the monthly data (in english and french) to the left of the yearly average.

There is a separate excel file for 2014 and 2015, blue data are estimates and the black data are actual reported output by the provinces. Any Canadians that are more familiar with NEB data, please correct me if I am mistaken.

Conversion factor is 6.2898108 barrels per cubic meter.

Got it, thanks. I have made some changes in the post based on those numbers.

How long do you think the fossil fuel lobby is going to hang on? The ones who are fighting every attempt to transition to something other than oil, gas, and coal.

I’m not saying those sources of energy are about to run out. But when do you suppose policy makers will start to think in terms of Plan B?

Hi Boomer II,

My guess is that when output starts to decline over the course of several years (2017 to 2023), the mainstream media may wake up to the reality of peak oil. Reporting total liquids in barrels of oil equivalent may help somewhat because currently the barrels of NGL and ethanol are reported as being the same as a barrel of crude by the IEA which is silly. Output should be reported in Gigajoules (or Exajoules).

“My guess is that when output starts to decline over the course of several years (2017 to 2023), the mainstream media may wake up to the reality of peak oil. ”

Dennis, I don’t think that will happen. Not in your timeframe mentioned. When output starts to decline oilprices will rise far over $ 100. Then demand destruction will kick in and mainstream media begin to talk about demand being the ‘problem’. Only a few months they get the chance to talk about peakoil, like several years ago.

I tend to think that demand destruction has already kicked in. Consider 2 million barrels/day of biofuel, another million in demand offset by CNG vehicles, and another 500,000 offset by electric, and hybrid electric vehicles.

The Saudis obviously see the demand shrinking, and want to sell as much oil as they can while there’s still a market. It’s the exact opposite of what peak oil proponents have been predicting.

Hi JohnB and Han,

The whole “peak demand” meme is kind of silly. Even peak oil proponents understand that supply is equal to demand, this is Econ 101.

Peak oil is about oil output where supply=demand so a decline in oil output would always be about a decline in supply and demand.

Bottom line, peak oil= peak output, whether it is because supply or demand has peaked really does not matter, the correct answer is that both supply and demand have peaked.

If your point is that the mainstream media is pretty clueless, on that we are in agreement.

DC,

I think it is all about guys like JohnB trying to salvage the last bit of respect that they can muster, considering how right the Peak Oil thesis has turned out.

So they try to rewrite the argument as Peak Demand and then attempt to declare victory. How phonily transparent.

Would that be “The Hubbert Thesis” ?

http://www.hubbertpeak.com/hubbert/natgeog.htm

Or “The Oil Drum Thesis” ?

http://www.theoildrum.com/node/2716

Dennis,

While I agree with you, I think a finer distinction needs to be made.

When people say “peak demand” they mean something like: world oil demand peaks, and decreases in spite of falling prices thanks to renewable energy.

The typical idea associated with “peak oil” or “peak supply” is that the oil supply peaks, decreases, and this leads to ever increasing price, which of course prices a lot of people out but ultimately leads to a slowing economy, lower living standards, and some sort of civilizational collapse over decades.

Hi anonymous,

There can be many interactions between supply and demand. Oil will become more difficult to extract as it depletes and this will cause the price to rise, the economy will respond by finding other sources of energy, over time these may decrease in cost as economies of scale and technological development reduce costs. I guess my point is that it is not either/or the two effects will interact in a complicated way. And the main point is that peak oil includes both of these effects, it is not about only supply or only demand it is simply that oil output will reach a maximum and then decline, nothing more or less.

Hi Dennis,

The price of oil rose spectacularly between 2005 and 2008. This did not result in the economy responding by finding other sources of energy. Instead, the result was demand destruction and recession. Then oil prices rose again from 2009-2014, and averaged over $100 for about 3 years. The result was demand destruction again. So, the invisible hand did not produce your expected result in both cases, yet you continue to hope it eventually will. Why would it do so in the future if it can’t seem to today? The economy appears to be only getting weaker. Perhaps you should consider some physical limits to growth in your projections.

Alternatives constitute 3 times the production of ND, and continue to increase.

http://www.reuters.com/article/2015/06/16/usa-oil-production-kemp-idUSL5N0Z22JM20150616

Yes, that’s what I mean exactly. If we’re going to look ahead to 2023, we need to consider the growth of alternatives. E.g battery electric vehicle production has been doubling every year, for the past 4 years. If this rate of growth continues, there will be 300 million EVs on the road in 2023. There is also growth in Hybrid, CNG, and Biofuel based vehicles. Japan is now pushing Hydrogen as the ultimate solution.

http://www.usnews.com/news/business/articles/2015/07/01/toyota-nissan-honda-back-hydrogen-stations-for-fuel-cells

Bottom line – oil is no longer the only game in town. You can’t project into the future without considering all of the variables.

While I am open minded about new technologies enabling us to get by with less oil per capita year after year and still maintain our present day standard of living – everything else held equal- I am not of the opinion that alternative tech such as electric cars etc will scale up fast enough to keep the price of oil down.

EVERY year the tired old super giant and giant fields that supply most of the oil supply get a little older and a little more tired. EVERY year the new fields that are brought into production seem to be ON AVERAGE smaller and more expensive to produce than the ones brought on line the previous year.

Now it MIGHT be that the Saudis are doing all they can to keep the price of oil down in order to force the Yankee tight oil industry out of business.

But MY opinion , for what it is worth, is while they are not sorry to see our domestic tight oil industry on its knees, this is not their primary goal but rather a bit of ” icing on the cake” in terms of their REAL goals.

First off anybody with any real acquaintance with business must understand that the tight oil industry is basically here to stay once prices go back up – and that it will stay so long as the money to run it is available and the oil comes out of the new wells.

When some industries shut down, they shut down for good. The tight oil industry is NOT one of that kind.

The equipment is being or will be put in storage and brought out again when the price of oil goes up.

There are PLENTY of people in need of just about every kind of job in the oil fields these days- with the possible exception of a few people with highly specialized skills the industry will NOT have much trouble scaling up again.

The ground has been surveyed and explored, the regulations are in place , the infrastructure such as pipelines, roads, rail terminals, and housing is already in place to a huge extent etc.

The ONLY thing that is going to KEEP the tight oil industry down is geology and cheap oil.

Now let us think about WHY the Saudis sell oil. There is ONE and only one primary reason they sell it- to get the money.

There are some secondary reasons – they don’t want to upset the world wide economic apple cart for instance.

But they could INCREASE their GROSS revenue by CUTTING their production by say three million barrels a day which would probably be enough to put the price back above ninety bucks within a few weeks. Their NET revenue would skyrocket.

So – Maybe I am wrong but I do not think the Saudis or anybody else is willing to sell oil cheap over the long term to keep tight oil PERMANENTLY off the market. That would mean selling cheap for just about forever in practical terms.

Now as far as selling oil while there is still a market for it-given that it depletes by about four percent annually it is extremely likely that the supply ON AVERAGE will fall faster than the need for it so long as the world economy holds up.

The existence of hundreds of millions of ice powered trucks cars ships tractors farm machines etc etc virtually guarantees a robust market for oil for at least a couple of decades longer even if we were to go on a war time footing switching to alternatively fueled or driven vehicles.

BP wasn’t trying for oil twenty thousand feet under the sea for the fun of it but rather because the company believed it had little choice. Shell has not been trying to crack the ARCTIC NUT for the fun of it either.

So far as I know just about every body agrees the Saudis could make MORE money by selling a LOT LESS oil.

Time to fix supper now but I will post some possible reasons later why I believe they are pumping as usual without cutting back. They may not convince other people but I think they fit the facts better than the idea they are just out to destroy the tight oil industry.

“……That would mean selling cheap for just about forever in practical terms.”

o f m, that doesn’t concur with:

“……it is extremely likely that the supply ON AVERAGE will fall faster than the need for it so long as the world economy holds up.”

There is no plan B as such. Oil and gas Companies have been buying up their stock and shrinking. Prices will eventually rise, they’ll produce less oil, try to switch to produce more gas and NGL, and as they shrink the earnings per share will do ok. This will go on for 30 to 40 years, beyond that they have no idea. If you think oil companies will invest in wind turbines you have a surprise coming.

If you think oil companies will invest in wind turbines you have a surprise coming.

That wasn’t what I meant.

I meant communities might start making plans for a world that has less oil. I expect that the oil company owners will get as much money from their companies as they can and then they’ll all likely be gone (i.e., cashed out or dead).

Computer technology ended the reign of many companies. Those companies didn’t necessarily go away, but they were no longer dominant.

Boomer, two great questions

How long do you think the fossil fuel lobby is going to hang on?

I expect it to be around a long time, but lose it’s dominance as it helps destroy the Republican party. Which can be seen in the clown bus of candidates. Pretty much the only thing holding the lobbies power together now is the racial, religious, gun loving South lead by Texas and Oklahoma. As the country continues to become more cultural diversified and the old guard dies off. The lobby will continue lose it’s power.

But when do you suppose policy makers will start to think in terms of Plan B?

It’s already happening. I would put the transition turning point to be when President Obama took office and the war fighting Republican oil men left in disgrace. Plan B will take a couple of decades to implement, but the world is already in transition. The auto industry is advancing faster than anyone would have guessed back in 2008, when oil reached $147 a barrel. Within 5 more years this will be clear to almost everybody. In fifth teen years from now, you won’t be able to buy a new car or light truck powered by fossil fuel. You already see economic growth at more than twice the rate of oil production growth. Many here at this blog don’t get that concept, but they don’t have to be tied to each other equally.

“Computer technology ended the reign of many companies. Those companies didn’t necessarily go away, but they were no longer dominant.”

History will repeat it’s self, but the names will be changed to Exxon and Chevron. This too is already happening. Exxon is no longer the largest company by market capital value.

Chief. Could you expand on your belief that in 15 years no new fossil fuel powered cars or light trucks will be sold?

All going to be plug in electric powered by solar and wind?

Do you think increasing fuel efficiency standards could push that out further? Miles driven seems to be growing faster than gasoline consumption.

Global warming is real and the only way to slow it down is to stop burning fossil fuel. Like gay marriage and legal marijuana use. There is a major transition going on in the American publics view about the damage humans are doing to the earth.

I might be a little optimistic in my prediction of 15 years, but if it turns out to be 20 years. No one here is going is going to burn me to the cross, I hope. I live in southern California and you can’t help but see the transition to the future. Solar panels are going up on homes all around me. You see Tesla’s and Volt’s on the street every day. The advancement in technology in EV’s is huge. GM is saying they will have a 200 mile range EV in a few years. An EV life style is not really that big of a sacrifice or challenge when you understand what is at stake. Switching personal transportation to EV’s will be seen by policy makers as low hanging fruit shortly and will be the only way to reach CO2 levels that countries are already trying to accomplish. Change is already in the works. We are just watching it unfold.

I remember back in the 60’s when you couldn’t see 200 yards because of pollution, but today those days are seldom. Big things can be accomplished with regulation. One of the biggest obstacles holding back a reasonable CO2 future is the fossil fuel lobby. Clearly, oil producing states and countries have an interest in slowing this progress down. But, holding up a snowball in congress and denying globe warming isn’t going to fly in the future.

I believe increasing fuel efficiency standards are part of the transition and predicting the future time line is difficult but the direction regarding this change is not. We have to reduce our CO2 pollution and there are a lot of policy makers that already understand that.

But, alas, not certain policy makers in Washington State, where the ongoing saga over the $15-something billion transportation bill (mostly for even yet more new highway miles) includes a nice poison pill for any low-Carbon fuel standard (the pill would, predictably, direct money to roads). Now, some might possibly wonder as to how all those new roads might actually be maintained by future generations given the present less-than-swell maintenance of the existing sprawl but umm yay road pork! I guess that’s why they call it a beltway. Ah yep, just ease that out a notch or two more…

States rights, poor education saves, can’t write complete need help and large debt. Minimum wage family values none with more religion and proud to wave confederate(blue, red &white) on pole low carbon to you too and lost AK-15 can’t kill Prius in trailer park. and peak coal back to me? and Obama bad

Bajesus back to ya Amen ! coming to finally tank think – southern lobby shouldn’t vote all at foxy newsless

Do you know what I mean ?

I arrived in the USA when I was a teenager, and I remember the song they used to play was called “California Dreaming”. When I asked my school mates about that song, they told me it meant people in California liked to go to the beach and smoke a lot of pot. That sure gave a weird impression about California. I didn’t find out until later that most Californians were Mexicans and California Dreaming meant they dreamed about Crossing the border and getting to California.

So after 50 years you still don’t know what the song is about. It expresses the narrator’s longing for the warmth of Los Angeles during a cold winter.

Chief, I’m as connected to California culture as you are to the outside world. A lot of what you discussed may work in a California dream, but the Chinese have other ideas.

The global economy cannot work properly without increasing its energy input. We need a different type of economy that doesn’t require continuous growth, but I am not sure that is possible. As it is now, our economy will collapse if confronted with a long reduction in energy input.

As Michael Ruppert (God rest his soul) used to say, nothing will change until we change how money works. Any system that charges interest on money requires growth in order to be sustained. The banksters will most likely blow up the world before there is a monetary system where the govt issues money at no interest.

“Any system that charges interest on money requires growth in order to be sustained.”

One of the things I remember having read, in other words, on the site ‘lifeaftertheoilcrash’.

Hi MudGod,

The problem is not our monetary system. It is our biology. Our species requires growth in order to be sustained.

Screw the banksters, but the coming disaster is not their fault. That is just a false narrative, a rationalization designed to affix some sort of blame or responsibility where none really exists. This sort of story is just a product of how our brains evolved to solve problems by scapegoating. It is similar to the widespread belief that the Saudis are somehow responsible for the drop in oil prices. Just a useful story.

Jay Hanson.

But welcome back, Futilitist. Looks like the POB Futilitist Cycle didn’t collapse entirely. ‘u^

“Just a useful story.” ~ Futilitist

So now what? What are you doing, given all these stories, etc.? Preparing? How?

I still see people driving around in traffic, one person per vehicle, while the city in which I currently reside, Halifax, has solar panels few and far between. Maybe that’s a good thing. Maybe it’s a sign that they are never really going to come in any sufficient capacity, which means that we may need to go back to the Earth and real-time sunlight, real community, and growing/gathering our own food again, etc.. Back to where we belong. No Mars or a Stairway to the Stars for us. Our cultures are and likely will always be as long as we are the way we are, the averaging-out manifestation of the average of human intelligence.

Hello Caelan.

Thanks for the welcome back from my sabbatical.

And thanks for bringing up Jay Hanson. I am obviously a big fan. Everyone should read the link you posted. The Maximum Power Principle, and how it has shaped our evolution, is at the heart of many of the arguments I tend to make here.

“The destruction of the natural world is not the result of global capitalism, industrialization, “Western civilization” or any flaw in human institutions. It is a consequence of the evolutionary success of an exceptionally rapacious primate. Throughout all of history and prehistory, human advance has coincided with ecological devastation.”

~ John Gray, STRAW DOGS

“…in fact, telling primates (human or otherwise) that their reasoning architectures evolved in large part to solve problems of dominance is a little like telling fish that their gills evolved in large part to solve the problem of oxygen intake from water.”

~ Denise Dellarosa Cummins

Hi Futilitist,

John Gray did a critical piece on Steven Pinker’s work regarding violence, incidentally, and we touched on that hereon recently.

But again, given your take on collapse, what are you doing about it, if anything?

Want to join an ecovillage? I have a plan to post an ecovillage project idea here, where the project would involve leveraging a ghost town and turning it into an ecovillage. I also have a specific ghost town in mind.

I have already posted Hanson’s link previously, and suspect that the who’s who of here are already fairly aware of his work, which was also featured on The Oil Drum some years back if recalled.

I agree, the big problem is overpopulation. And seeing how sex is just so darn good a huge dieoff is probably the only solution. My previous point was that we are reaching the limits of a growing economy and any system that charges interest on money must have growth in order to be sustained. It will implode along with the growing population.

My previous point was that we are reaching the limits of a growing economy and any system that charges interest on money must have growth in order to be sustained. It will implode along with the growing population.

I think that will likely happen. But the result, while painful, may help the remaining population survive.

Of course, if the much smaller population ends up thriving, it may repeat the cycle all over again if it forgets the lessons of the past.

Actually there is another solution. Do unto others as you want done unto you. And you don’t have to believe in a virgin birth or the resurrection of a man to live by this principle.

I think “do unto others as they would want done unto themselves” would be an even better principle to live by, but neither the golden rule, nor the platinum rule, will save us from collapse.

You may be right, but if everybody lived by that rule it would be the closest we would ever get to heaven on earth.

Ethics

Hi Fernando,

Nobody thinks oil companies will invest in wind and solar. Society’s resources will shift to energy sources other than fossil fuels as they become more costly than the alternatives.

Dennis, I read dozens of articles, op eds and comments insisting that oil companies have to be forced to invest in renewables. I think biofuels and geothermal are suitable investments, but wind and solar don’t make much sense.

I think biofuels and grothermal are suitable investments, but wind and solar don’t make much sense.

If oil companies think of themselves as energy companies, then any possible investment in that area could make sense.

However, what has changed since some of the oil companies got involved with wind and solar is that Silicon Valley is pushing for a different energy model altogether, whereby big energy companies and centralized energy generation and distribution become less important than distributed generation, utilizing Silicon Valley business models.

Hi Fernando,

If the externalities of coal are taxed appropriately, wind and solar make sense in many places, as natural gas depletes or if natural gas is exported from the US, then natural gas prices will rise and wind and solar will be more comperitive in the US as well.

Yes Dennis, but oil and gas companies, in general, don’t mine coal.

Hi Fernando,

I think we should use all alternatives to fossil fuels, solar is pretty expensive at present relative to wind, we should maximize geothermal and hydro where they are available (if environmental destruction does not result), use biofuels where they are cost effective (and do not create more carbon emissions by destroying rain forests as in some parts of Asia), and use solar in areas where insolation is high.

If the costs of solar continue on there present path it will not be long before solar will make more sense over more of the planet.

We should use what works at minimum cost when all externalities are accounted for.

Yes, but oil companies won’t invest in areas such as wind and solar. Some invest in biofuels. I think geothermal makes sense because it involves wells and topside facilities. The point I try to make here is that trying to force a company to do something it doesn’t know how to do is a bit naive.

The point I try to make here is that trying to force a company to do something it doesn’t know how to do is a bit naive.

Why would they invest? Other companies will just replace them.

Most of the majors do invest in renewable energy. Chevron in particular.

http://www.chevron.com/globalissues/climatechange/renewableenergyandemergingtechnology/

Euan Mears has just posted a truly excellent overview article about geothermal on his own blog called Energy Matters.

I strongly recommend it.

Hi Dennis,

We write a lot of ‘shoulds’ and a lot of it seems to refract through a particular BAU/status-quo(-dependent) techno-energy, self-disempowered, undemocratic prism.

How about more about re-community, relocalization, re-naturalization, re-self-empowerment, resilience, re-generalization (de-specialization), and low energy/tech (individual-empowered) natural/local approaches, like passive solar (good glazing and insulation) and even human migrations to warmer/etc. climes? It’s happening anyway.

We keep talking about when or as the shit hits the fan who are going to take control of nuclear power plants and their wastes and waste pools (and how are they going to manage it with diminishing resources/economics and potentially-increasing social unrest, etc.?), and yet some continue to mention nuclear as if that’s not a concern. Much discourse borders on the ignorant, wreckless, irresponsible and unconscionable, but then practically our entire way-of-life is built on those.

How often do we have to say that our species did not evolve and doesn’t appear to be meant to live at these levels of, generally unethically-derived, social and technological, paradoxically-disempowering/diminishing-returns/diminishing-control complexity before we accept that?

Much of what is written about in terms of responses/solutions requires a society like ours that is predicated on an unethical and corrupt platform. The cart before the horse.

The new CAFE standards require 54 MPG by 2025. It would be hard to build a car that gets that much mileage without making it an Electric Hybrid. A Plug-In option is not that hard to add from there, e.g. the Prius Plug-In.

Necessity is the mother of invention and fifty mile plus per gallon ice powered cars are not out of reach. Building them however is going to cost more due to the high prices of lightweight materials and more sophisticated engines and drive trains.

I foresee hybrids, plug in hybrids, and pure electrics gaining market share far faster than expected by mainstream pundits and conventional thinkers but I am not willing to go so far as to predict a total electric car takeover and the complete demise of the conventional car and light truck within the next couple of decades.

The rules are going to change. Speed limits will be lowered, smart roads are in the offing, car sharing and car pooling are growing by leaps and bounds but from a very low starting point.

Modern communications make it reasonably safe to get in a car with a stranger TODAY . Snap a pic of him or her and his car with your smart phone and send it to your friend or a web site set up especially for the purpose. Check in along the way using the dead man switch failsafe technique. If you FAIL to check in , somebody calls YOU to make sure you are ok and properly enroute. Drivers who want to share rides can get documentation prepared proving they are good citizens. Sharing rides is going to get to be easier and easier as time passes.

Cars will be substantially downsized as fuel supply problems grow. I have no problems foreseeing suburbanites driving two seat fore and aft very narrow , very low plug in hybrid cars that run almost entirely on battery power supplemented with a twenty five horsepower diesel ” lawn mower” sized engine.

A hundred miles per gallon in such a car with such an engine on diesel alone is within reach TODAY. When diesel hits ten or fifteen bucks somebody will start selling them. VW has already put an experimental model on the road that got over two hundred mpg equivalent.

We will see laws passed that in effect MANDATE the production and sale of such cars and other laws passed that will add substantially to the price of gasoline and diesel fuel thereby forcing the owners of older larger cars and trucks to drive them as little as possible and also resulting in the scrapping of such older cars and trucks well before they are actually worn out.

Those of us who believe we will never raise the gasoline tax in this country are failing to take into account the effect the rise of the younger generations have on the culture. We are morphing into a western European type culture fast as the old farts such as yours truly die off. We old farts will be gone in two decades and losing importance fast as far as elections are concerned in another decade.

Young people are no longer fascinated by cars as they once were and cars are no longer necessary status symbols for young men looking for women etc. The cost of owning a car is prohibitive in relation to the cost of car sharing or taking mass transit and neighborhood biking in the community of the future. People who are marginally hard up are already having a very hard time affording a car to get to work.

In a nutshell what this means is that the public OVERALL is not always going to believe in a god given right to cheap gasoline. People who cannot afford to drive will gladly ” stick it ” to those who can expecting the higher tax revenue from higher fuel prices to be spent on more mass transit, bike paths, etc.

This is not to say the average suburbanite is going to give up his suburban home with garage, back yard ,garden spot ,privacy, shade trees ,etc for a non existent comparably desirable place to live down town.

Mr. Suburbanite will buy one of ” them there newfangled leterc go carts” to get to work and run his errands. He will probably keep his Audi since it will be worth very little if he sells it to use for the occasional family trip or outing. Putting ten or fifteen dollar gasoline in a car ONCE IN A WHILE is no big deal compared to not having that car available to go see Grandma. Transit is never going to amount to much in the suburbs compared to super cheap running super small sized cars.

Just getting to a train station and from the destination station to the final destination -door to door – for a fairly short trip – anything under say four hundred miles – can take hours plus the train riding time. Such a trip can usually be accomplished faster and for a damned long time to come , CHEAPER, by driving directly, unless both doors are near the train stations. Cabs and train tickets are NOT cheap compared to driving an existing car. A twenty five year old car with only fifty thousand miles on the odometer is just about as reliable as a brand new car if it has been properly maintained. So the conventional car – old but nice – will remain in most suburban driveways as electrics take over the mass market.

And if we are lucky enough that business as usual lasts another twenty years, there will be plenty of pure electric cars capable of making door to door trips of five hundred miles with no more than one or two stops to recharge at a fast charger.

Most restaurants near a major highway interchange will have a fast charger by then to entice customers into the restaurant. If you spend enough on lunch your charge will be complimentary. Otherwise they will just add it to your check.

As you probably know, some restaurants and some stores already have fast chargers, to lure people to come inside while using the chargers.

As for transportation patterns, in some cases using the train (say from New York to DC) is faster than flying because the train stations are downtown, while the airports are in outlying areas, and because you don’t need to arrive early to deal with airport security.

Front and back 2 passenger seating is an interesting concept.

https://www.startengine.com/startup/elio-motors

Watcher says:

06/29/2015 AT 9:39 AM

Oh and heads up. Oil was down over a dollar in Asia last night as Greece lifted the dollar. Sub 59.

There are 2 days until the 1st of month event. Remember, it is the average of price on 1st of months that determine underground collateral valuation for lending for completions.

Wrapping from end of last ronpost. Doesn’t really matter why the price is what it is. July 1 is an important day, as is the 1st of month of all months.

And the other comment, of more signif:

Watcher says:

06/29/2015 AT 9:35 AM

Probably due for another ronpost, and I’ll wrap this over when it appears.

Re: energy content of varying API degree oil being mass dependent:

http://hypertextbook.com/facts/2009/BennyWong.shtml Quoting The Physics Factbook:

One of the primary constituents of petroleum is hexane (C6H14). The amount of energy released when burned is 4163.2 kJ/mole. You multiply that value by the mass of 1 mole of petroleum. Afterwards you get the value in kJ/gram. Multiply that value by how much mass per liter of petroleum there is. Multiply the final value by how many liters there are in 1 barrel of petroleum and you receive the approximate value of 6.72 GJ.

This supports the energy content of crude vs condensate analysis above that relies simply on mass/barrel, which is more specifically a layout of energy content per API degree.

Regardless of theoretical derivation of energy release per (CHx)n, seems pretty hard to imagine that someone by now didn’t just take some measurements of energy content per barrel of XX API degrees.

And so, looks weight defined.

REPLY

Hi Watcher,

For the non-chemists (like myself), if C+C output was reported in tonnes rather than barrels (lots of counties already do this), would we estimate the energy content of the C+C (or total liquids) more accurately relative to reporting by volume? BP already does this for total liquids consumption, so we could simply take the tonnes of oil consumption and multiply by 7.33 barrels per tonne and divide by 365.25 days per year to estimate the barrels of crude equivalent liquid energy consumed each day. Using BP data we get the chart below. Mboe/d= millions of barrels of oil equivalent per day

A better chart that compares world liquids in Mboe/d (energy) and in Mb/d (volume), data is from BP.

Sorry about the typo, chart without consumption misspelled below.

Thanks Dennis, I enjoy your data-driven posts.

It would be interesting to plot these against population to look at ‘All liquids / total energy vs population’. Any chance you could plot this please?

Cheers.

Hi Dave P,

I have one with Primary energy per capita and oil consumption (based on mass) per capita.

Thanks, that’s great! I wonder when energy / person will peak.

Hi DaveP,

As we move away from fossil fuels to more solar, wind, geothermal, hydro, tidal, wave, and nuclear energy and as population peaks and declines we might continue to see a small rise in energy use per capita. At some point (200 years from now) we could see World income levels (in real terms) at similar levels on a per capita basis as current average European real income levels. Under this very optimistic scenario, where World population levels have fallen to 1 to 2 billion and net carbon emissions are close to zero energy per capita may peak and the economy might reach a steady state (no growth). This does not mean there will not be many bumps in the road between here and there, but it is the road humans should aim for.

It’s be really nice to know what exergy per capita has done over the years, since ultimately we use exergy, not energy. With the general increases in efficiency in many processes I suspect that it might have continued to rise somewhat, however without knowing the aggregate energy efficiencies of various industrial sectors in different countries it’s impossible to say. Of course, many industrial processes are at or approaching their thermodynamic limits, which limits the potential for future gains.

Hi Sam,

I agree exergy would be nice to know, but the devil is in the details, energy is the best data I have (and it is not really great, but any exergy numbers we could come up with would be quite speculative IMO).

I agree we will approach thermodynamic limits at some point, but moving to less thermal production of electricity and more use of electric motors overall will reduce thermal losses. We can do much better in transport by moving to electric rail as much as possible and more public transportation would help as well (in the US). Increased energy costs will drive efficiency improvements, but as always there are physical limits to efficiency improvements.

So, that’s something like 0%/yr. per capita and negative per capita since 2005?

Also, the peak in ND production last summer-fall coincides with the peak for the economy, including employment. In fact, the 12-month avg. of US Treasury withholding receipts vs. wages and salaries suggests that employment is overstated perhaps as much as ~1% (assuming there was not a further decline in labor force participation by a similar amount).

This also fits with the Redbook retail sales (ex autos and gas stations) growing ~1.5% YoY, which is down from 3.5% in 2014 and 3.2% in 2013.

Moreover, the latest estimate for Q2 real final sales SAAR has decelerated to ~1.3% since Q4 (2% for the 4-qtr. avg.), and that’s just 0.7% SAAR YTD and ~0% real per capita.

In order for the 4-qtr. avg. for real final sales to maintain the 2% rate, the SAAR for Q3 needs to accelerate to ~4%.

The incipient bust in the shale and energy-related transport sectors is dragging down goods orders, production, and employment since Q4 2014. The economy is weaker than the headlines indicate. Auto sales are still strong but largely because of sub-prime auto loans. Ex sub-prime loans, and sales would be 12-13M vs. 17M.

Interesting chart, Dennis. What about EROEI the last, say, five years ? And what Dave P wrote.

Hi Han,

There really is not very good data on EROEI, there are a lot of problems with such a measure, where should the boundry be drawn? I pretty much ignore the EROEI stuff, but you are welcome to delve into it. Oil consumption per capita has been pretty flat since 1983 at around 4.2 b per person per year for the World using BP energy data and UN population data (and US census bureau data from 2011 to 2014).

Dennis, I have read about it f.e. in an abstract from an ASPO conference several years ago. Much less EROEI for the ‘hard to get’ oil of course, but this is not that important indeed. Because the energy invested comes from much more than oil products. The quality of crude oil seems to decline (less BTU) on average also though, IIRC.

To the rest of us, who remain concerned about the next generations, the only thing that matters re energy is

Useful energy (needed) return on Carbon Poison dumped into the future atmosphere.

That’s why I am spending my time on wood pyrolysis- it results in Carbon Taken Out, not put in to the atmosphere, with useful net energy produced.

An oil trader, an astrophysicist and a republican go into a bar to have a beer, a guy comes by and says ” what do you people think about Global Warming?”

trader- ” I only think about money”

astro- I only think about black holes”

repub- “Think?”

7.33 barrels/tonne is not the correct number.

And not all of it is converted to energy.

The focus is to what extent can a rising API degree world, bespeaking less and less energy out of the ground, push trucks around that feed you.

First off, it depends on the specific gravity of the “oil” in your barrel because you’re converting volume to weight. Or is that what you’re getting at? Barrel of oil equivalent (“BOE”) is a measure of energy. According to your government, a BOE as equal to 5.8 × 10 to the power of 6 BTU. But surely you know this Watcher; are you playing silly games again? You’re always harping on definitions, well It’s just a question of how you define stuff. Which you know perfectly well.

Meanwhile, I have a question for you. Why do you Yanks insist on using obsolete measuring systems: Fahrenheit, Feet, Gallons, Barrels, Furlongs, Cubits. You could just as well measure oil in buckets or how about pint glasses.

Hi Doug,

So what would a barrel of crude weigh that has the BOE energy, my guess it is 7.33 b/ metric tonne? Which is the figure that BP gives in the BP Statistical Review of World Energy.

7.33 barrels per ton would be correct for very light oil. Very heavy oil with an API gravity of 10 would give 6.25 barrels per ton, the same as water.

How many barrels of crude oil in one MT?

Petroleum has a specific gravity of 0.88 which means 1 liter weighs 0.88 kilograms.

From the volume page we know that:

1 barrel [US, petroleum] = 158.9872972 liter

So 1 barrel weighs:

158.9872972 * 0.88 = 139.908821536 kilograms

1 metric ton is 1000 kilograms:

139.908821536 / 1000 = 7.1475121

So there are a little over 7 barrels of petroleum in a metric ton.

This is assuming that 0.88 is the correct specific gravity. Since as you said, the grade of the oil may make a difference. If you know the exact specific gravity of the oil in question, you will get more accurate results.

Actually I don’t know. I think this as a can of worms that Watcher has opened, the contrary character that he is. You just have to pay attention to the way it’s being used and by whom.

The BTU figure I quoted above is from the US Tax people (whatever you call them). A lot of people just assume one barrel of oil is has the same amount of energy content as 6,000 cubic feet of natural gas and leave it at that: Pretty pathetic I admit. For most purposes, your 7.33 b/ metric tonne sounds OK to me. [By the way, tonne IS metric already]

Just what is the point of determining an accurate BTU content for oils or for that matter for fossil fuels in general. What is it going to tell you?

The end uses are so variable and have such efficiency variation and use variation, what does the BTU value have to do with it?

Sure quality varies, but is that significant to how well civilization actually works.?

Someone tell me why this is actually important?

Hi Marblezepplin,

Energy matters. In many cases humans are attempting to accomplish useful tasks which usually entail work ( force applied over a distance in physics). In a non-magical world energy is expended in the process of doing work, I will not go into the physics and chemistry of this, but typically this is non-controversial for scientists.

Whatever the efficiency of any thermodynamic process, a certain amount of energy will be needed to accomplish a task. So if we want to move food from the farm to the city in a truck, a barrel of ethanol will not get the truck as far down the road as a barrel of diesel fuel.

The ethanol has roughly 65% of the energy content by volume as the diesel, the point is that as currently reported by the IEA a barrel of crude is reported as being the same as a barrel of ethanol, they do not adjust for the lower energy content of the ethanol. If you live 100 miles from where the food is produced and 1 barrel of diesel will get the food to the city, you don’t want ethanol to replace your diesel, unless you would like to walk 35 miles to get your food (where the truck fueled with ethanol would run out of fuel).

Well said Dennis.

To Dennis Coyne in response to his 8:45 AM response.

First Dennis you answered the wrong question. I asked what is the point of determining an accurate BTU value when the BTU value has little to do with what actually happens out at the end use and in society. An 11 percent change in BTU is insignificant to society.

Since you like simplistic examples I will give you a low case one. The car I drove in the 60’s got 1/3 the mpg of the car I drive today. Since the energy is supposedly less per volume, that car is even better than I thought. Do you see it, the change in fuel (if it’s real) did not effect society because society changed the end use capability. Today’s cars are more efficient, have much better handling, longer life and better performance. They are safer too.

Radios. TV, electronics, microwave ovens, fiber optics, lasers, medical devices, and on and on. All better, more efficient and much more capable. A 25 percent gain in world use per capita and no gain in oil use per capita since the 1960’s and society is orders of magnitude further along.

If there was a direct link between BTU value and societal ability then we would hardly have progressed at all since the 1960’s. I would still be consulting a magic eight ball, posting letters in the mail, and dialing a phone. Oh, yes I would also still have an antenna on my roof and we would be unable to breath the air or drink the water by now.

Society is now providing other transport means that are much more efficient and make any minor BTU problems irrelevant.

And feel free to use physics and chemistry if you can, I started out in astrophysics and then spent decades working in chemistry. So cut the patronizing crap.

BTW, even a moron would stop to get more fuel rather than try to carry the food 35 miles (your example). Also, EtOH is not a fossil fuel.

Since the comments have nested off to the right …

Marble Zep

The exact BTUs is for the U.S. Internal Revenue Service tax code,

specifically 26 US Code section 45 K – Credit for producing fuel from a nonconventional source.

https://www.law.cornell.edu/uscode/text/26/45K

see down at (d)(5)

It’s so the taxpayers can subsidize unconventional fossil fuels and biomass gas.

This brings to mind the apocryphal Michael Faraday comment allegedly in response to Gladstone’s question “of what use is electricity?” “One day sir, you may tax it”.

But it seems our society is so perverse, that instead of taxing, we subsidize depleting fossil fuels.

You are right that the actual BTUs in a volume of crude vary greatly, as does its effective use.

Hi Marblezepplin,

I agree that efficiency matters. Do you think there is no limit to how efficient an internal combustion engine can become?

Clearly the average car became more efficient from 1975 to 1985, since then in the US there has been very little improvement in the car fleet’s average fuel economy. The electronics and safety equipment are beside the point.

At any given level of efficiency, the number of Joules in a volume of liquid fuel matters.

I suppose you could claim that if the liquid fuel has half the energy will just make our engines 2 times more efficient, and claim that we have just as much energy as we did before because the volume of liquid remains the same and we can go just as far as we did before.

Then when we run short on liquids, we will just repeat this(1/4 the energy/volume and 4 times more efficient), we won’t worry about physical laws because as every economist knows, we are not bound by the laws of physics when we have human ingenuity. 😉

Hi Dennis.

You are very selective in your application of the laws of thermodynamics.

You disregard exergy. You also disregard EROEI. And you don’t consider or factor in entropy, either. Your fanciful graphs and projections never account for any physical constraints at all. And now you try to chide MarbleZeppelin for his question on efficiency gains, by making a tongue in cheek joke about how economists “know” we are not bound by the laws of thermodynamics. And you add a wink because we all know how silly it would be to disregard the laws of physics! Wow.

Dennis, efficiency was the smallest change I was talking about. Take a look at the whole system not just one small portion.

But even so, Jay Leno asked some young people what kind of mpg their car got. They responded “over 2000”. A special case but still it’s nice to know the boundaries. The Dutch solar car gets infinite mpg. So even so primitive and minor a change as efficiency can make huge differences.

But, to reiterate, look at all the changes in society that have occurred with very little change in fuel per capita. Our abilities are orders of magnitude further along now.

Hi Marblezepplin,

I agree we have made progress. I also agree that a solar car would be a wonderful thing and some day they might be widely available for driving on a sunny day. Do you agree there are thermodynamic and mechanical limits to how efficient we can make an automobile powered by an internal combustion engine?

If not, there is no point of discussing further. I agree much progress has been made, I do not agree that there are no limits to how much more progress can be made.

I also understand that better fuel efficiency can be attained using hybrid electic technology (and have owned a hybrid since 2004 and now have 3, one for a teenager).

Fifty miles per gallon is attainable in a Prius, maybe 60 if you stay off the highway and drive under 45 MPH most of the time.

If the energy in the fuel is lower (as in an E10 blend), you cannot go as far on a tank of gas in any given car. I think that matters if you want to travel from point a to b.

“But it seems our society is so perverse, that instead of taxing, we subsidize depleting fossil fuels.” ~ sunnnv

It is perverse.

We yankees are generally capable of handling the arithmetic involved. LOL

Seriously I HATE metric measure when I am doing hands on work. The decimal inch works just fine for detailed work using micrometers etc.

And the inch denominated tape is infinitely easier to read when actually working by hand. When I was younger I could see halves quarters eighths sixteenths thirty secondths sixty fourths easily. Thirty secondths are hard now but the different height of the markings still keeps me seeing easily down to that level. The millimeter is just too damned big for hand work and a tenth of a millimeter is too damned small. It is too easy to miscount the small millimeter marks all the same height on a metric tape.

Beyond that every thing was BUILT here to the old system of measure. So when you try to use metric denominated plywood or drywall you have to cut some off of every sheet. Trying to use metric measures on any old USA infrastructure is a complete and total pain in the ass.

So far I have not encountered metric lumber personally. But I expect each and every piece would have to be bought over sized and trimmed to work on existing American houses and buildings.

Beyond that going metric means buying new tools in a lot of cases. I AM STILL CUSSING EVERY DOMESTIC MANUFACTURER FOR NOT GOING EITHER TOTALLY METRIC OR STAYING TOTALLY OLD ENGLISH.

I have to own twice as many wrenches as I used to and find just about every domestic machine has mixed fasteners.

Some guys I know who do drywall work just quit when their companies went to doing an occasional job using metric. The sheets are so much bigger and heavier they decided it was no longer worth it lugging them around.

The pay scale stayed the same with the work getting to be substantially harder.

Hi Watcher.

If all liquids were crude 7.33 barrels per tonne would be correct according to BP. I believe what you were saying was that mass would get us pretty close to the energy content of liquid petroleum.

So you take the petroleum consumption (BP’s all liquids) in millions of tonnes per year and find the equivalent bu multiplying the mass by 7.33 to approximate the crude equivalent. How much do you think the average barrel of crude oil weighs. The fact is we don’t have the data on how many barrels of various API densities of crude are produced so this is about as close as we can get. One source on the internet suggests it should be 7.15 barrels per metric tonne of crude.

In another place I found 7.3 barrels per metric tonne.

Dennis,

BP uses different conversion rates for each country.

Furthermore, these rates are not constant, and change from one year to another, reflecting changes in crude mix.

Using one conversion rate for global production would be misleading.

Hmm,

BP reports crude in millions of tonnes, they also say that if you want to convert a metric tonne of crude to barrels you multiply by 7.33. This really isn’t that hard. It is of course possible that the average barrel of World crude does not weigh 1/7.33 metric tonnes, but BP has given this statistic for years, my guess it was the weight of an average barrel at some point in time and is used as a “standard” barrel that has 5.8 million BTUs.

If the mass of oil is roughly equivalent to its energy content, then using 7.33 b/tonne converys this mass of petroleum into these “standard” barrels, AKA a barrel of oil equivalent.

Now we could also use scientific measurements where a BTU= 1055 J so 5.8E6=6.12 GJ.

Now we multiply by 7.33 b to get 44.85 GJ per metric ton.

API 120 liquids are hydrocarbons and are 11+ barrels per ton.

There is an energy conversion issue of CH2(X) vs CH4(X). The methane has more per kilogram, but uncompressed or unfrozen it takes a LOT of volume to add up to the same weight/mass.

Dennis,

BP indeed has 7.33 barrels per ton rate in the table called “Approximate conversion factors” “Based on worldwide average gravity”. But if you use their oil production or consumption numbers from the Statistical Review, you should take into account that these numbers include NGLs (with conversion ratio of more than 10 barrels per ton). So if you make very simple calculations comparing BP numbers in tons and in barrels/day, you can find that the “real” conversion ratio is different for different countries and for different years. This reflects the changing share of NGLs in the C+C+NGL mix. But it may also reflect the changing mix of different crudes (C+C) in global (and individual countries’) consumption and production. Thus, the US LTO, which includes light crude + a lot of condensate has much lower specific gravity than, for example, Venezuelan crude. Hence there are less barrels in a ton of Venezuelan crude than in a ton of US crude.

BP barrels/ton conversion rates for key global oil producing countries and world total (my calculations based on the Statistical Review of World Energy 2015)

Hi AlexS,

The idea is pretty simple. I realize that the API gravity is variable. The point is that if the mass of the petroleum liquid is roughly proportional to its energy content and if the average World barrel of crude oil has a density which is equivalent to 7.33 b per metric tonne, then we can find the barrels of oil equivalent based on these assumptions.

Maybe better drawing the line in the first graph in color red ? Because in the other graph it is the red one.

We take the energy content of crude oil quite often. The first time I had it done was in 1983, to submit Information to a foreign ministry on the tax revenue per energy unit they were collecting. We also do it to understand how much oil we have to burn if we don’t have enough gas.

All large crude oil streams and oil discoveries are submitted for full assays, which include a simulated refinery product slate. Thus it’s fairly easy to get the energy content. Are you trying to set a conversion from barrels to tons?

Almost. It’s mostly an examination of the extent to which a rising condensate / crude ratio world loses energy for X number of barrels. This is another mechanism for trucks delivering less food.

Article on condensate vs. C+C in Russia:

http://blogs.platts.com/2015/06/29/crude-russia-wellhead/

Thanks for posting this link Jeff. This is a very good article. This is just more confirmation that Russia has peaked.

Thus, even if gas condensate production would continue growing through the rest of the year, it is unlikely to compensate for an estimated 3%-5% natural decline at old oil fields in West Siberia. Russia’s main oil province accounts for around 60% of the country’s total liquids output.

I see. Good luck. We have increasing light ends from tight rocks and increasing heavy ends from extra heavy. What’s the future peak for the unconventional tight rock light crude? 10 or 15 mmbopd?

Hi Fernando,

Those guesses for LTO are very optimistic, I would put the peak for LTO Worldwide at 6 to 7 Mb/d, maybe 10 Mb/d is possible at $200/b, but I doubt it. And if oil prices get to $400/b (in 2015$) maybe LTO would peak at 15 Mb/d, but I doubt we would reach that price level for any sustained period.

Dennis, I tend to agree with you. So what’s the world extra heavy oil peak going to be? 10 to 15 mmbopd?

Hi Fernando,

Jean Laherrere’s estimate for extra heavy (XH) oil peak is 15 Mb/d in 2070, my guess is more conservative (I have recently changed this) at 10.4 Mb/d in 2056. So you nailed it. It might be lower than this if Venezuela doesn’t manage to straighten out its government, but I doubt it will be less than 8 Mb/d unless we have a World economic collapse before 2040.

Right, so the extra light and the extra heavy are peaking at roughly the same level. This means we won’t see a lighter mix. We will see a heavier mix coming out of the wells. But some of the extra heavy will be upgraded near the field. I think it’s going to be roughly the same.

The 12 month NYMEX strip for WTI is right at $60. The 12 month NYMEX strip for natural gas is right at $3.

The current month prices for each are in that ballpark.

I understand there are no price guarantees, and either or both could go up or down in the next 12 months.

However, if prices stay in the $60 WTI range and $3 mcf range for 12 months, I think the numbers clearly show continued losses, or at best, meager profits, for US shale. That is even accepting as true the cost reduction claims. My assertion is backed up by consensus earnings estimates, which are near zero or negative.

Of course, we know GAAP earnings make things look better than they are, whereas cash flow, the really important metric, is comical. Cash flow negative for years on end. Sounds like the dot com bubble.

I read an article recently that the US shale companies are winning the “war” against OPEC. I think OPEC is hurting quite a bit too, so ultimately I think no oil producer is winning the real or perceived “war”.

However, for someone to make such a claim given the tremendous amount of financial evidence that is in the open, for all to see, is ridiculous. Yet it happens over and over again. I posted a retort to the ‘winning the war” comment. The author responded that the CLR’s of the world have won because OPEC wants them out of business and they are not. REALLY? Thanksgiving was just 7 months ago.

Did US oil producers and wall street, during the 1986 price crash, make claims as ridiculous as those being made about US shale today? I was around then, but was young and not paying as much attention.

Would be interested in hearing from those who recall what was being said around the time of the 1986 crash. I also welcome opinions as to why the BS keeps on being churned out. Seems like the only one of the financial “in crowd” to take a shot at US shale claims has been David Einhorn.

There were more talking heads willing to take down the dot com bubble than there are US Shale. Why is that?

Speaking of OPEC countries not faring so well the last few months, Bloomberg reported yesterday that KSA foreign reserves fell over $50 billion from 1/15 to 5/15.

Now THAT is a CASH BURN.

shallow sand,

Unlike most other oil exporting countries, KSA has actually increased budget spending this year, and their fiscal breakeven is higher than in 2014

$50 billion in 5 months with exports at around 7,100 kbpd would mean they are spending about $46 per barrel from savings, which would agree with previous estimates that they need $110 per barrel to break even. And as their exports fell 5% last year they maybe need more than that until all the shale gas and solar power developments they have been promoting come on line. There might be a few worried princes over there, and not just because of the problems in Yemen.

Shallow,

Nothing makes sense with shale economics and nothing makes sense with economy in general anymore. Wheels of financial and monetary system are falling off and it is getting harder not to notice that as long as you are not paid not to notice that 🙂

And that narrative of winning the oil “war’ is so imbecile. That “war” left so much collateral damage all over the world and economy that only imbeciles can talk about winning.

Wow. Looking at the production forecast from Canada combined with the data from Texas and no, it looks like North America is down by over 700,000 bpd in June. Or am I reading the data wrong?

I think you are reading it pretty close. North America should be down about that amount from the December high.

Ron, reference Venezuela: the black market rate is 482 bolivars per dollar. The government ran their party primaries, i read a few reports of snipers or armed bands shooting at national guardsmen who arrived to provide security at the polling stations. I posted a link in a previous post about increasing theft of oil well and plant equipment. Medicine shortages are very serious. Food shortages continue. I hear lots of anecdotes of people who can’t repair vehicles due to lack of spare parts. Somebody seems to be murdering the bodyguards of high level chavistas. This may be spurred by their weapons and fancy gear, which is always stolen.

I would say that Venezuela is not all that far from becoming a failed state. What would you say?

I don’t think it’s a failed state yet. Criminal bands are taking over part of the cities, but the government has the firepower to stop them.

The problem Maduro faces is his reliance on these bands to repress the people. The regime uses a layered Brownshirt repression machine, the criminals in these biker gangs are the special forces. They go in to break up protests and murder opposition members as required.

The national guard and the Sebin (a secret police agency which includes Cuban agents) are the official line of repression. Sebin uses arbitrary arrests, took over a bank building near the central university where they keep a torture center, but they are very targeted, and their numbers are small (I know because they copied the Cuban system).

I suspect the sheer anarchy is used as a means to keep people scared and depressed. The government is also incredibly incompetent. If things continue this way there will be a breakdown in December, and at that time we may see a civil war break out. This will be internal to the Chavista ranks, because they are the ones with the weapons. If that continues for a while it may totally break down, and by 2017 we could say it will be a failed state. In which case we can thank Dilma Rouseff, Correa, and other leftist leaders for providing diplomatic cover to one of the most terrible and destructive regimes ever seen.

But a civil war doesn’t automatically mean a state has failed. The failure happens if one side fails to win, and nobody takes control of all large cities and keeps a semblance of order. Colombia has had Marxist and narco guerrillas for 50+ years, but it’s not a failed state.

Meanwhile, in Greece:

Greek crisis: ‘We rely on imports. Soon even the most basic goods won’t be available’

http://www.telegraph.co.uk/news/worldnews/europe/greece/11707173/Greek-crisis-We-rely-on-imports.-Soon-even-the-most-basic-goods-wont-be-available.html

Dunno if I have mentioned this yet, but media stories will get funded by editorial staffs from here on out to horrify everyone about the extreme plight of Greece now that they have dared to try to get out from under the debt.

It’s not about Greece. It’s about Spain and Italy.

“For years, he’s [Noam Chomsky] written about how the west uses a propagandistic press to coerce its own citizens and how it uses covert forms of violence [covert to Steven Pinker?] to maintain power around the world…”

~ From the show, ‘Hot Type’ (CBC)

“Think of the press as a great keyboard on which the government can play.”

~ Joseph Goebbels

James Hamilton posted a link to a very good summary of the Greek crisis:

http://econbrowser.com/archives/2015/06/anil-kashyap-on-the-greek-crisis

http://faculty.chicagobooth.edu/anil.kashyap/research/papers/A-Primer-on-the-Greek-Crisis_june29.pdf

The 2011 , 2012 deal redefined bond maturities that were held by private hands, aka banks. This was decreed. Euro banks didn’t want to take the haircut, but the EU threatened their business licenses. And so their holdings of Greek bonds were slashed — and they were forced to say this was voluntary (always remember . . . in the world post 2008 bond redefinitions aka “restructure” aka “ain’t gonna pay” needs above all other things to be VOLUNTARY, because a voluntary gutting of holdings by ISDA bylaw is not a “credit event” aka default and thus won’t trigger the swaps.

Cyprus banks held a lot of this paper. So when this was imposed by the EU, they essentially were destroying Cyprus, which didn’t bother them much because they felt that Russian money belonged in Paris real estate.

As for Spain enduring the same measures and succeeding:

https://en.wikipedia.org/wiki/2008%E2%80%9315_Spanish_financial_crisis

That’s 2008-2015. It ain’t over, and they requested $100 billion in 2012, which the Greeks never did in one event.

This is all monumental BS. Draghi said he’d do “whatever it takes” and crushed the traders short in European bonds — because he was telling them he would buy bonds. He kept repeating this for years as the Germans said no, we won’t allow it, but the threat kept bond yields down. But failure still reigned supreme and this year he finally got the Germans to say okay. He’s presently buying 1 Trillion Euros worth of European bonds with printed money he creates at a whim, and this will stretch to Sept 2016.

(Interesting tidbit as regards logistics. The ECB (Draghi) is doing this but the way he does it is he creates some Euros and then sends it to member country Central Banks. THEY buy their country bonds. He proportions his magic Euros based on economy size, so Germany is supposed to do most of the buying, of their own bonds. But news out recently indicates Germany is dong these buys, but only at the short maturity end. 6 month paper, not 10 years. Then it expires . . . or they redeem it (which drains that money right back out of existence)). Not what Draghi had in mind.

Whatever the banksters want, they usually get. And the top 0.001% owners of the banks (and central banks and gov’ts) are virtually untouchable, accountable only to themselves.

My go-to explanation on the crisis is this paper from the Levy institute a few years ago:

http://www.levyinstitute.org/pubs/wp_721.pdf

The abstract:

“This paper investigates the causes behind the euro debt crisis, particularly Germany’s role in it. It is argued that the crisis is not primarily a “sovereign debt crisis” but rather a (twin) banking and balance of payments crisis. Intra – area competitiveness and current account imbalances, and the corresponding debt flows that such imbalances give rise to, are at the heart of the matter, and they ultimately go back to competitive wage deflation on Grmany’s part since the late 1990s. Germany broke the golden rule of a monetary union: commitment to a common inflation rate. As a result, the country faces a trilemma of its own making and must make a critical choice, since it cannot have it all — perpetual export surpluses, a no transfer / no bailout monetaryunion, and a “clean,” independent central bank. Misdiagnosis and the wrongly prescribed medication of austerity have made the situation worse by adding a growth crisis to the potpourri of internal stresses that threaten the euro’s survival. The crisis in Euroland poses a global “ too big to fail” threat, and presents a moral hazard of perhaps unprecedented scale to the global community.”

The overall conclusion is that the eurozone (and Germany in particular) is at war with double entry book-keeping and accounting identities. Since books always balance, there’s only going to be one winner in this war.

Misdiagnosis and the wrongly prescribed medication of austerity have made the situation worse by adding a growth crisis to the potpourri of internal stresses that threaten the euro’s survival.

That's all fine and dandy!

But, I guess I keep going back to asking, "when will people finally grasp the concept the infinite 'GROWTH' of any kind, including economic, can not and therefore will not be able to continue on a finite planet"

The underlying premise of the global economic system is profoundly and fundamentally flawed! Either that, or it is the largest ponzi scheme ever perpetrated!

Happy Monday Everyone!

If you’d bow to Thor rather than that fake snake you’re always on about you’d realize that we can squeeze infinitely more of everything we need out of the dirt under our feet (forever). Have a nice day sir.

My Fat Snake Goddess will constrict and swallow your wimpy Thor and put out his little thunder and lightening… It is you who needs to worship at the feet of my snake Goddess… no pun intended! GRIN!

Your obsession with pulsars seems to have taken a strange form, Doug.

Not really, I typically give religion, in any form, about 1-10 milliseconds of thought (per day), typical rotational period of nicely behaved pulsars.

Hi Doug,

I am not a fully qualified biologist by any means, as Fred is, nor an engineer. But I AM a sort of Renaissance Man hillbilly and suggest that both of you should take into account the undeniable FACT of religion and spend substantially more time than a millisecond a day thinking about it.

😉

Religion is to culture and politics somewhat like the weather is to farming- something that has to be DEALT with. Ignoring it is not an option. It confers fitness on the members of religious groups – short term at least.

We gave up the loner life so far back we will never know when. We live and survive as BANDS or tribes these days – super sized of course and now known as nations mostly.

The real religion and god of the world.

http://thetaoofneverdun.com/2014/10/26/money-is-a-god-capitalism-its-religion/